How Federal Reserve Bank Presidents Ensure “Main Street” is Represented in Monetary Policy

—James Bullard, President, Federal Reserve Bank of St. LouisSee https://www.stlouisfed.org/open-vault/2018/july/how-fed-president-connects-local-economies.

When Federal Reserve policymakers gather in Washington, D.C., eight times per year, the focus is on national economic policy. But it's important to realize that 12 of the 19 policymakers are from outside the Washington, D.C., metro area and that each represents the concerns of the people living in their respective districts. This article provides an overview of how the concerns of people across the country are reflected in monetary policy.

The Structure of the Federal Reserve System

The Federal Reserve System is the central bank of the United States. The Federal Reserve System includes three key entities—the Board of Governors, 12 Federal Reserve Banks, and the Federal Open Market Committee (FOMC). These parts work together to promote the health of the U.S. economy and the stability of the U.S. financial system, as follows:

- The Board of Governors in Washington, D.C., is the governing body of the Federal Reserve System. The Board of Governors guides the operation of the Federal Reserve System to promote the goals and fulfill the responsibilities given to the Fed by Congress. The Board of Governors is overseen by seven "governors" who guide all aspects of the operation of the Federal Reserve System.

- The United States is divided into 12 Federal Reserve Districts, with a Federal Reserve Bank established in each District (Figure 1). The 12 Reserve Banks examine and supervise financial institutions, lend to depository institutions, and provide U.S. payment system services, among other things. Each Federal Reserve Bank is managed by a president who serves as chief executive officer (CEO), and each president plays a key role as a maker of monetary policy. Federal Reserve Bank presidents contribute to making national monetary policy but also serve as the voice of "Main Street."

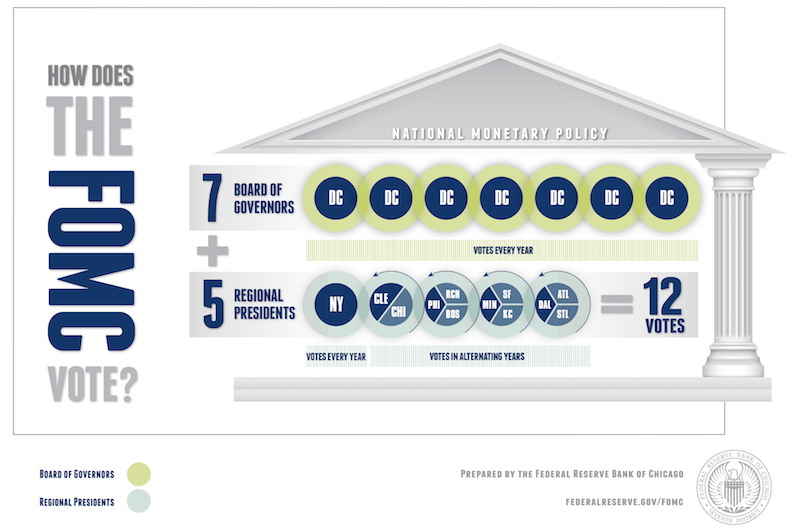

- The Federal Open Market Committee (FOMC) is the body within the Federal Reserve System that determines monetary policy for the country. The FOMC sets monetary policy to promote maximum employment and price stability in the U.S. economy. The Committee includes up to 19 participants—seven Federal Reserve Board governors (if all positions are filled) and the presidents of the 12 Federal Reserve Banks. Of the 19 FOMC participants, 12 are voting members of the Committee, on a rotating basis. The structure of the FOMC ensures that diverse sets of voices are reflected in the policymaking process.

Figure 1: Districts of the Federal Reserve System

SOURCE: Federal Reserve Bank of St. Louis; https://www.stlouisfed.org/about-us.

Representing Washington, Wall Street, and Main Street on the FOMC

The Federal Reserve System balances national and local interests by having both a central authority with the Board of Governors and 12 regional Federal Reserve Banks. In this way, the economic power of the Federal Reserve is not concentrated in a single entity in Washington, D.C., or on Wall Street. Rather, monetary policy decisions include policymakers distributed across the country to ensure that Main Street has "a seat at the table." This structure allows the Fed to balance national and local interests, and it ensures that Washington, Wall Street, and Main Street are all represented in the policymaking process.2

Washington

The Board of Governors is a federal government agency located in the heart of Washington, D.C., in touch with the culture and processes that drive national government. As such, the Board ensures that Washington is represented at the FOMC table.

Wall Street

The Federal Reserve Bank of New York (one of the 12 Federal Reserve Banks) is located in lower Manhattan, in the heart of the financial district. The New York Fed plays a key role in the implementation of monetary policy because it operates the open market trading desk, which is where the Federal Reserve System interacts with the U.S. financial system. The open market trading desk buys and sells Treasury securities and other assets to influence interest rates and manage the Fed's portfolio. The New York Fed ensures that input from Wall Street is represented in policy.

Main Street

In a country as large and economically diverse as the United States, it is essential that policymakers receive input from beyond Washington and Wall Street. The distribution of the 12 Federal Reserve Banks—and their 24 branches—provides a structure for serving constituents and gathering information about the economic conditions throughout the country. Through the work of the Reserve Bank presidents, these 36 locations serve as the voice of Main Street and provide the FOMC with key information, or "economic intelligence," as they consider what policies best serve the national interest.

President Bullard regularly visits communities to interact with local business and civic leaders and better understand local economic conditions. Colombia, Missouri, April 7, 2022.

Preparing for the FOMC Meeting: Gathering District Information

Let's take a step back and talk about how each Federal Reserve Bank president ensures that their district is well-represented at FOMC meetings. These preparations focus on both the national and regional economy.

At the Federal Reserve Bank of St. Louis, President James Bullard and his closest policy advisors meet regularly to discuss economic conditions and policy options. In short, while the president of a Reserve Bank has many responsibilities as president and CEO of their Bank, the role of president as policymaker is always at the forefront. Reserve Bank presidents also travel throughout their districts giving presentations and interacting with community members and business leaders to ensure they know what is happening on Main Street, and they listen to the concerns of the people living in the district.

Each Federal Reserve Bank has a board of directors whose members provide broad oversight of Bank operations while also supplying vital information on regional economic and credit conditions. These directors report what they see in their business operations that might be useful for understanding economic conditions more broadly. Each Federal Reserve Bank's branch office also has a board of directors whose members provide similar information about their region and industry. President Bullard maintains contact with the St. Louis Fed's directors on a regular basis.

The St. Louis Fed also has advisory councils in agribusiness, health care, real estate, and transportation; and, to ensure it has input from community bankers, the St. Louis Fed has the Community Depository Institutions Advisory Council (CDIAC). These councils lend additional perspectives on economic conditions unique to their industries. President Bullard meets regularly with industry leaders, academic economists, and other members of the community in the District and across the country.

All Reserve Bank presidents, including President Bullard, are in a constant learning mode—gathering information about economic conditions. For example, they engage with people in the everyday business of life, whether neighbors are shopping for groceries or talking about their jobs. These conversations offer qualitative insights that might not be reflected in, or may be more nuanced than, quantitative national economic data or a formal presentation by a staff economist.

Together, these voices of Main Street help inform the work of each Bank and the Federal Reserve System as a whole.

Preparing for the FOMC Meeting: The Contribution of Staff Economists

Federal Reserve Banks have staff economists who conduct research on many aspects of the economy and study policy-related issues. One of the important roles these staff economists play is helping their Bank president prepare for FOMC meetings. The fact that these economists do research in different areas adds nuance to policy discussions. A labor economist brings a different perspective to the discussion of the national economy than does an economist who focuses on the influence of international trade flows. In addition, economists bring their diverse personal perspectives, including those on age, gender, and race, as well as their own skills and cultural differences and experiences.

In briefing President Bullard before FOMC meetings, the Bank's staff economists provide overviews of financial markets, international economic conditions, national economic conditions (using key data such as inflation, employment, unemployment, and GDP), and economic conditions in their District. The briefings also include a rich discussion of policy options centered around whether the current setting of the target range for the federal funds rate is appropriate, given current economic conditions and the economic outlook.

Representing Main Street at the FOMC Meeting

The FOMC meets eight times per year in Washington, D.C., to make decisions about monetary policy. Each meeting includes some key components that allow Federal Reserve Bank presidents to ensure Main Street is represented at the policymaking table.

The Economic Situation

The beginning of the meeting focuses on the economic situation: It's when FOMC participants receive briefings and present their views. First, FOMC participants receive briefings about national economic and financial conditions from Board of Governors staff economists and a review of open market operations from New York Fed staff economists. Then, the presidents and governors offer their assessments of and outlook on the economy. In their remarks, each Federal Reserve Bank president provides a summary of economic conditions in their District. The presidents usually refer to information from their District contacts or to research their staff has done in their remarks, ensuring that the District is represented.

Monetary Policy

During the next part of the meeting, FOMC participants discuss appropriate policy and members vote. When discussing appropriate policy, Board of Governors staff present options for policy along with messaging that might occur in a press statement. Then, FOMC participants share their individual views and judgments on policy, how they expect policy to evolve over the medium term, and how the Committee's decision should be communicated.

After the other Committee members have spoken, the Chair of the FOMC (currently Jerome Powell) speaks and strives to form a consensus view for the Committee to support. While all participants take part in the discussion, only some participants vote: Members of the Board of Governors and the president of the Federal Reserve Bank of New York vote at every meeting, and four of the remaining 11 Bank presidents vote on a rotating basis (Figure 2). Even though only five of the 12 Reserve Bank presidents vote at any particular meeting, all of the presidents speak about what is happening in their Districts, and each one states their views on the appropriate setting of policy.

Figure 2: Federal Open Market Committee: Who Votes?

SOURCE: Federal Reserve Bank of Chicago; https://www.chicagofed.org/education/fomc-infographic.

Conclusion

Policy communications have become a priority for the Federal Reserve System. At the end of the meeting, the FOMC releases a statement that is published on the Board of Governors website; it includes a summary of economic conditions, the policy decision, factors to consider for the path ahead, and the vote of each Committee member. Shortly after the FOMC statement is published, the Chair of the FOMC presents a written statement at a press conference and then answers questions from reporters representing the major media outlets.

Federal Reserve Bank presidents return to their Districts to explain the policy decision and implications for the people in their Districts. And, knowing that the next meeting is about six weeks away, Bank presidents are already thinking about what lies ahead and how it might affect the people in their Districts. All said, the Federal Reserve System is well-designed to make national policy that considers local, or Main Street, concerns.

Board of Governors: The federal government agency that is the centralized component of the Federal Reserve System. These governors guide the policy actions of the Federal Reserve System.

Central bank: An institution that oversees and regulates the banking system and quantity of money in the economy.

Federal funds rate: The interest rate at which a depository institution lends funds that are immediately available to another depository institution overnight.

Federal Open Market Committee (FOMC): A Committee created by law that consists of the seven members of the Board of Governors; the president of the Federal Reserve Bank of New York; and, on a rotating basis, the presidents of four other Reserve Banks. Nonvoting Reserve Bank presidents also participate in Committee deliberations and discussion.

Federal Reserve Bank: One of 12 regional Banks providing services to commercial banks, serving as fiscal agents for the U.S. government, and conducting economic research on its region and the nation.

Federal Reserve Districts: Twelve regions in the United States that are represented by a Reserve Bank.

Federal Reserve System: The central bank system of the United States.

Maximum employment: The highest level of employment that an economy can sustain while maintaining a stable inflation rate.

Open market operations: The buying and selling of government securities through primary dealers by the Federal Reserve. When the securities are bought or sold, reserves in the banking system are increased or decreased, respectively.

Price stability: A low and stable rate of inflation maintained over an extended period of time.

Citation

Scott A. Wolla, ldquoHow Federal Reserve Bank Presidents Ensure “Main Street” is Represented in Monetary Policy,rdquo Federal Reserve Bank of St. Louis Page One Economics, Nov. 14, 2022.

These essays from our education specialists cover economic and personal finance basics. Special versions are available for classroom use. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us