How the St. Louis Fed Helps Educators in the Classroom

The St. Louis Fed offers a wide range of materials to help educators improve curriculum for students of all ages—from pre-K to the college level. The resources cover numerous topics, such as basic personal finance courses, in-depth lessons about microeconomics and macroeconomics, primers on government debt, productivity, monetary policy, and much more.

To see how these resources are impacting students around the Eighth Federal Reserve District, we reached out to a variety of educators who have used them in their classrooms. We contacted:

- Marsha Masters, associate director at Economics Arkansas, a nonprofit educational organization in Little Rock, Ark.

- Frank Seery, a teacher at Collierville High School in Collierville, Tenn.

- Judy Girard, who retired in 2025 from teaching at Lindbergh High School in St. Louis County

- Angel Pilcher, a teacher at Center Hill High School in Olive Branch, Miss.

- Jennifer Inman, program director at Los Angeles-based nonprofit Gifted Savings and former executive director of the Kentucky Financial Empowerment Commission, a financial literacy nonprofit organization in Frankfort, Ky.

- Rodney Gerdes, who retired in 2025 from teaching at Oakville High School in St. Louis County

Here’s what they had to say (these responses have been edited for length and clarity):

When and how did you become familiar with the St. Louis Fed’s economic education resources?

Masters: I began to incorporate economics into my very full elementary classroom schedule in 1993. At that time, I really had to search for resources to use that I felt were quality and engaging for the classroom. I am thrilled that educators today do not have to look far to find the amazing resources the Federal Reserve Bank of St. Louis has created.

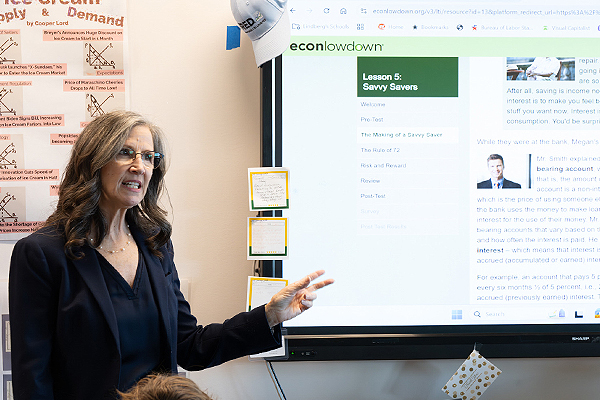

Judy Girard, who recently retired from teaching at Lindbergh High School in St. Louis County, says the St. Louis Fed’s Econ Lowdown portal has been essential for introducing economic concepts and models to students in a variety of engaging ways.

Girard: My familiarity with the St. Louis Fed’s economic education resources began in the summer of 2007. That year, Missouri passed legislation requiring personal finance to be a graduation requirement, meaning every student would need to complete the course in some form. While we had offered personal finance as an elective, the new mandate meant we had to design a curriculum that met state standards and addressed the needs of our diverse student population. I received an invitation to attend a summer workshop introducing the St. Louis Fed’s personal finance resources.

Inman: As a high school business and finance teacher, I frequently used the St. Louis Fed’s economic education resources in my classroom. I later completed the Kentucky Master Teacher of Personal Finance Certification (another St. Louis Fed initiative), which gave me the opportunity to explore Econ LowdownEcon Lowdown will be retired Dec. 31, 2025, and FRE.org will serve as the website for economic education materials across the Federal Reserve System. and FRED resources in greater detail.

Are there standout topics or materials that teachers have found particularly useful?

Masters: I love the modules for all grade levels from the Ella series to It’s Your Paycheck. I am a big fan of the “Explore Economics” video series for the elementary classroom. I love the children’s literature-based lessons, and the resources developed to complement the stock market and investing are a wonderful addition to our Arkansas educators.

Seery: I always use the Feducation videos at the start of a topic and supplement the lesson with data from [online database] FRED. The longer modules are useful for asynchronous learning days and reteaching students who didn’t master the topic. My room is covered in posters and infographics provided for no charge by the Fed banks. I like to joke that the chart that says “There is no such thing as a free lunch” was FREE.

Girard: The St. Louis Fed offers a wide range of valuable content, including articles, videos, lesson plans, curriculum and activities. The Econ Lowdown videos and podcasts collection have been essential tools in my classroom approach, particularly for AP economics. These resources help introduce key concepts and models in a variety of engaging ways. Many complex macroeconomic and microeconomic concepts are clearly explained through animations and infographics, which capture students’ attention and aid their understanding.

Inman: Some of our most-used resources include cryptocurrency lessons for public library financial literacy workshops; FRED to support economic discussions with high school students, community groups and funding proposals; Page One Economics for easy-to-understand, relevant economic insights; and St. Louis Fed podcasts, which provide excellent professional development and classroom discussion material.

Gerdes: The Federal Reserve Bank of St. Louis has outstanding resources for macroeconomics, but they have been growing their extensive resources for personal finance and microeconomics. Recently, I had students complete Sold Fast: Price Tags and the Impact on Consumer and Producer Surplus as a reading Q&A. It is a fantastic addition to what is otherwise a very abstract concept for students. My financial planning students are working through the Inflation module in Econ Lowdown as they need a thorough grasp of what it is and why it takes place so they better understand how one can invest with an aim of increasing real returns and not just nominal returns.

Why are economic/personal finance topics and lessons important for students to learn and educators to teach?

Masters: Arkansas administrators share with us often that students are looking for those life skills that will prepare them for success once they leave the high school classroom. That’s exactly what economics and personal finance does.

Seery: I always start out each term with the statement “This is the most relevant class to your life you will take in school, probably not the most exciting, but definitely the most relevant.” Every student is making choices that have both large and small consequences in their future. Understanding cost/benefit and opportunity costs is relative to all the decisions the students are facing in school.

Girard: As a personal finance educator, my goal each year is to help students understand the critical importance of financial independence and security. While some financial lessons come with experience over time, the earlier individuals grasp the fundamentals of earning income, budgeting, saving and building wealth, the sooner they can reap the long-term benefits of financial security.

Rodney Gerdes, who recently retired from teaching at Oakville High School in St. Louis County, says the St. Louis Fed’s education resources are world class, easy to use, economist reviewed and effective.

Inman: Financial literacy is an essential life skill. Teaching students about economic principles, personal finance and decision-making prepares them for real-world challenges—whether it’s managing money, understanding credit, or making informed career and investment choices. It’s crucial that teachers have access to high-quality, engaging resources that boost their confidence in teaching these topics.

Gerdes: Personal finance is as important as it has ever been. Gone and not likely to return are the days when workers could rely on a pension in retirement. Today’s students need to know the power of compounded returns, which is part of the Time Value of Money module in Econ Lowdown, and how to utilize investment options like 401(k), IRA and Roth IRA to plan for their retirement.

Is there anything you wish more educators in the Fed’s Eighth District, or nationwide, knew about the St. Louis Fed’s economic education program?

Masters: I want educators to note it is very easy to “see” economics in everything they do. There is certainly not time to prepare resources with their many other requirements, and the wonderful thing about the St. Louis Fed is that they have already created and vetted them.

Seery: The economic education specialists at the St. Louis Fed do a great job getting the word out to the economics teachers. I have shared FRED and [digital economic history library] FRASER with our history department. Many teachers found resources to add to their lessons.

Girard: Economics is often viewed as a complex and intimidating subject, but the Fed’s efforts to educate, support, and advocate for financial literacy in schools, homes, and communities have a profound, far-reaching impact. One of my favorite events is the annual AP Economics Educator Summer Institute. With early registration now in high demand, the event maintains a virtual component to allow more educators to benefit. The conference provides an invaluable opportunity to collaborate with peers, hear from AP test leaders, listen to economists apply macroeconomic theory in real-world settings, and gain practical teaching strategies and resources to implement in the classroom.

Pilcher: I wish more educators in the Fed’s Eighth District and nationwide knew just how engaging, accessible and practical the St. Louis Fed’s economic education resources are for students of all backgrounds.

Inman: I wish more educators knew just how expansive and user-friendly the St. Louis Fed’s resources are! The materials are not only free but also incredibly versatile—whether you’re teaching elementary students, middle and high schoolers, or even adults.

Gerdes: The education resources available through the Federal Reserve Bank of St. Louis are world class, easy to use, economist reviewed and effective. Many teachers, including social studies teachers, steer clear of economics and finance because they had a bad experience in college with their economics class. Core economic concepts do not require calculus, are unbelievably fascinating, and will enrich the education that you provide to your students, which will give them a competitive advantage when they leave school for college, work or military service.

Notes

- Econ Lowdown will be retired Dec. 31, 2025, and FRE.org will serve as the website for economic education materials across the Federal Reserve System.

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us