A Soft Landing for the Economy: What It Means and What Data to Look At

One of the definitions of “soft landing” in the Britannica dictionary is “a landing in which an airplane, a spacecraft, etc., touches the ground in a controlled and gradual way that does not damage it.”

It’s easy to picture a soft landing for something like a spacecraft. But what does it mean to have a soft landing for the economy? If you’ve seen that reference in the news, it was probably related to the Federal Reserve’s tightening of monetary policy and the potential economic impact. “Tightening,” or contractionary monetary policy, is intended to restrain spending by consumers and businesses when there is higher-than-desired inflation.

The Fed has a dual mandate to promote stable prices and maximum sustainable employment. In a period where inflation is higher than desired, the Federal Open Market Committee—the Fed’s main monetary policymaking body—might take actions such as raising the target range for the federal funds rate to bring inflation down.

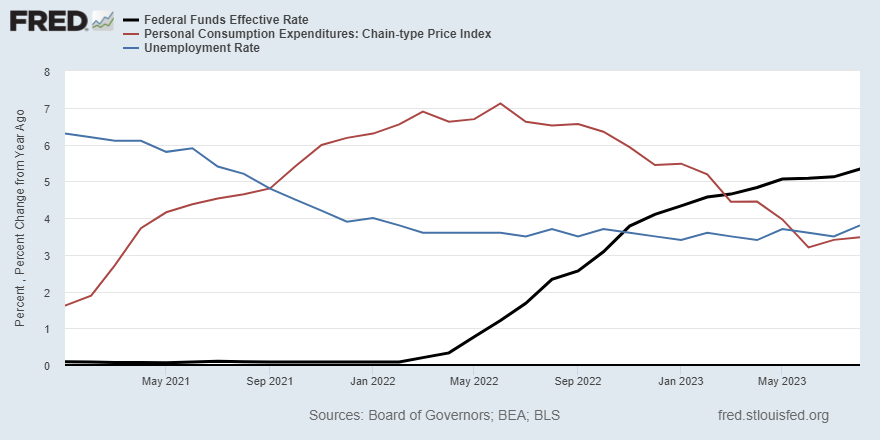

For example, the period starting in mid-2021 and continuing to the date of this blog post has been marked by a strong labor market and inflation running higher than the Fed’s 2% target. The FOMC has raised the federal funds rate target range by 5.25 percentage points since March 2022 to counter the inflation.

The following FRED graph shows the effective federal funds rate, inflation calculated as the percentage change from a year ago in the personal consumption expenditures price index and the unemployment rate from January 2021 to August 2023.

When the FOMC tightens monetary policy, it can raise the question of whether the Fed can achieve a “soft landing” for the economy. I consulted Paulina Restrepo-Echavarria, an economic policy advisor in the St. Louis Fed’s Research Division, about soft vs. hard landings and what data we might look at to get a sense of whether a soft landing is possible.

Definitions: Soft Landing vs. Hard Landing

So, what does it mean for the economy to have a soft landing? And conversely, what constitutes a hard landing?

“I would say that a soft landing is when we increase interest rates and we manage to decrease inflation, but without causing unemployment to go up drastically and GDP growth to go negative,” Restrepo-Echavarria said.

“And a hard landing would be yes, we increase interest rates and we decrease inflation, but at the cost of a recession and high unemployment.”

However, she noted that there isn’t an exact definition of a soft landing, as it’s possible to have a mild recession without very high unemployment.

“What we really care about is the well-being of people, and we don’t want unemployment to go up too much,” she said.

Historical Examples of Hard and Soft Landings

When you think about a hard landing, the example that may come to mind is the monetary policy tightening in the late 1970s and early 1980s and associated economic contractions and high unemployment. The FRED graph below shows that period and includes gray shaded areas that indicate recession.

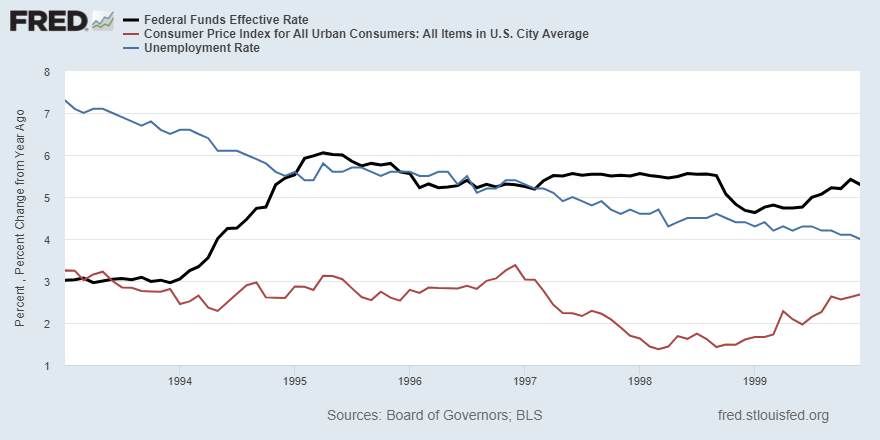

(Note that the FRED graphs in this section show consumer price index inflation, which was the FOMC’s preferred measure before 2000.)

In contrast, the monetary policy tightening episode in the mid-1990s was associated with a soft landing for the economy, with a strong labor market and no recession during the second half of the 1990s, as shown in the FRED graph below.

Economic Indicators to Assess the Potential for a Soft Landing

When trying to evaluate whether a soft landing has occurred, the No. 1 indicator to look at is the unemployment rate, Restrepo-Echavarria said. The other indicator to look at is real gross domestic product (GDP) growth, which gives us information about whether the economy is in recession.

But what if you’re trying to assess whether a soft landing is even possible? To explore that question, economists at the St. Louis Fed have examined additional economic indicators, with two examples discussed below.

Job Openings

Restrepo-Echavarria has looked at the Beveridge curve, which is the relationship between the job vacancy rate and the unemployment rate. She has studied two Beveridge curves—one for unemployed workers and the job openings that typically go to them, and another for employed workers who are looking for a different job and the openings that typically go to them.

“Historically, what we’ve observed is that if there are more vacancies, there’s lower unemployment, and if there are fewer vacancies, then there’s more unemployment,” she explained.

She noted that the job vacancy rate had never been as high as it has been during the tightening episode that started in March 2022, which “changes the dynamics of the labor market in a very big way.”

Restrepo-Echavarria said the following scenarios are very different:

- Scenario 1: Going into a monetary tightening episode with a low number of job openings, suggesting a loose labor market in which it’s difficult to find a job

- Scenario 2: Going into a monetary tightening episode with a high number of job openings, suggesting a tight labor market in which unemployed people can find a job more easily

Thus, examining job openings is a way to think about the conditions that will allow the Fed to raise interest rates without causing a large increase in the unemployment rate, she said.

Hours Worked

Another indicator to keep an eye on is hours worked, as Economic Policy Advisor Serdar Birinci discussed in a video released in August.

“Why should we care about hours worked? Well, if we saw a reduction in hours worked, this may imply a lower aggregate income and lower aggregate demand, and that might reduce the possibility of achieving a soft landing,” he said.

When Can We Know the Type of Landing?

How long does it take to know whether the U.S. economy will have a soft or hard landing during periods of monetary tightening?

Asked whether there are still “long and variable lags” in the time it takes for interest rate changes to affect the economy, Restrepo-Echavarria said the thought used to be that it takes about two years.

“It’s hard to say if that’s the case anymore,” she said. “And it’s very difficult to say how long it will take for us to figure out if there’s going to be a soft or hard landing.”

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us