Most Popular Blog Posts of 2022

How many of the top blog posts below have you checked off your reading list?

Posing a question is a clue to what some of the St. Louis Fed’s most popular posts of 2022 had in common. They looked to answer questions, both topical and practical—from what the financial markets say about future inflation, to what to do with ripped or torn money.Readers were curious in 2022, making our explanatory posts some of the most widely read.

First, More about Our Blogs …

The posts below were published on two of our blogs:

- Open Vault covers everyday economics and topics related to the Federal Reserve. It’s geared toward a mainstream audience—anyone curious about economic and personal finance concepts or the people and programs that make the St. Louis Fed central to America’s economy.

- On the Economy delves a bit deeper into—you guessed it—the economy, with regular commentary and analysis penned by our Bank’s economists and other experts. Do you consider yourself an economics or monetary policy wonk? We’ve got you.

Top Blog Posts—and the Questions They Sought to Answer

Here’s a look at some of the St. Louis Fed’s most popular posts published or updated in 2022. (Results are based on web session traffic Jan. 1 through Nov. 30.)

Drumroll, please ...

How Will the Fed Reduce Its Balance Sheet?

As part of its efforts to tighten monetary policy, the Federal Open Market Committee announced in May that it would begin shrinking the Fed’s $8.5 trillion balance sheet in June. This May 11 post, written by Jane Ihrig and Scott Wolla, explained some of the mechanics behind reducing the Fed’s securities holdings, including the phasing in of the monthly caps for redeeming maturing securities.

“Mechanically, the Fed will reduce its securities holdings by not reinvesting the funds it receives from maturing securities,” the authors wrote. This practice is known as balance-sheet runoff.

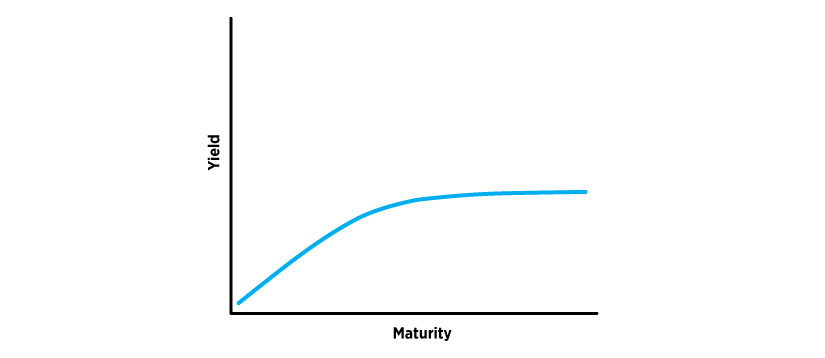

What Do Bond Yields Signal about the Economy?

Is this post about a famous Bond? No, but it’s intriguing just the same.

Bond yields are an important economic indicator for investors, even those who don’t invest in bonds. There are multiple definitions and ways to calculate bond yields. In this April 20 post, author Praew Grittayaphong discussed current yield and yield to maturity.

“Bond prices and yields are inversely related: the higher the price, the lower the yield and vice versa, including for U.S. Treasuries,” Grittayaphong wrote. She then explained how Treasury yields are widely followed as an indicator of investor confidence.

What Do Financial Markets Say about Future Inflation?

An analysis of “inflation swap” data in a June 23 post by YiLi Chien and Julie Bennett indicated that, while U.S. inflation was unexpectedly high over the prior 12 months, longer-term inflation expectations hadn’t seen a similar shift upward.

Relatively steady expectations suggest that the market believes the Fed will get inflation under control: “According to the inflation swap data, market participants believe the Federal Reserve can and will control the high inflation rate, despite price increases being more persistent than previously thought,” the economist and research associate, respectively, wrote. “The well-anchored longer-term inflation expectation provides additional supporting evidence of this.”

What to Do with Ripped, Torn or Damaged Money

This blog post from 2019 was updated in 2022 with more recent currency inspection numbers, and curious readers took notice. What happens to old or worn-out money?

Generally, U.S. paper currency that’s no longer fit for use is taken out of circulation by the Federal Reserve. “However, different fates can befall a bill, and there are different processes for handling money depending on what happened to it,” explained author Laura Taylor.

What to do if your cash is “unfit”? Your moola “mutilated”? Your currency “contaminated”? When it comes to those decisions, the buck stops here, with this post.

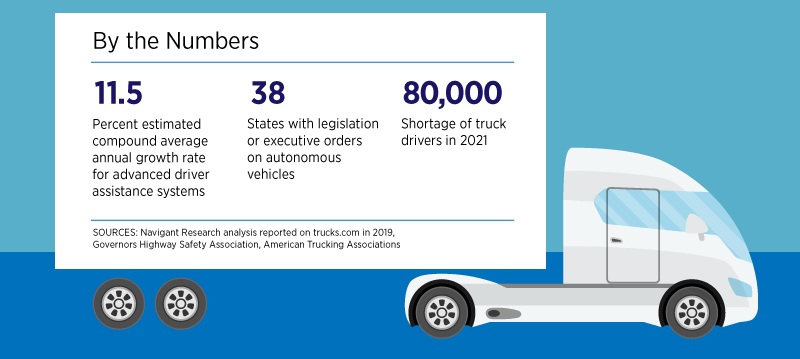

Will Automation Reduce Trucking Jobs?

The advancement of artificial intelligence, or AI, technology could heavily impact labor in multiple industries. In what ways—through job loss or job creation? Companies introducing autonomous driving in trucking say it will complement drivers’ work, according to this Aug. 10 post by Jack Dunn.

Curious about another industry that interested readers in 2022? Check out the same author’s Aug. 24 post on the fast-growing esports industry. We bet you’ll learn something.

On to the next post. Beep, beep …

Is the Labor Market as Tight as It Seems?

“The labor market is said to be ‘tight’ if vacant jobs are plentiful and available workers are scarce,” explained authors David Andolfatto and Serdar Birinci. “It is said to be ‘loose’ if the opposite holds true.”

In their June 21 post, the economists cautioned that interpreting measures of labor market tightness and what those measures may imply for real wages should be approached with care. They noted that the conventional measure of labor market tightness is the ratio of vacancies to the number of unemployed workers (i.e., the V/U ratio). They found that when including employed workers who moved to new jobs in their calculation of available workers (along with those who were unemployed), the labor market wasn’t as tight as the conventional measure indicated.

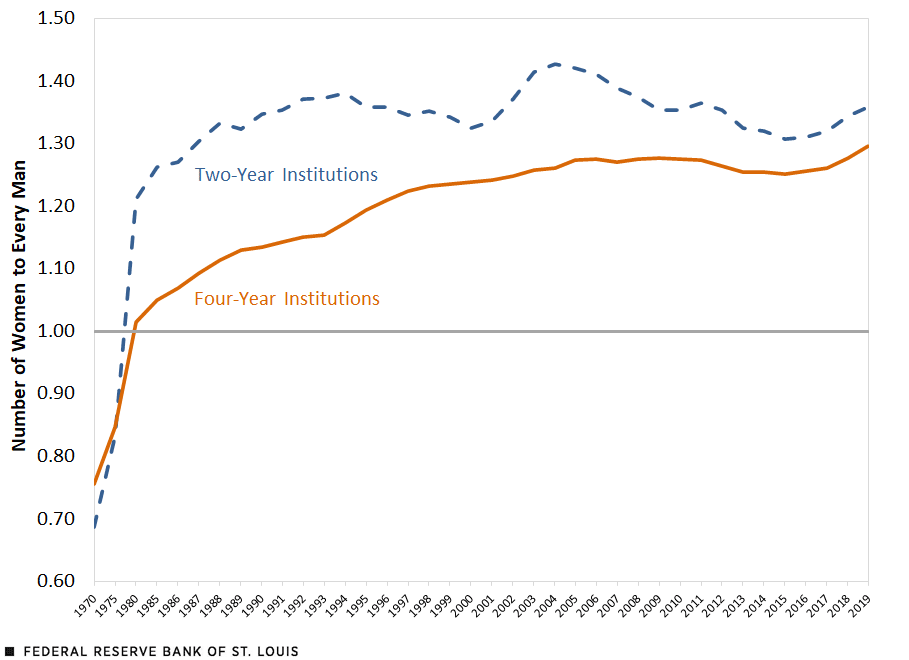

Why Do Women Outnumber Men in College Enrollment?

The highest ever gender imbalance favoring women in U.S. college enrollment—nearly two women for every man for the 2021-22 school year—was the focus of a March 15 post by authors Oksana Leukhina and Amy Smaldone.

The economist and research associate, respectively, asked why the stark imbalance:

- “Are girls receiving preferential treatment in high school and boys increasingly slipping through the cracks?”

- “Did the recent change in SAT scoring disproportionately favor female test-takers?”

- “Are the college admissions to blame?”

The authors found that a more likely explanation was that women are being rewarded with relatively higher financial returns from college. Their research also showed that the recent stark imbalance was actually a “continuation of an ongoing historical trend.”

The Great Retirement: Who Are the Retirees?

Millions of U.S. workers aged 65 and older exited the labor market during the pandemic. Which workers were more likely to retire?

Authors William M. Rodgers III and Lowell R. Ricketts, of our Institute for Economic Equity, found that Black, Hispanic and Native American workers were less likely to be retired than their white peers of similar ages, for instance. “Combining the results into a ‘typical’ retiree, retirements were much more common among older white women without a college education,” the authors observed.

In their demographic spotlight on the labor market published a year ago, the economist and data scientist, respectively, pointed to historic asset gains, in addition to fears related to COVID-19 exposure, as possibly prompting retirements.

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us