What Do Financial Markets Say about Future Inflation?

The recent rise in the inflation rate, first observed in 2021, has surprised financial markets as well as monetary policymakers. In just one year, the annual inflation rate measured by the consumer price index (CPI) increased substantially from 1.4% in January 2021 to 7.5% in January 2022. The recent war between Russia and Ukraine helped push the CPI inflation rate to 8.6% in May 2022, the highest level in 40 years. In response to rising inflation, the Federal Reserve has already started a rate hike cycle to combat inflation.

The Importance of Inflation Expectation

The effectiveness of monetary policy hinges critically on inflation expectations. If economic agents, such as households and firms, expect higher inflation in the future, the rational reaction is to purchase goods and services right away in order to avoid higher future prices. As a result, the demand for goods and services immediately rises and so does the price level, which results in higher inflation right away. Hence, the Federal Reserve needs to anchor economic agents’ long-term inflation expectations close to the inflation target in order to effectively combat inflation. This blog post looks at the recent movements in so-called market-based inflation expectations for various time horizons.

Market-based Inflation Expectation

We utilized inflation expectation data from the inflation swap market. An inflation swap is a financial contract agreed between two market participants. One party seeks to hedge inflation risks and the other is betting on lower-than-expected inflation. Specifically, the hedging partyCommon hedging parties are pension funds or life insurance companies, which have financial obligations tied to the inflation rate and hence would like to offload inflation risks. agrees to pay a fixed amount in order to receive a CPI inflation adjusted payment by the other party (betting party) after a given period of time.For example, today, the hedging party agrees to pay a swap rate of 2% in exchange for a payment indexed to CPI inflation rate in five years. Namely, the maturity of the swap is five years; there is no actual payment occurring today. Five years later at the swap maturity date, suppose that the average realized inflation during the five-year period is 1.2%, then the hedging party pays a fixed amount of (1+0.02)^5 and receives an amount of (1+inflation rate)^5 = (1+0.012)^5. The net cash flow from the hedging party to the betting party is therefore (1+0.02)^5 - (1+0.012)^5 = 0.04263 per dollar notional of the swap. Hence, the price of inflation swaps across different contract durations could reveal the market’s expectation of future inflation over various time horizons.

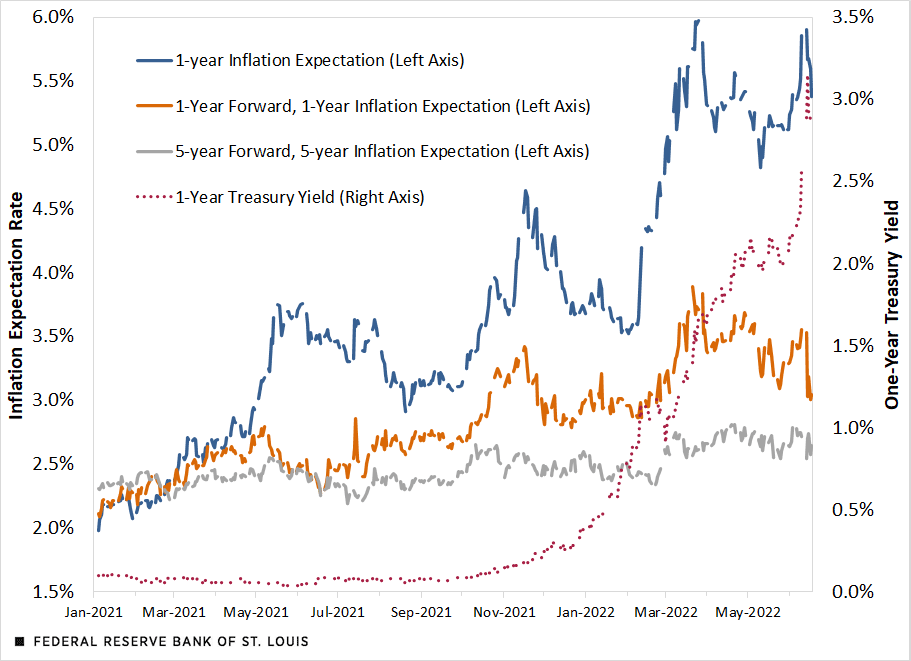

The figure below plots inflation swap prices from the beginning of 2021 to the latest available date for several time horizons. The blue line represents one-year inflation expectations (the one-year inflation swap), and the orange line represents the one-year inflation expectation starting one year from the date indicated on the x-axis (called the one-year forward, one-year inflation expectation rate). For example, the one-year forward, one-year inflation expectation rate measured in January 2021 indicates the market’s expectation of the annual inflation rate from January 2022 to January 2023.

Inflation Expectations and Treasury Yield

SOURCES: Bloomberg and authors’ calculations.

Expectations amid Rising Inflation

In the first quarter of 2021, the one-year inflation expectation was rising modestly. Its level surpassed the one-year forward inflation expectation in March 2021, which indicates that markets expected a higher short-term inflation rate at that point. In May 2021, the one-year inflation expectation started to significantly exceed the one-year forward, one-year inflation expectation rate, which suggests that the market expected the higher inflation rate to be transitory and that it should come down in one year. However, in the second half of 2021, the one-year forward, one-year inflation expectation rate started to move more closely with the one-year inflation expectation rate. This indicates that, during this period, market participants adjusted their expectations in the belief that the elevated inflation could stay longer.

Fed Signals Possible Rate Hike Cycle

The next turning point occurred near the end of 2021 when the Federal Reserve started to signal a possible upcoming rate hike cycle in order to tame inflation. The expectation of rate hike policy can be seen in the one-year nominal Treasury yield, which is plotted by the red dotted line in the earlier figure. (See the figure’s right axis.)

In the beginning of this year, the one-year Treasury yield started to rise rapidly, which indicates that market participants believed that a rate hike cycle was going to be implemented in the near future. If market participants are confident in the Federal Reserve’s capacity to control the inflation rate, then the longer-term inflation expectation should be stabilized despite additional inflation shocks to the economy. This is roughly what we observed in the past four months of data.

Despite several inflation shocks, including higher-than-expected CPI data reported in March as well as the war between Russia and Ukraine, the one-year forward, one-year inflation expectation increased only modestly compared with the one-year inflation expectation. More specifically, the one-year inflation expectation jumped from 3.6% on Feb. 8 to its peak of about 6% on March 25, an increase of about 240 basis points. During the same period, the one-year forward, one-year inflation expectation rate increased only about 80 basis points from about 2.9% to 3.7%. The smaller response of the one-year forward, one-year inflation expectation rate may indicate the market’s confidence in the Fed regarding its ability to tame the rising inflation rate.

The inflation expectation at an even longer time horizon provides additional supporting evidence of this confidence. The gray line shows the five-year average inflation expectation starting five years from the date on the x axis (called the five-year forward, five-year average inflation expectation rate). For example, the five-year forward, five-year average inflation expectation rate in January 2021 indicates what the average annual inflation rate is expected to be over the span January 2026 to January 2031. Throughout our sample period, this longer-term measure of inflation expectations is well-anchored at around 2.5%, only rising modestly from 2.3% in the beginning of 2021 to 2.65% on June 17, 2022.

Conclusion

In short, according to the inflation swap data, market participants believe the Federal Reserve can and will control the high inflation rate, despite price increases being more persistent than previously thought. The well-anchored longer-term inflation expectation provides additional supporting evidence of this.One caveat is that the market-based inflation expectation could be potentially biased due to a time-varying inflation risk premium embedded in the inflation swap rate. The inflation risk premium represents a premium required by market participants to account for the possibility that actual inflation deviates from what they expect. Typically, the inflation risk premium is thought to be positive, therefore the swap rate would be slightly higher than actual inflation expectations. The analysis of this post could be affected if the value of the risk premium changed significantly over the sample period. However, there is no consensus regarding the size and time variability of inflation risk premium.

Notes

1 Common hedging parties are pension funds or life insurance companies, which have financial obligations tied to the inflation rate and hence would like to offload inflation risks.

2 For example, today, the hedging party agrees to pay a swap rate of 2% in exchange for a payment indexed to CPI inflation rate in five years. Namely, the maturity of the swap is five years; there is no actual payment occurring today. Five years later at the swap maturity date, suppose that the average realized inflation during the five-year period is 1.2%, then the hedging party pays a fixed amount of (1+0.02)^5 and receives an amount of (1+inflation rate)^5 = (1+0.012)^5. The net cash flow from the hedging party to the betting party is therefore (1+0.02)^5 - (1+0.012)^5 = 0.04263 per dollar notional of the swap.

3 One caveat is that the market-based inflation expectation could be potentially biased due to a time-varying inflation risk premium embedded in the inflation swap rate. The inflation risk premium represents a premium required by market participants to account for the possibility that actual inflation deviates from what they expect. Typically, the inflation risk premium is thought to be positive, therefore the swap rate would be slightly higher than actual inflation expectations. The analysis of this post could be affected if the value of the risk premium changed significantly over the sample period. However, there is no consensus regarding the size and time variability of inflation risk premium.

Citation

YiLi Chien and Julie Bennett, ldquoWhat Do Financial Markets Say about Future Inflation?,rdquo St. Louis Fed On the Economy, June 23, 2022.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions