How Tariffs Are Affecting Prices in 2025

Since early 2025, tariffs have returned to the center of U.S. trade policy debates. In this blog post, we take a close look at how these developments have started to show up in consumer prices—particularly in the personal consumption expenditures (PCE) price index, the Federal Reserve’s preferred inflation measure.

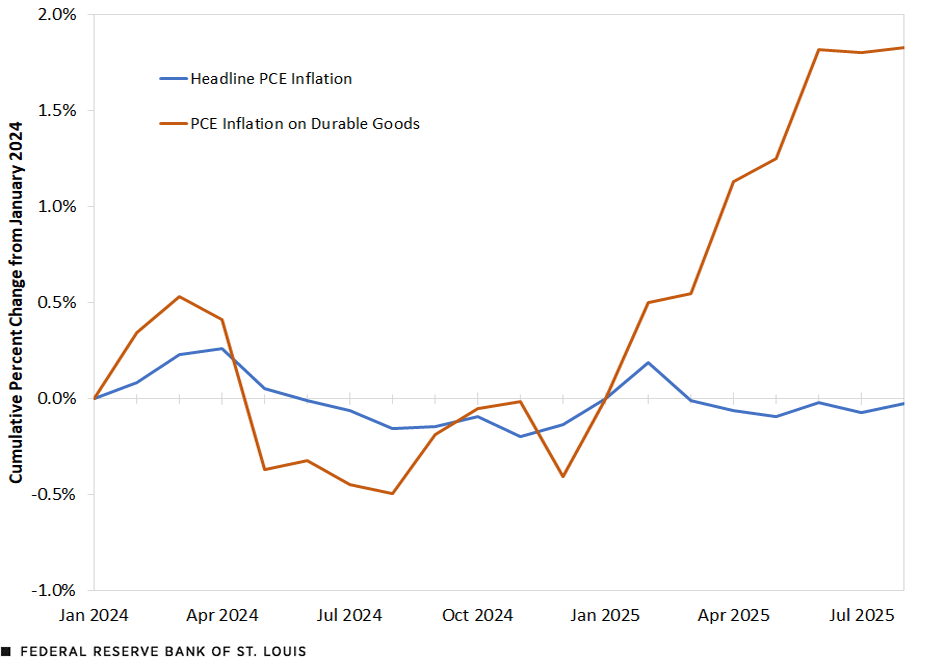

While headline PCE inflation has increased only modestly in recent months, the categories of goods most exposed to international trade tell a different story. In the U.S., prices for durable goods—such as vehicles, electronics and furniture—have increased noticeably. These price movements align with the timing of tariff hikes earlier this year. The figure below shows this divergence, plotting the evolution of the headline PCE price index and durable goods PCE price index, in percent deviations from January 2024, relative to their linear trends estimated using data for 2024.

Cumulative Price Change Relative to Trend, January 2024-August 2025

SOURCES: U.S. Bureau of Economic Analysis and authors’ calculations.

NOTES: Cumulative price change for each series was measured against its linear trend calculated for the period using 2024 data. Percent deviations from January 2024 were computed as differences of logarithms. The January 2024 value for both series is zero because the figure illustrates cumulative price change from that point in time.

To understand the extent to which tariffs have been affecting inflation, we combine model-based estimates of price increases due to tariffs with recent PCE data. This approach allows us to trace how tariff shocks are transmitted to consumers and to quantify their contribution to recent price movements across product categories.

A Model of Tariff Pass-through

In the first step of our analysis, we use a model to estimate the increase in the price of final goods we would expect across product categories based on their exposure to tariffs. Tariffs raise the cost of imported inputs and of imported final goods, and part of that increase in cost is passed on to consumers. The impact on prices depends on the size of the tariff increases, which vary across both products and trading partners, as well as by how much of a good’s value is imported either directly or through imported inputs used by domestic producers.

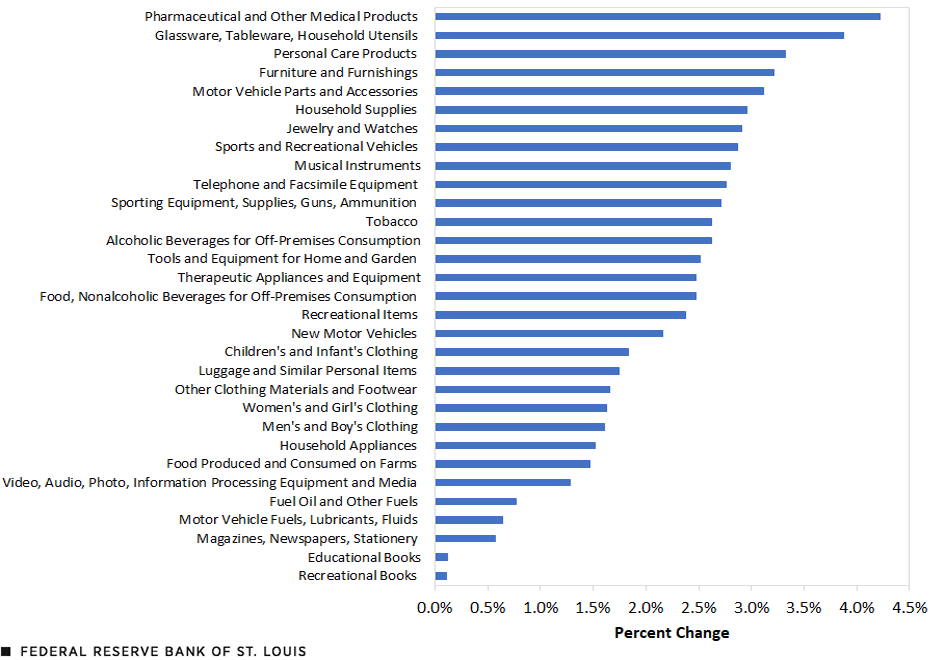

Assuming full pass-through, meaning that all tariff-related cost increases are fully reflected in final consumer prices, we compute the model-predicted price change for each PCE product category. The estimates incorporate tariff increases observed in the data until July 2025 and are reported in the next figure. Two forces shape the magnitude of the effects:

- First, tariff rates differ across goods and across trading partners.

- Second, consumer goods that are imported or that rely heavily on imported components will be more affected by tariffs than goods with higher domestic content.

The figure shows that the effect of tariffs varies widely among goods. Categories such as furniture, motor vehicle parts and musical instruments show some of the largest predicted price increases due to tariffs, while others, such as fuels and books, display much smaller effects.The PCE-weighted average effect of the tariffs on prices implied by the model is 0.87%.

Estimated Price Effect of Tariffs by Product Category with Perfect Pass-through

SOURCES: U.S. Census Bureau and authors’ calculations.

NOTE: Estimated effects were computed using U.S. imports and effective tariffs (collected duties over value of imports) between May and July 2025.

Measuring Tariff Pass-through in the Data

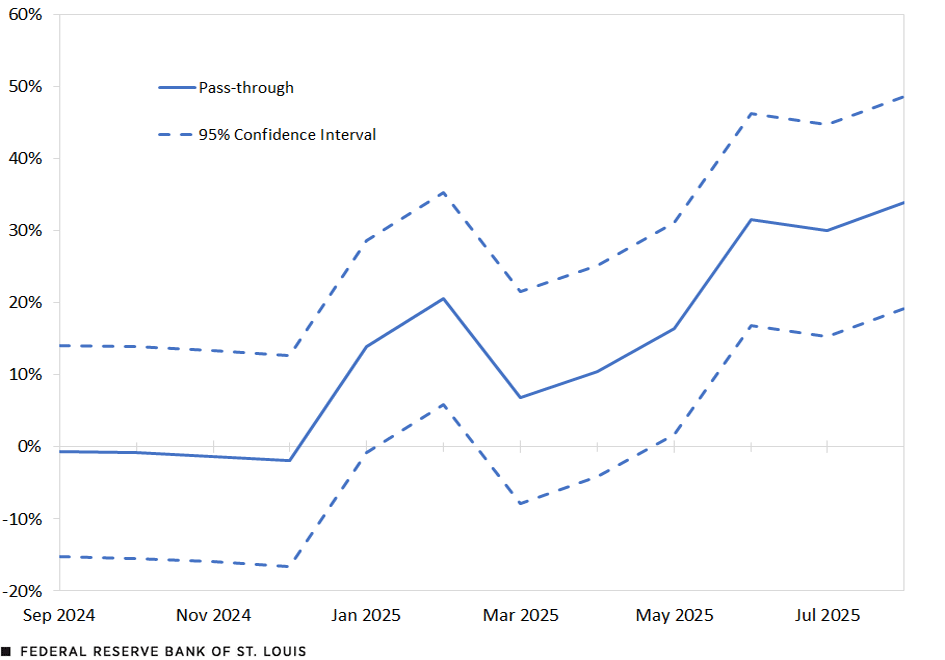

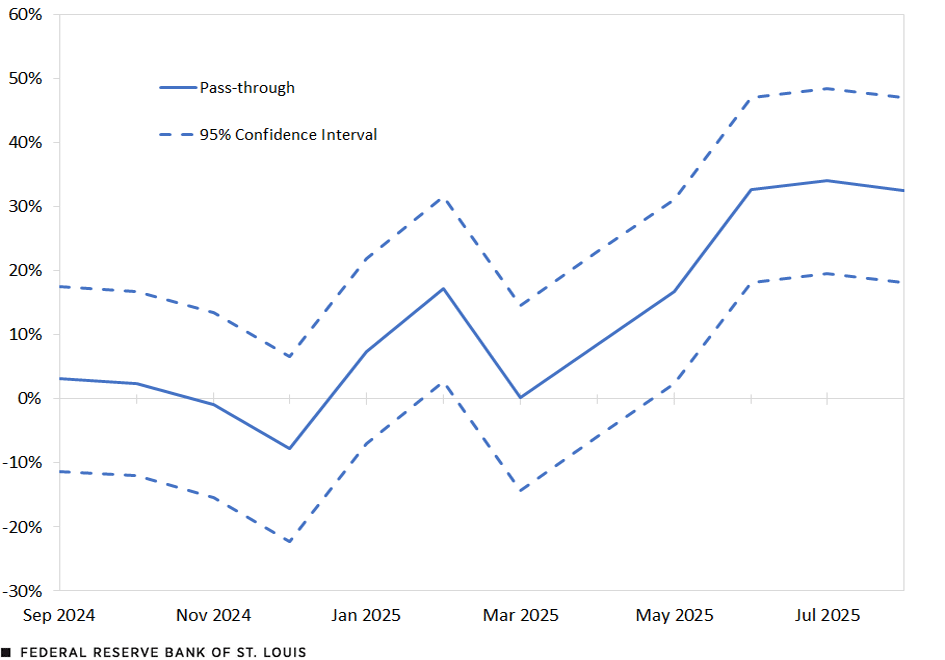

To assess how these predicted price effects due to tariffs are materializing in practice, we estimate the relationship between observed changes in PCE prices and the tariff exposure implied by our model using an event study, or “local projection,” regression. We follow a methodology similar to that of a 2025 Fed analysis.See Robbie Minton and Mariano Somale’s May 9, 2025, FEDS Notes article, “Detecting Tariff Effects on Consumer Prices in Real Time.”

The identification comes from comparing how prices move across product categories that differ in their model-based exposure to tariff shocks. Specifically, we determine how much PCE prices change, month by month, after a tariff increase and whether the categories more exposed to the shock experience larger price responses. The regression recovers a separate coefficient for each month, allowing us to trace how these effects evolve over time.

The next two figures show the estimated effects of tariffs on headline and core PCE prices, respectively. The solid blue line represents the estimated impact, and the dashed lines show the 95% confidence interval. For headline PCE, estimates of the pass-through remain stable and close to zero early in the sample but begin to rise after the new tariffs take effect at the beginning of 2025, with the increase becoming more pronounced in subsequent months. By August 2025, about 35% of the model-predicted effect appears to have materialized in the data. (See the first figure below.) The pattern for core PCE, which excludes food and energy, is similar. (See the second figure below.)

Pass-through of Tariffs on Headline PCE Prices, September 2024-August 2025

Pass-through of Tariffs on Core PCE Prices, September 2024-August 2025

SOURCE FOR THE TWO FIGURES: Authors’ calculations.

Next, we combine the estimated coefficients from the local projection regression with a PCE-weighted measure of tariff exposure across product categories. This measure aggregates the predicted tariff shocks using expenditure weights, capturing the overall exposure of the consumption basket to tariffs over time. By linking this aggregate exposure to our estimated coefficients, we obtain a time series representing the cumulative contribution of tariffs to PCE prices. The resulting series provides an economy-wide measure of how much of the observed increase in inflation can be attributed to tariffs, as summarized in the table below.

The table shows that tariffs account for a meaningful share of recent inflation. Over the June-August 2025 period, tariffs explain roughly 0.5 percentage points of headline PCE annualized inflation and around 0.4 percentage points of core PCE annualized inflation.Measured for the 12-month period ending August 2025, tariffs explain 10.9% of headline PCE annual inflation.

| Headline PCE | Core PCE | |||

|---|---|---|---|---|

| Data | Without Tariffs | Data | Without Tariffs | |

| June-August 2025 Annualized Inflation | 2.85% | 2.35% | 2.90% | 2.49% |

| SOURCE: Authors’ calculations. | ||||

Putting It All Together

Our analysis suggests that tariff measures are already exerting measurable upward pressure on consumer prices. The rise in prices beginning in early 2025 coincides closely with tariff developments, and our model-based regressions confirm that these effects are statistically and economically significant.

At the same time, the pass-through remains partial; only a portion of the model-predicted effect has materialized so far. This could reflect delays in price adjustments, competitive pressure limiting firms’ ability to raise prices, or expectations that the tariffs may prove temporary.

As we continue to monitor inflation dynamics in the months ahead, understanding the link between trade policy and consumer prices will be essential for assessing the persistence of inflation and the broader implications for economic policy.

Notes

- The PCE-weighted average effect of the tariffs on prices implied by the model is 0.87%.

- See Robbie Minton and Mariano Somale’s May 9, 2025, FEDS Notes article, “Detecting Tariff Effects on Consumer Prices in Real Time.”

- Measured for the 12-month period ending August 2025, tariffs explain 10.9% of headline PCE annual inflation.

Citation

Maximiliano A. Dvorkin, Fernando Leibovici and Ana Maria Santacreu, ldquoHow Tariffs Are Affecting Prices in 2025,rdquo St. Louis Fed On the Economy, Oct. 16, 2025.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions