How Child Care Impacts Parents’ Labor Force Participation

As of February 2023, the number of child care workers in the U.S. was about 6% below its pre-pandemic level while the cost of child care was up by 14%.The number of child care workers measured at 960,000 prior to the pandemic and declined to 630,000 in March 2020. Since then, the number of workers has continuously increased, reaching 900,000 in recent months. This is based on our calculations using the Quarterly Census of Employment and Wages data from the U.S. Bureau of Labor Statistics. We calculated the increase in child care prices based on the series “Consumer Price Index for All Urban Consumers: Tuition, Other School Fees, and Childcare in U.S. City Average” retrieved from online database FRED. The shortage of child care workers and rising child care prices have been deemed partly responsible for the lackluster rebound of labor force participation (LFP) rates. Consistent with this hypothesis, a larger share of nonworking parents of young children and those working only part time currently report child care needs as the main reason for their low work hours. This fraction increased from about 15% prior to the pandemic to 18% in February 2023.To compute these numbers, we used the Current Population Survey from the U.S. Census Bureau. We focused on a sample of working age individuals who are either out of the labor force or work part time and have at least one child age 5 or younger. We included the share of this sample that reports child care needs as the main reason for not working full time.

This two-part blog series explores the child care hypothesis. In this first post, we describe LFP trends of various groups, which differ in terms of their child care needs. In our next post, we analyze data across states and over time to separate the effects of rising child care costs from those of other factors behind the nationwide trend in labor supply. Contrary to popular belief, we did not find strong empirical support for the child care hypothesis.

How Household Needs Vary

We begin by considering time trends in LFP rates of different groups of households. If the child care hypothesis were the main factor behind the LFP dynamics, we would expect to see weaker labor supply rebounds for households with small children. In this blog post, we focus on the demographic groups qualified by gender (man or woman), presence of partner in the household, and age of the youngest child in the household, i.e., below 6 or between 6 and 17.

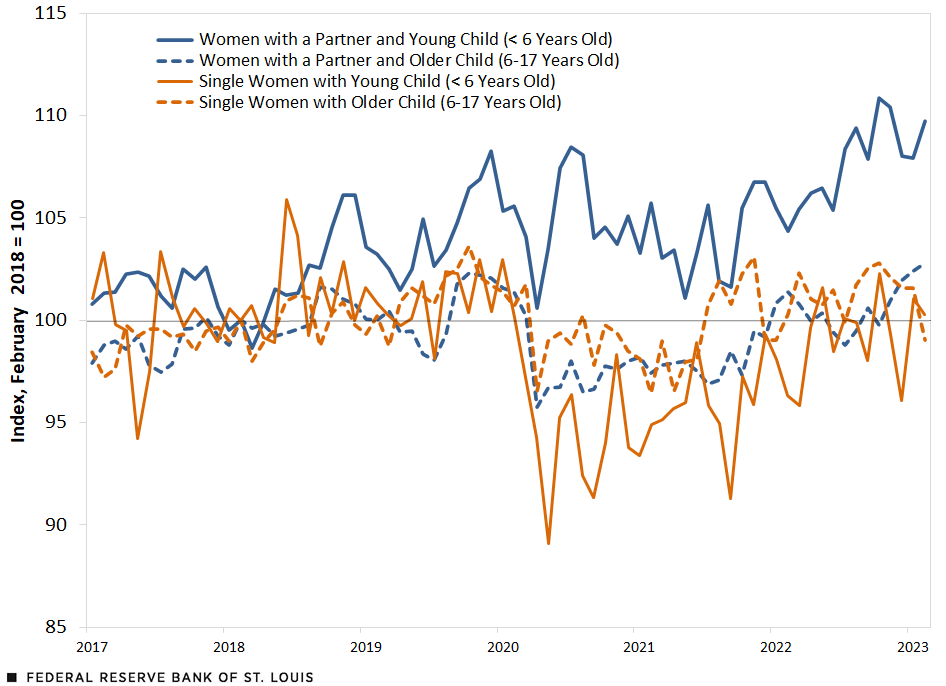

The figure below shows the index of LFP for women with at least one child in the household by relationship status and age of the youngest child. For all groups, the index is normalized to 100 in February 2018. The LFP index dropped sharply for all groups at the start of the pandemic (March 2020).

All groups, except single women with young children—the group that also experienced the largest impact during the initial shutdown period—have returned to their pre-pandemic LFP levels by the end of the sample (February 2023). Interestingly, women with a partner and young children—the group we expected to be most sensitive to child care prices—showed the strongest rebound with their LFP index having surpassed its pre-pandemic level. As a result, we do not see clear evidence for weaker labor supply rebounds among households with small children by early 2023.

Labor Force Participation Index for Women with Children

SOURCES: Current Population Survey and authors’ calculation.

NOTE: Groups are defined by the presence of a partner and age of the youngest child in the household.

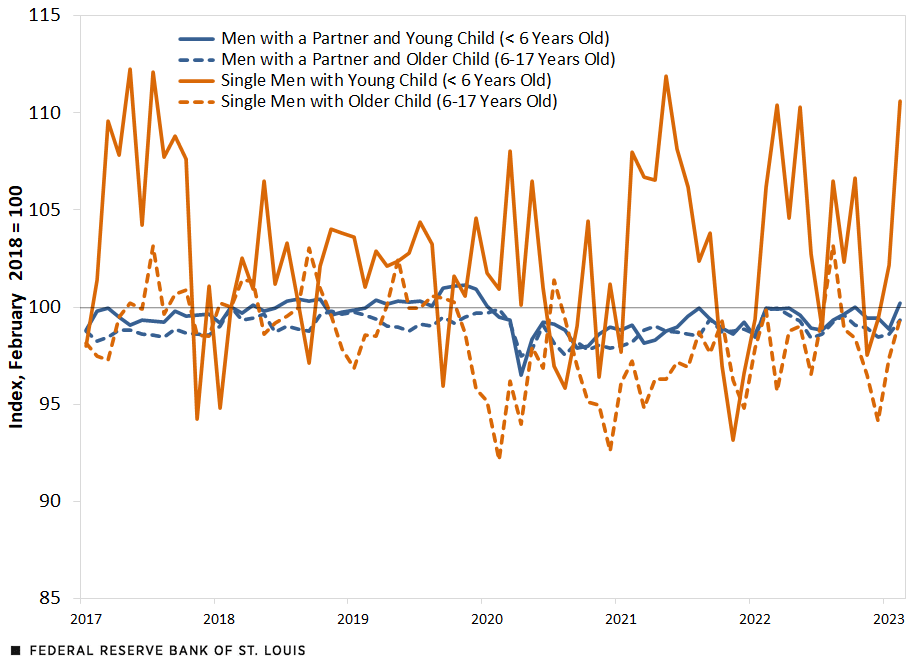

Focusing on men (see the figure below), we notice little variation over time in their LFP index, which implies that women are the primary drivers of the drop and rebound of aggregate LFP rates among individuals with children. Interestingly, it looks like partnered men with young and old children—the two groups with historically high and stable participation rates of 93%-95% (not shown)—have pulled back somewhat on their participation in the first months of 2023 while their female partners stepped up as we saw in the first figure.

Labor Force Participation Index for Men with Children

SOURCES: Current Population Survey and authors’ calculations.

NOTE: Groups are defined by the presence of a partner and age of the youngest child in the household.

The LFP Rates for Adults without Children

The remaining population segment of interest is adults without children younger than 18 in the household, which we split into two groups according to their age—those who are younger than 55 and those who are 55 or older.

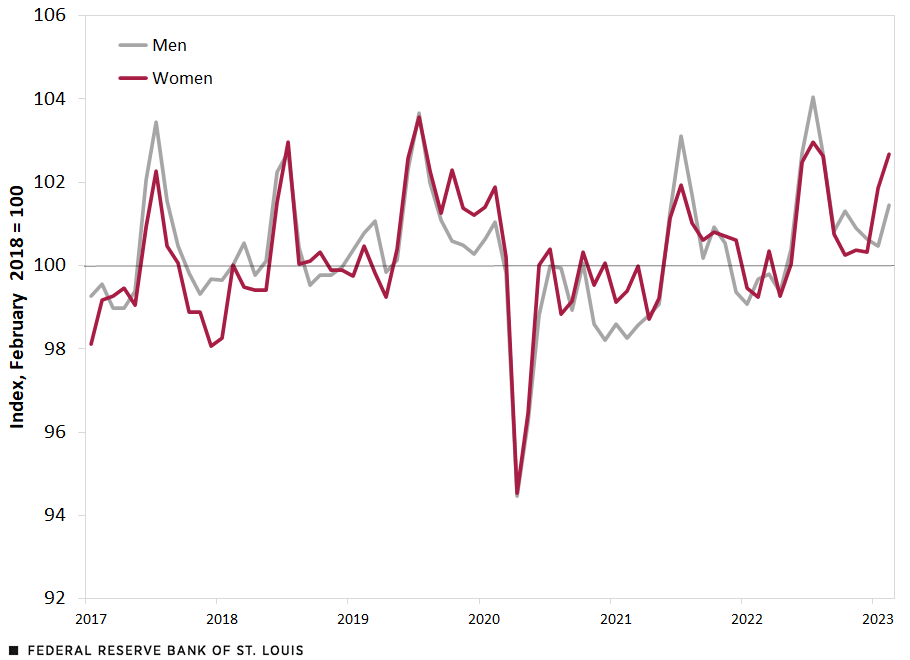

We found that, for the younger group, the LFP index dropped by about 5 percentage points during the first month of the COVID-19 pandemic and had fully rebounded by early 2023 to its pre-pandemic level. (See the figure below.) Note that this group is not affected by child care costs, yet we do not see its LFP index rebound more strongly compared with that of adults with children.

Labor Force Participation Index for Adults under Age 55 without Children in the Household

SOURCES: Current Population Survey and authors’ calculations.

For those that are 55 and older, however, the LFP index dropped by 5 percentage points and had remained at that lower level at least until February 2023, the last data point. (See the figure below.) This is the only population segment that showed a long-lasting decline in market work, thereby pulling back the aggregate LFP statistic. Note that the dynamics look similar for men and women, which sheds doubt on the idea that older women reduced their labor supply to help take care of their grandchildren. If this were indeed the reason for the decline in their LFP, we would expect the decline to be larger for women.

Labor Force Participation Index for Adults Age 55 and Older without Children in the Household

SOURCES: Current Population Survey and authors’ calculations.

Other Factors Could Play a Role in LFP Dynamics

To summarize our look at aggregate trends, we do not see clear evidence for the child care hypothesis. Indeed, the overall labor market sluggishness has been predominantly driven by individuals over the age of 55. Also, women with a partner and children exhibited the strongest rebound of LFP among all groups.

Nonetheless, we cannot rule out the child care hypothesis based on time series data. After all, there are other factors that influence LFP dynamics, which may introduce different trends for different population groups. It is possible that higher child care costs—reflecting both possible reductions in numbers of child care workers but also general increases in cost—did depress the labor supply of young parents and that there would be higher LFP rates in the absence of rising child care costs.

In our next post, we examine the impact of higher wages for child care workers on LFP rates.

Notes

- The number of child care workers measured at 960,000 prior to the pandemic and declined to 630,000 in March 2020. Since then, the number of workers has continuously increased, reaching 900,000 in recent months. This is based on our calculations using the Quarterly Census of Employment and Wages data from the U.S. Bureau of Labor Statistics. We calculated the increase in child care prices based on the series “Consumer Price Index for All Urban Consumers: Tuition, Other School Fees, and Childcare in U.S. City Average” retrieved from online database FRED.

- To compute these numbers, we used the Current Population Survey from the U.S. Census Bureau. We focused on a sample of working age individuals who are either out of the labor force or work part time and have at least one child age 5 or younger. We included the share of this sample that reports child care needs as the main reason for not working full time.

Citation

Alexander Bick, Victoria Gregory and Oksana Leukhina, ldquoHow Child Care Impacts Parents’ Labor Force Participation,rdquo St. Louis Fed On the Economy, July 10, 2023.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions