Domestic Debt Before and After the Pandemic Recession

The recent pandemic recession lasted a mere two months, less than a quarter, according to the National Bureau of Economic Research. It was the shortest recession on record since 1857, but it was also one of the sharpest, with real U.S. gross domestic product (GDP) falling by 31.2% in the second quarter of 2020 (annualized). For comparison, the worst quarter in terms of economic growth experienced by the U.S. economy during the Great Recession (2007-09) corresponds to a growth rate of -8.5% in the fourth quarter of 2008.

In a previous blog post, I studied domestic debt dynamics around the Great Recession. Many economists argue that one of the factors that made the previous recession “great” was the high levels of household and financial sector debt as the economy experienced a downturn. This blog post updates my previous analysis and looks at the evolution of different components of domestic debt around the pandemic recession.

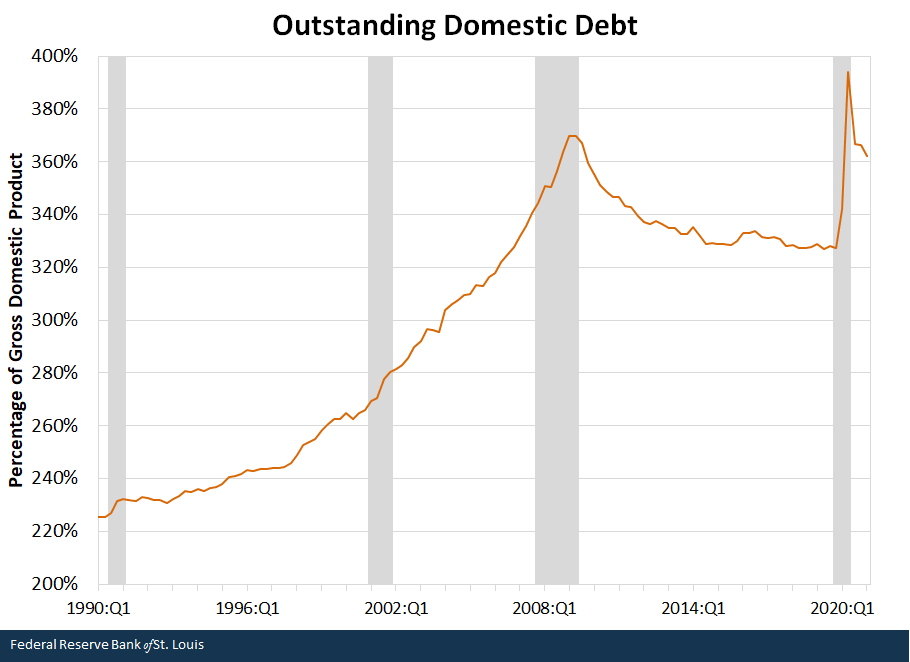

The figure below plots total domestic debt outstanding as a percentage of GDP. Total domestic debt includes both financial and nonfinancial sector debt, with the latter including households, businesses and the government.

NOTE: Gray shading represents recessions.

SOURCES: Federal Reserve Board of Governors' Financial Accounts of the United States, FRED (Federal Reserve Economic Data) and author’s calculations.

The figure shows that total domestic debt outstanding had peaked at around 370% of GDP during the Great Recession, only to progressively fall and stabilize at around 330% in the years leading up to 2020. Domestic debt then jumps from 327% of GDP in the fourth quarter of 2019 to 394% in the second quarter of 2020. This increase is partly, but not totally, explained by the large decrease in GDP: As GDP recovered to its pre-pandemic level in the following quarters, this ratio remained elevated above its pre-pandemic level, at around 360% of GDP.

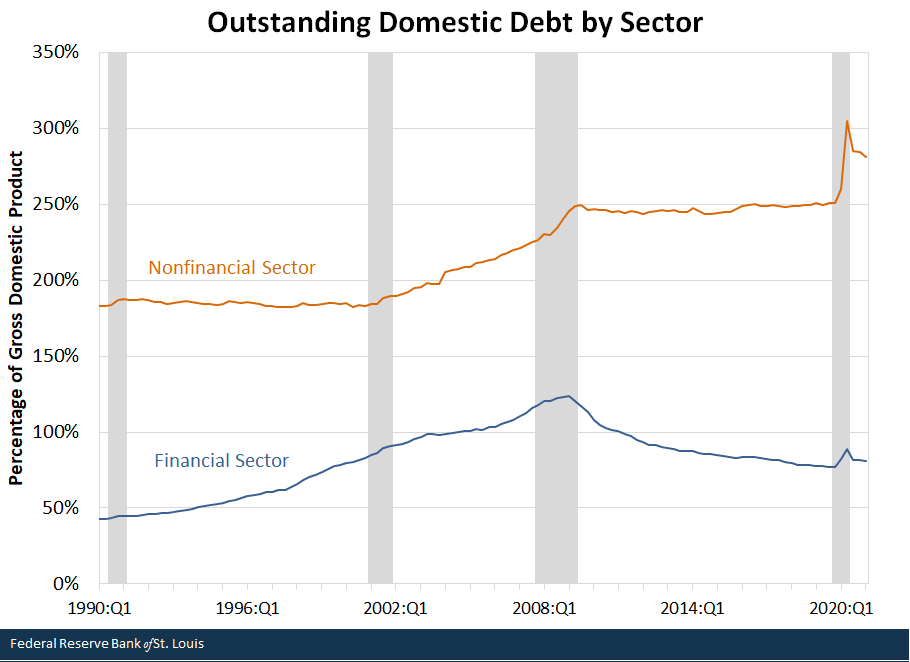

We now proceed to investigate which sectors were responsible for this increase. The next figure disentangles total domestic debt into its two main components: financial sector debt and nonfinancial sector debt, both as a percentage of GDP.

NOTE: Gray shading represents recessions.

SOURCES: Federal Reserve Board of Governors' Financial Accounts of the United States, FRED and author’s calculations.

The leveraging and deleveraging of the financial sector in the pre- and post-Great Recession periods are very visible, as shown by the sharp rise and then by the sharp decline in the debt-to-GDP ratio. While financial sector debt increased during 2020, it roughly returned to its pre-pandemic level, which suggests that the increase in this ratio was mostly attributable to the large drop in GDP. This implies that the large increase in domestic debt was attributable to the nonfinancial sector, which again is very visible in the figure: rising from 251% of GDP in the fourth quarter of 2019 before the pandemic to about 305% at its peak and stabilizing at 281% of GDP in the first quarter of 2021.

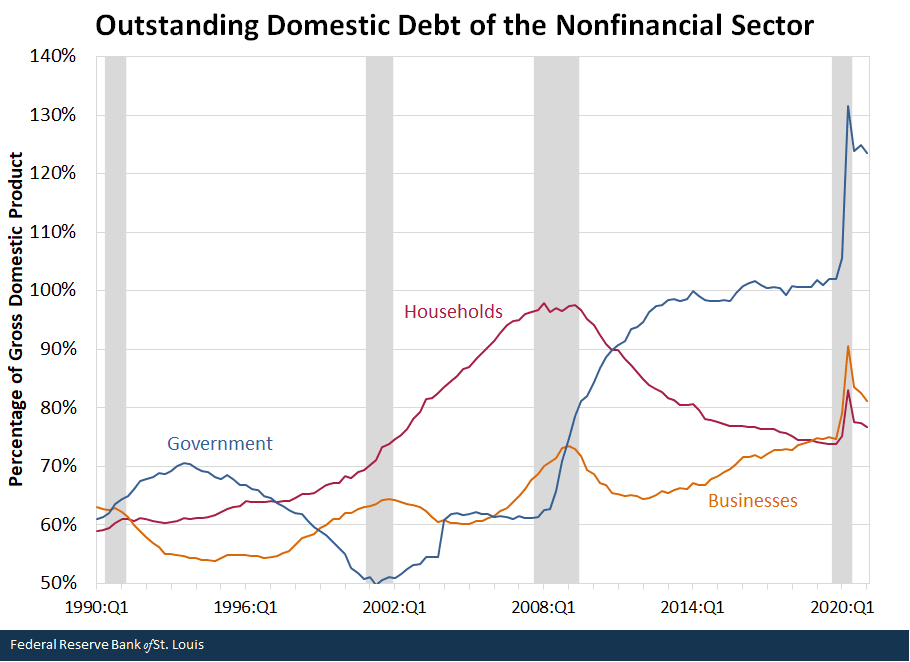

The figure below decomposes nonfinancial sector debt further into its three main components: debt owed by households, nonfinancial businesses and the government.

NOTE: Gray shading represents recessions.

SOURCES: Federal Reserve Board of Governors’ Financial Accounts of the United States, FRED and author’s calculations.

As with the financial sector, the great leveraging and post-2009 deleveraging of the household sector are clear in the figure. Also, similar to the financial sector, household debt increased in 2020 relative to its pre-pandemic trend. This increase is, however, dwarfed by the increases in nonfinancial business and government debt during that same period.

Nonfinancial business debt went from 74% of GDP in the fourth quarter of 2019 to 81% of GDP in the first quarter of 2021. There are several different factors that explain this increase. First, the Federal Reserve activated liquidity facilities (such as the Primary and Secondary Market Corporate Credit Facilities) that either directly or indirectly made it cheaper for businesses to borrow.

Second, a large part of the fiscal policy response to the pandemic recession involved subsidized loans to businesses to help them weather liquidity issues, most notably the Paycheck Protection Program.

Finally, the single largest increase as a percentage of GDP was that of government debt: from 102% of GDP before the pandemic to 124% in the first quarter of 2021. This increase was associated with the large fiscal response to the pandemic recession that was undertaken by the U.S. federal government, notably through the $2.2 trillion Coronavirus Aid, Relief and Economic Security (CARES) Act of March 2020 and the $1.9 trillion American Rescue Plan of March 2021. These were some of the largest fiscal packages ever deployed by the federal government, only comparable in magnitude to the American Recovery and Reinvestment Act of 2009 and the New Deal of the 1930s.

More than one year has passed since the end of the pandemic recession, and the outstanding domestic debt is still at much higher levels than before the pandemic. This increase was driven mostly by government and nonfinancial business debt. As with the Great Recession, there were also some interesting changes in the composition of this debt: Government debt, which was lower than household or business debt before 2011, has now firmly secured its place as the largest stock of nonfinancial debt. Additionally, nonfinancial business debt continued to exceed household debt, something that occurred in 2019 for the first time since the early 1990s, and which reflects not just the large increase in business debt as a consequence of the pandemic recession and associated fiscal policy response, but also the continued deleveraging of the U.S. household sector that began after the Great Recession.

Citation

Miguel Faria-e-Castro, ldquoDomestic Debt Before and After the Pandemic Recession,rdquo St. Louis Fed On the Economy, Sept. 30, 2021.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions