Market-Based Measures of Inflation Risks

Central banks spend a lot of time worrying about inflation. There are entire teams of economists who monitor various types of forecasts based on models or on surveys such as the Survey of Professional Forecasters. A third type of forecast they consider is market-based measures.

Typically, each of these types of forecasts aims to provide an estimate of inflation expectations over a certain horizon. Yet understanding downside and upside inflation risks—such as the probability that inflation averages 1% or 5% over the next five years—may be more valuable. This blog post will compare traditional market-based measures of expected inflation with market-based measures of inflation risks and show how inflation probabilities can provide policymakers with greater insight.

Forecasting Inflation

One commonly used market-based measure of expected inflation can be inferred from the cost of Treasury Inflation-Protected Securities (TIPS) and nominal Treasury securities. The interest payments on TIPS are adjusted for consumer price index (CPI) inflation, while the interest payments on nominal Treasury securities are specified as a fixed dollar amount at the date of purchase.

A conjunction of the yields of these two types of assets—on a given date and for the same maturity—allows us to estimate the real-time market-based inflation expectations by finding the inflation rate at which these two types of assets will yield the same return. This rate is often referred to as “inflation compensation.”

While there is a lot of heterogeneity in the actual values of conventional model-, survey- and market-based forecasts, in large part there is one common theme: They are all estimates of what we expect future inflation to be. As an example, the Federal Reserve has a target of 2% personal consumption expenditures price index (PCEPI) inflation, which means the Fed will conduct monetary policy in such a way that steers inflation toward 2%. Naturally, it is common for forecasts of inflation to cluster around 2% over the longer term.

Forecasting Inflation Risks

There are, however, other types of inflation forecasts that get much less attention. One of these is the prediction of inflation risks. For example, we may expect inflation to average 2% over the next five years, but we may want to have an idea of the likelihood that inflation exceeds 3% instead. Having this type of information improves investors’ ability to balance their portfolio against unexpectedly high inflation and similarly helps consumers to manage their spending patterns.

The Survey of Professional Forecasters provides survey-based estimates for the probabilities of inflation rates, ranging from prices deflating to prices rising 4% or more. But these are only quarterly and hence not sensitive enough to react to idiosyncratic changes in the economy.

Luckily, a higher frequency measure of future inflation probabilities can be inferred from inflation caps and floors. Caps (floors) are option-like contracts that are often used to insure against high (low) inflation. Each type of derivative is purchased for a given maturity and pre-specified inflation rate, or the strike rate.

In the case of a cap, the buyer pays a premium up front to protect the real value of an asset; if actual inflation over the maturity is higher than the strike rate, the seller pays out. Floors work in the opposite fashion—if actual inflation is lower than the strike rate, the seller pays out. By comparing the premiums of either caps or floors of different strike rates for a given maturity, it becomes possible to form a market-based estimate of inflation probabilities over the period of that maturity.

Senate Races’ Impact on Inflation Risks

One example of where these probabilities could be useful is related to the Georgia Senate runoff election in January. Many economists and political pundits alike predicted that with the victory of both Democratic candidates in the Georgia Senate runoff—thus leading to a Democrat-controlled Senate—the risk of higher inflation would significantly increase.

Inflation compensation gives us some information about whether this is true. The Georgia Senate runoff took place on Jan. 5, and five-year inflation compensation was 1.9% and 2.1% on Dec. 30, 2020, and Jan. 13, 2021, respectively. Clearly, inflation expectations increased following the election, but this does not give us any information about upside inflation risk; for example, this increase could have stemmed from a decrease in the probability of 0%-2% inflation instead.

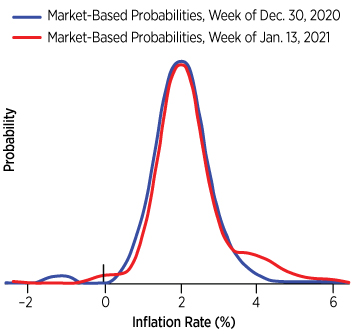

The figure below plots the market-based five-year inflation probabilities for these two dates; the Minneapolis Fed calculated these probabilities using premiums of caps and floors.

Market-Based Probabilities of Longer-Term Inflation

(Market-Based Probabilities of Average Annual CPI Inflation over Five Years)

SOURCE: Federal Reserve Bank of Minneapolis.

NOTES: The figure plots the market-based probability of average annual consumer price index (CPI) inflation being a certain rate over the next five years. The probability is calculated using premiums of inflation caps and floors. The figure generated by the Minneapolis Fed does not provide a scale for the y-axis; see this webpage for details.

The centers of the two distributions look nearly identical, but the right tails are clearly different. To the right of 3% inflation, the areas under the blue and red curves are 15% and 21%, respectively. This means that markets agreed with media predictions—the probability of inflation exceeding 3% over the next five years was measured to be 6 percentage points higher after the Democratic candidates’ victories in Georgia.

Conventional inflation forecasts are useful tools that allow central banks to make informed monetary policy decisions. However, they have a glaring weakness: They do not give any information about the risk of high or low inflation.

Forecasts of inflation probabilities amend this weakness, and thus can often be more useful in gaining insight about the market’s perception of future inflation. Going forward, market-based inflation probabilities in conjunction with other types of inflation forecasts could equip policymakers with the ability to make more-knowledgeable decisions.

Additional Resources

- On the Economy: How COVID-19 May Be Affecting Inflation

- On the Economy: Using Data to Show When Recessions End

- On the Economy: Why the Same Inflation Target May Not Fit All Countries

Citation

Michael W. McCracken and Aaron Amburgey, ldquoMarket-Based Measures of Inflation Risks,rdquo St. Louis Fed On the Economy, March 24, 2021.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions