How COVID-19 Has Impacted Stock Performance by Industry

The COVID-19 pandemic led to a sharp decline in financial markets in March 2020. After peaking on Feb. 19, 2020, the S&P 500 dropped to 66% of its peak by March 23. The market has since recovered, with the S&P 500 reaching 115% of the pre-crisis peak on Feb. 19 of this year. However, the recovery has been highly uneven across sectors. Some recovered quickly, while others are still below pre-COVID-19 levels.

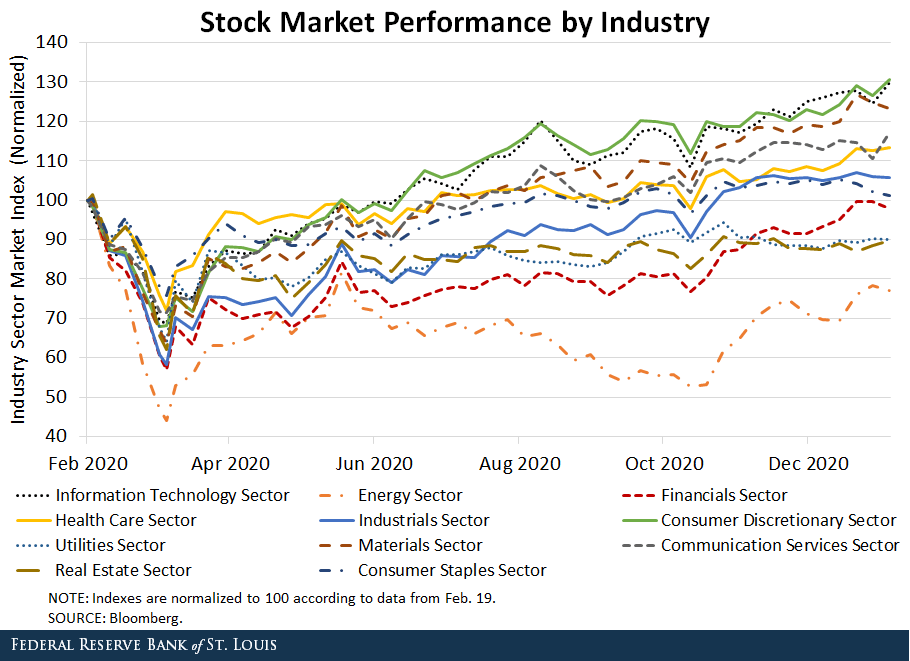

The figure below shows how various sectors have performed since the 2020 peak, with each sector normalized to 100 on Feb. 19, 2020, for comparison.We classified the companies in the S&P 500 into industrial sectors using the Global Industry Classification Standard (GICS), an industry taxonomy developed by MSCI and S&P in 1999.

Hardest Hit Sectors

The sectors that were hit the worst initially were energy, industrials and financials, with low points of 44%, 58% and 57% of their index level on Feb. 19, 2020, respectively. Regarding the energy sector specifically, COVID-19 shutdowns pushed oil demand down, in turn pushing down oil prices and oil company stock prices. As of Feb. 19, the sector had still only recovered to 84% of its level a year earlier.

Other sectors that had not yet recovered to pre-COVID-19 levels were utilities and real estate, which were at 88% and 93% of their level on Feb. 19.

Sectors Faring the Best

During the initial market drop in March, the health care and consumer staples sectors fared the best, with low points of 72% and 76% of their level on Feb. 19, 2020, respectively. The consumer staples sector includes goods and services that are viewed as necessities—such as groceries and nondurable household goods—and typically performs relatively well during recessions. Similarly, it is no surprise that the health care sector fared well during a pandemic-induced recession.

Since the initial drop, the strongest recoveries have been in the information technology, consumer discretionary and materials sectors, with index values at 133%, 130% and 124% of the pre-crisis level. Many companies in the information technology sector—such as Amazon and Microsoft—benefited from the pandemic. The consumer discretionary sector—which covers goods and services that are considered nonessential, such as apparel, restaurants and automobiles—dropped more than the consumer staples sector at the beginning of the pandemic but has since performed well as economic conditions improved.

To sum up, although aggregate market indexes such as the S&P 500 have fully recovered since the beginning of the pandemic, not all sectors have performed equally well. Vaccine distribution and the lifting of pandemic restrictions will likely aid the remaining sectors to return to pre-COVID-19 levels.

Notes and References

- We classified the companies in the S&P 500 into industrial sectors using the Global Industry Classification Standard (GICS), an industry taxonomy developed by MSCI and S&P in 1999.

Additional Resources

- On the Economy: Not All Bursting Market Bubbles Have the Same Recessionary Effect

- On the Economy: Credit Spreads during the Financial Crisis and COVID-19

- On the Economy: More Irrational Exuberance? A Look at Stock Prices

Citation

Yi Wen and Iris Arbogast, ldquoHow COVID-19 Has Impacted Stock Performance by Industry,rdquo St. Louis Fed On the Economy, March 21, 2021.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions