Credit Spreads during the Financial Crisis and COVID-19

The COVID-19 pandemic disrupted financial markets to an extent not experienced since the financial crisis of 2007-09. This time, however, it seems that financial markets recovered much faster than during the financial crisis, part of what many commenters labeled as a K-shaped recovery.In this context, we refer to a K-shaped recovery as a situation in which financial market conditions seem to have quickly recovered from the initial shock, while real economy indicators—such as GDP growth or the unemployment rate—languish. In this entry, we compare the evolution of corporate bonds markets during these periods.

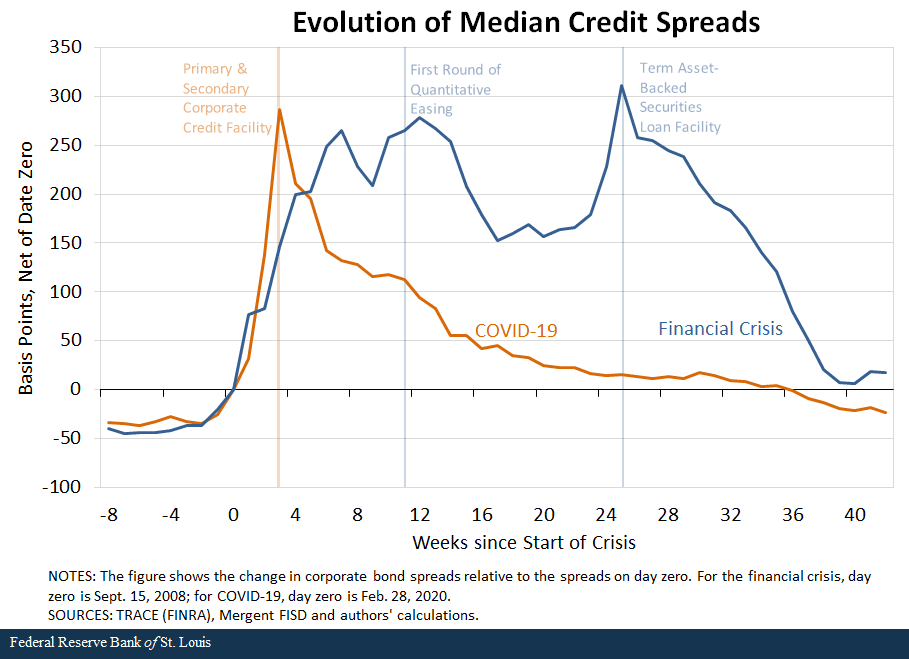

The figure below shows the evolution of credit spreads during the financial crisis and the COVID-19 pandemic.Credit spreads are the difference between the yield of a corporate bond and the interest rate of a safe asset, such as a U.S. government security. The figure shows the median value across credit spreads of different firms and issuances. Credit spreads can represent many different factors, the most important being the ability of firms to repay loans. In other words, higher credit spreads reflect increased probability a firm will not be able to repay their loan. See our previous blog post on credit markets during the pandemic for details on the construction of this measure. For each episode, we plotted median credit spreads at different weeks since the start of each crisis:

- We set the beginning of the financial crisis on the bankruptcy of Lehman Brothers, which occurred Sept. 15, 2008.

- We set the starting date for COVID-19 to Feb. 28, 2020, when the pandemic started to generate large negative effects on U.S. financial markets.See FRASER COVID-19 pandemic timeline.

For each episode, we subtracted the initial level of credit spreads at date zero to focus on changes in credit spreads relative to the beginning of each crisis.

At the onset of both crises, credit spreads increased by about 300 basis points. However, the dynamics are very different:

- During the financial crisis, credit spreads remained significantly higher than pre-crisis levels for several months.

- During COVID-19, credit spreads quickly started to revert to trend.

In fact, when looking at spreads six months after each crisis began, credit spreads were at the peak during the financial crisis but back to pre-crisis levels during COVID-19.

Policy Responses to the Financial Crisis

One possible reason for the different recoveries can be due to policy actions. The vertical lines in the figure identify relevant policy announcement dates from the Federal Reserve. The first major response to financial turmoil in the financial crisis was the first round of quantitative easing, which involved large-scale purchasing of mortgage-backed securities. This occurred 10 weeks after the beginning of the crisis.

Three months later, credit spreads were still at elevated values, and the Fed announced the initial operations of the Term Asset-Backed Securities Loan Facility (TALF) in March 2009, about six months after the onset of the crisis. Only after TALF do credit spreads fall back to pre-crisis levels.

Policy Response to the COVID-19 Pandemic

During the COVID-19 pandemic, the Fed responded swiftly by announcing the Primary and Secondary Market Corporate Credit Facilities on March 23, 2020, just three weeks after the onset of the crisis. At this point, credit spreads quickly started to revert to pre-crisis levels.

Conclusion

This preliminary evidence suggests that the actions taken by the Fed in both episodes were important to contain the rise in corporate bond credit spreads. However, the economic disturbances generated by the financial crisis and COVID-19 were quite different, with potentially very different effects on the economy and space for the effectiveness of Fed policies.

Therefore, we need more research to understand whether the driving forces on corporate bonds markets resulted from different policy actions or by the nature of the economic disturbances.

Notes and References

- In this context, we refer to a K-shaped recovery as a situation in which financial market conditions seem to have quickly recovered from the initial shock, while real economy indicators—such as GDP growth or the unemployment rate—languish.

- Credit spreads are the difference between the yield of a corporate bond and the interest rate of a safe asset, such as a U.S. government security. The figure shows the median value across credit spreads of different firms and issuances. Credit spreads can represent many different factors, the most important being the ability of firms to repay loans. In other words, higher credit spreads reflect increased probability a firm will not be able to repay their loan. See our previous blog post on credit markets during the pandemic for details on the construction of this measure.

- See FRASER COVID-19 pandemic timeline.

Additional Resources

- On the Economy: Corporate Bond Spreads and the Pandemic

- On the Economy: The Effect of Tail Risk on Government Bond Liquidity

- On the Economy: The Maturity Structure of Treasuries Held by the Fed

Citation

Julian Kozlowski, Miguel Faria-e-Castro and Mahdi Ebsim, ldquoCredit Spreads during the Financial Crisis and COVID-19,rdquo St. Louis Fed On the Economy, Feb. 8, 2021.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions