Job Switching Rates during a Recession

The unemployment rate, labor force participation rate and initial unemployment claims are all commonly cited indicators that economists use to diagnose labor market conditions. These indicators become especially useful during and after economic downturns, when we want to know how workers have been affected.

However, there are other important labor market indicators that are often overlooked. One such indicator is the job switching rate, or the rate at which employed workers change jobs. The job switching rate can be thought of as a measure of job mobility—high job switching rates indicate high levels of job mobility.

While job mobility may perhaps be considered less critical than something like the unemployment rate, there is a significant connection between job switching rates and wage growth. Specifically, a high job switching rate is associated with high levels of future wage growth.See Giuseppe Moscarini and Fabien Postel-Vinay’s 2016 article, "Wage Posting and Business Cycles." This makes sense intuitively—workers often make job changes because they are seeking higher wages.

In this blog post, we will document the job switching rate during the COVID-19 recession for both the aggregate economy as well as heterogeneously across earnings groups. This way, we can better predict future wage growth of workers in different earnings groups during the recovery from the COVID-19 recession, which lasted from February to April 2020. Moreover, we will compare these findings with job switching rates during the Great Recession, which lasted from December 2007 to June 2009, to highlight the differences across the two episodes.

Aggregate Effects

For our analysis, we used data from the Current Population Survey (CPS) to track the employment status of U.S. workers. To calculate the job switching rate, we took the proportion of employed workers who started a new job in the reported month. To emphasize important trends, we then seasonally adjusted the data and took the quarterly averages of these monthly rates.

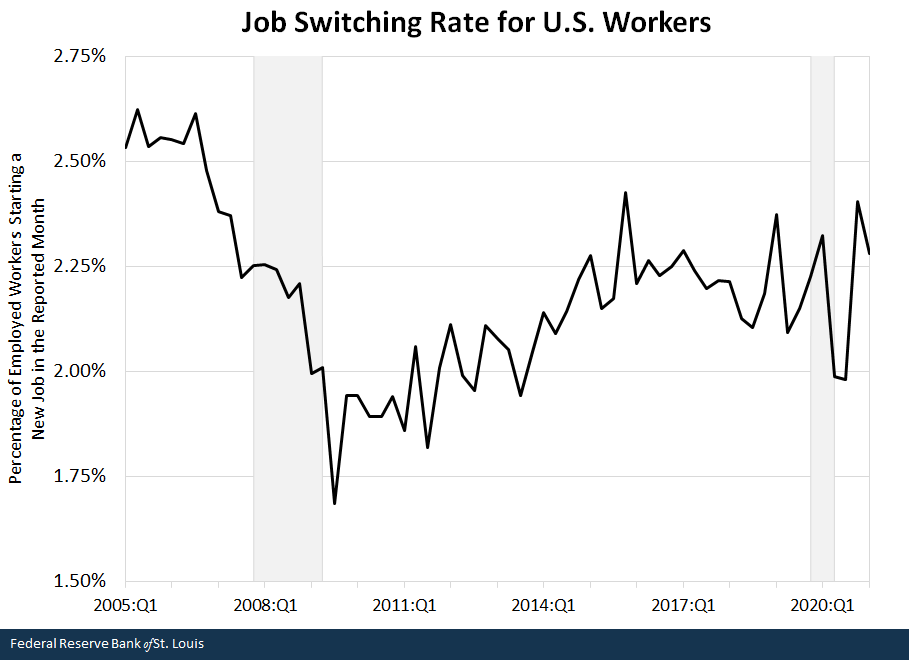

The figure below plots the job switching rate from first quarter of 2005 to the first quarter of 2021.

NOTES: Rates are seasonally adjusted. The gray shading represents recessions.

SOURCES: Current Population Survey and authors’ calculations.

During the Great Recession, we saw a consistent, steep decline in the rate from 2.25% in the fourth quarter of 2007 to 1.69% in the third quarter of 2009. Although the rate jolted back to 1.94% in the fourth quarter of 2009, the recovery back to pre-recession rates did not take place until the first quarter of 2015—more than five years after the recession’s end.

The rate was affected much differently during the COVID-19 recession. In the first quarter of the pandemic (i.e., the first quarter of 2020) the rate was mostly unchanged. However, in the second quarter of 2020, we saw a sharp 0.33 percentage point decline in the job switching rate from 2.32% to 1.99%. The rate remained diminished in the third quarter of 2020, but unlike in the Great Recession, it rose above pre-pandemic levels in the subsequent quarter. The rate remained high in the first quarter of 2021, our last reported date.

Effects by Earnings Group

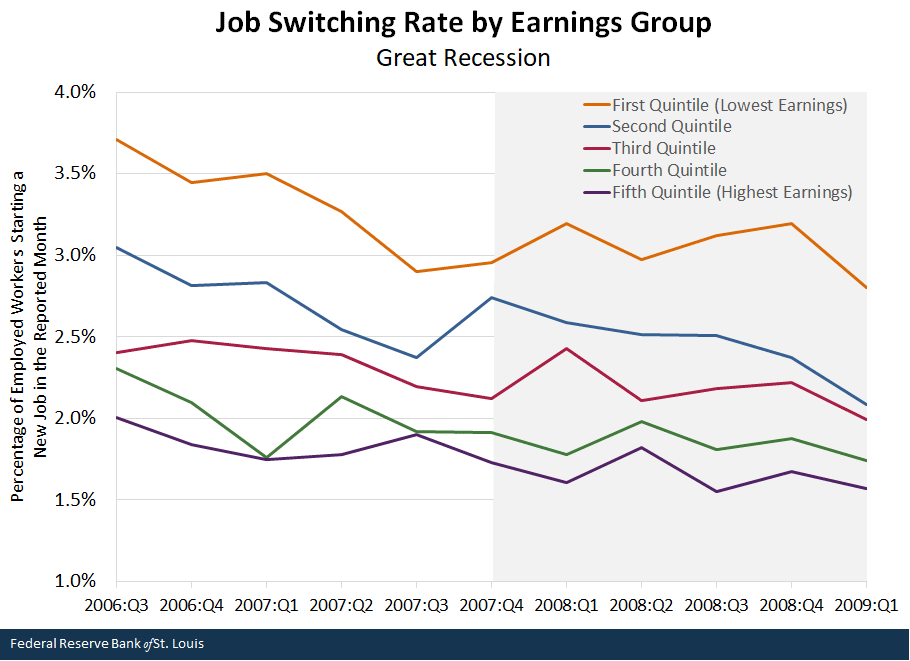

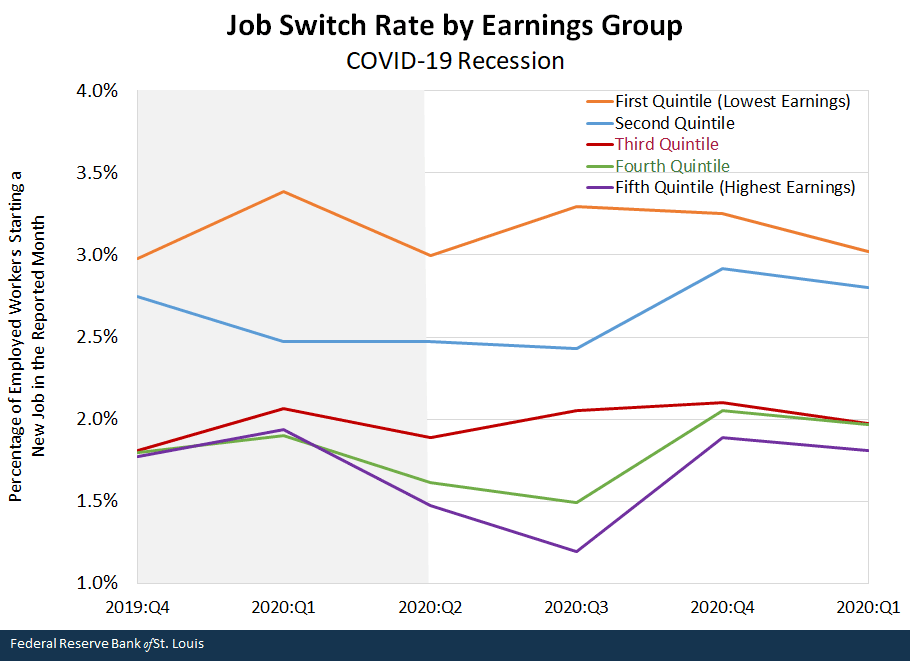

To extend our findings further, we also explored the job switching rates broken out by earnings groups. First, we grouped occupations into quintiles based on the average annual earnings of individuals in each line of work.For details on our methodology in determining quintiles, see our 2020 essay in Economic Synopses. Then we calculated the job switching rate for workers in each occupational earnings quintile using the same method as before. The two figures below display these job switching rates during the Great Recession and the pandemic recession.

In both recessions, job switching rates were consistently higher for lower-earnings groups. Focusing first on the Great Recession, one can see that there were strong declines in each earnings group. The lower-earnings groups did face larger decreases in job mobility, however. The rate for the first quintile—the lowest-earnings occupations—decreased by 0.91 percentage points from 3.71% to 2.80% between the third quarter of 2006 and the first quarter of the first quarter of 2009. On the other hand, the rate for the fifth quintile—the highest-earnings occupations—decreased by only 0.43 percentage points from 2.00% to 1.57% during the same period.

NOTES: Rates are seasonally adjusted. Occupations are grouped into quintiles based on workers’ average annual earnings, ranked from lowest to highest. The gray shading represents the recession.

SOURCES: Current Population Survey and authors’ calculations.

When focus is shifted to the COVID-19 recession plot, one can see that job switching rates decreased for each earnings group in the second quarter of 2020, as shown in the figure below.

NOTES: Rates are seasonally adjusted. Occupations are grouped into quintiles based on workers’ average annual earnings, ranked from lowest to highest. The gray shading represents the recession.

SOURCES: Current Population Survey and authors’ calculations.

However, by the third quarter of 2020, rates had either rebounded or remained unchanged for lower-earnings occupations—the first, second and the third quintiles. This was not the case for the higher-earnings fourth and fifth quintiles, whose rates continued to decrease before rebounding in the fourth quarter of 2020. These differences imply that declines in job mobility were longer lasting for those in higher-earnings occupations.

Why It Matters

Summarizing what we learned above, the key two differences between job switching rates in the two recessions were the speed of the recovery and the earnings groups that were most affected. The Great Recession was characterized by sharper decreases in the job mobility of lower-earnings workers and a slow recovery for all groups. In contrast, the COVID-19 recession was characterized by sharper decreases in the job mobility of higher-earnings workers and a speedy recovery for all groups.

As we noted earlier, job switching rates have an important relationship with wage growth. In line with this point, in the years following the Great Recession there was a slowdown in wage growth. In fact, after the Great Recession, median real wages started to increase only after job switching rates returned to pre-recession values in 2015. Shifting to the current COVID-19 episode, we may see a much quicker wage growth in the future given that job switching rates rebounded fast.

Notes and References

- See Giuseppe Moscarini and Fabien Postel-Vinay’s 2016 article, "Wage Posting and Business Cycles."

- For details on our methodology in determining quintiles, see our 2020 essay in Economic Synopses.

Additional Resources

- On the Economy: How Job Separations Differed between the Great Recession and COVID-19 Recession

- On the Economy: COVID-19’s Effects on Dual-Earner Households

Citation

Serdar Birinci and Aaron Amburgey, ldquoJob Switching Rates during a Recession,rdquo St. Louis Fed On the Economy, Aug. 19, 2021.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions