Firms Start with Fewer Employees over Last 25 Years

When people think about startups that quickly grow into large employers, entrepreneurs like Apple’s Steve Jobs and Harpo Productions’ Oprah Winfrey may come to mind. But often these startups began with just a few workers. An article in the Regional Economist looked at whether the average startup is still generating as many jobs as it once did.

Economist Sungki Hong and Research Associate Devin Werner found that the average startup—firms less than a year old—had 20% fewer workers in 2019 compared with 1994.

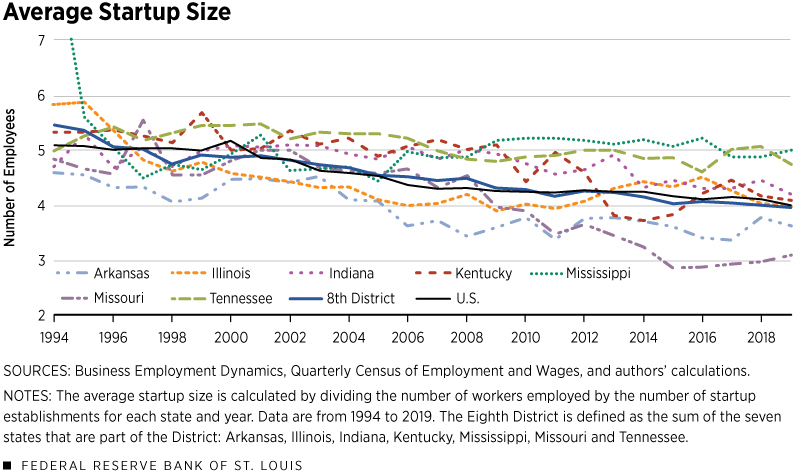

Hong and Werner analyzed the number of employees working at startups in the U.S., using data from the Business Employment Dynamics program and the Quarterly Census of Employment and Wages. They found that employment at startups has declined from five employees to four on average from 1994 to 2019, as shown in the figure below.Startup employment included part-time as well as full-time jobs.

“Interestingly, the decline is linear and smooth, suggesting that this trend was not much affected by booms or busts in the economy,” the authors wrote.

Eighth District Trend

Hong and Werner also found that a similar pattern holds in the seven states of the Federal Reserve Bank’s Eighth District:This analysis encompassed the totality of the seven states in the Eighth District: Arkansas, Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee. Startups required 5.5 employees on average in 1994, which was slightly more than the national average. But they employed only four workers on average by 2019—about the same as the national average.

Within individual states in the District, there are variations in employment trends, the authors noted. For instance, the average number of workers for startups in Tennessee was just under five in 1994 and at the end of the 2019. However, the average startup in Missouri employed around five people in 1994 but only three people in 2019.

“These results coincide with the results of our previous study, implying the shrinking startup employment share can at least be partially explained by a decline in startup size,” the authors wrote.

Startup Size by Industry

So does industry segment matter for U.S. startup employment? Hong and Werner found that it does.

The authors looked at four industries that are important to the U.S. economy: construction, information, leisure and hospitality, and manufacturing. They found marked differences in hires across those segments.

Averaged over time, the largest startup size (about 10 workers) occurred in the leisure and hospitality industry. New manufacturing and information firms averaged six and five workers, respectively, over the sample years. The construction industry had the fewest hires, with an average employment of four.

“The differences across these four sectors are probably due to the differences in input intensities,” the authors wrote. “Many tasks in the construction industry can be completed by machines (hence requiring fewer workers), while services in the leisure and hospitality industry tend to be more labor-intensive.”

During the period analyzed, new U.S. manufacturing and information firms markedly reduced their labor needs. The average manufacturing startup had eight employees in 1994, but this dropped to five by 2009, where it remained. The information industry had around five employees per startup in 1994, and then the number spiked during the dot-com bubble, reaching eight workers. However, the average quickly fell after the bubble burst, settling at around three in 2019.

In contrast, the leisure, hospitality and construction industries altered little, indicating that some industries drove the drop-off more than others, the authors concluded.

Notes and References

- Startup employment included part-time as well as full-time jobs.

- This analysis encompassed the totality of the seven states in the Eighth District: Arkansas, Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee.

Additional Resources

- Regional Economist: How Many People Does It Take to Start a Company?

- On the Economy: Startups Account for Smaller Share of U.S. Jobs

- On the Economy: Which Firms Create More Jobs: Startups or Older Firms?

Citation

ldquoFirms Start with Fewer Employees over Last 25 Years,rdquo St. Louis Fed On the Economy, Sept. 8, 2020.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions