The Connection between Corporate Bond Maturities and Projected GDP Growth

Corporations face significant fluctuations in the cost of issuing debt relative to the cost of issuing equity.

- Professors Malcolm Baker and Jeffrey Wurgler argued that these fluctuations provide an explanation for the capital structure of firms. Baker, Malcolm; and Wurgler, Jeffrey. “Market Timing and Capital Structure.” Journal of Finance, February 2002, Vol. 57, No. 1, pp. 1–32.

- Professors Urban Jermann and Vincenzo Quadrini argued that these financial cycles have important macroeconomic implications.Jermann, Urban and Quadrini, Vincenzo. “Macroeconomic Effects of Financial Shocks.” American Economic Review, February 2012, Vol. 102, No. 1, pp. 238–71.

In a recent working paper, Rodolfo Manuelli and I (Juan) built on this research by studying the implications of these fluctuations on the choice of corporate debt maturity with risk of default.Manuelli, Rodolfo; and Sánchez, Juan. “Endogenous Debt Maturity: Liquidity Risk vs. Default Risk.” Federal Reserve Bank of St. Louis Working Paper 2018-034B, October 2018. Our model delivers an optimal maturity that depends on factors such as financial cycle duration, earnings growth, volatility and asset salability.

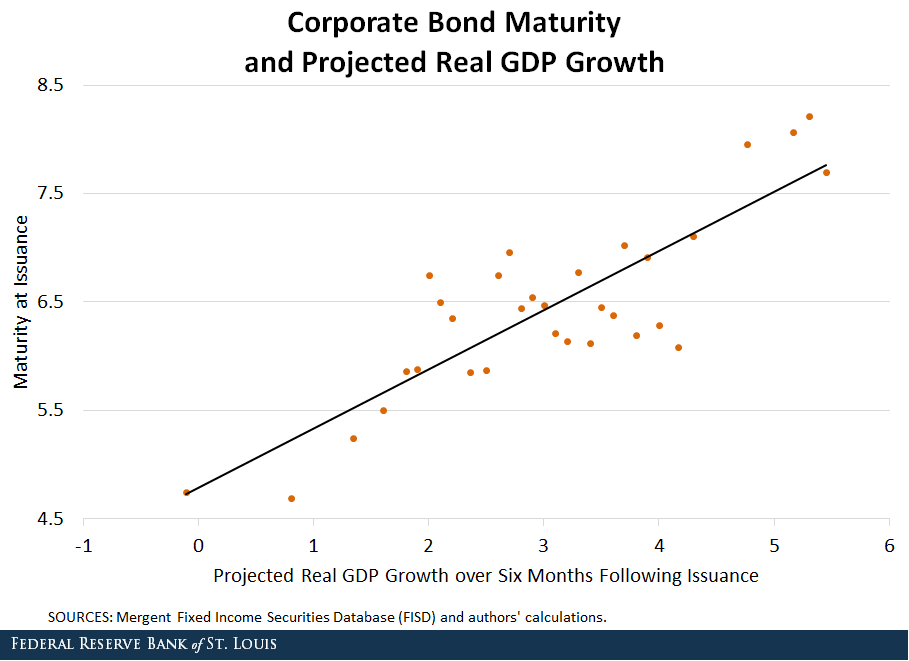

This post evaluates one of the new findings in our work, which is that there is a positive relationship between corporate debt maturity and expected growth. In other words, the better a firm thinks economic growth will be in the future, the longer the maturity of the bonds that they issue.

Economic Projection and Bond Issuance Data

In the paper, we established this relationship using the ratio of research and development expenditure to sales as a proxy for “growth opportunities,” much like the work of Jose Guedes and Tim Opler.Guedes, Jose; and Opler, Tim. “The Determinants of the Maturity of Corporate Debt Issues.” Journal of Finance, December 1996, Vol. 51, No. 5, pp. 1809-33. Here, we will instead directly use a measure of projected real gross domestic product growth two quarters into the future provided by the Federal Reserve’s Greenbook.

The Greenbook is a set of projections for key economic variables that the Fed’s Board of Governors prepares to inform meetings of the Federal Open Market Committee. Given that the Fed views the same information as everyone else, these predictions should provide a good representation of contemporary views among economic forecasters, particularly the forecasters businesses listen to when making decisions about the future.

We merged these data with the Mergent Fixed Income Securities Database, which includes information on bond issuance over time. We limited our analysis to corporate issued bonds that are not “puttable” because maturity is not necessarily relevant for these bonds, as holders of puttable bonds have the right, but not the obligation, to demand early repayment of the principal. Now, all of the necessary elements are in place to consider the relationship between bond maturity at issuance and forecasts for future economic growth.

The Relationship between Debt Maturity and GDP

The figure below shows a positive relationship between corporate debt maturity at issuance and projected real GDP growth over the next six months. An increase in growth from 2% to 4% is associated with an increase in maturity from almost six years to about seven years.

Although this correlation does not mean causation, the theory in our paper suggests an explanation.

When a firm’s debt comes due, there is a risk—called the “liquidity risk”—that the firm will not be able to pay its debt. All else equal, firms would like to issue debt with long maturities to delay this liquidity risk for as long as possible.

However, investors (also holding all else equal) would prefer to finance debt with shorter maturities, because the longer the maturity the less certain that the firm will repay their debts. (This is called “default risk.”)

In this context, increasing the expectations of firm earnings growth will decrease the default risk, making investors more willing to accept debt with longer maturities. Firms in this situation can thus lower their liquidity risk by taking advantage of investor’s changing preferences and lengthening the maturity of their bonds.

Notes and References

1 Baker, Malcolm; and Wurgler, Jeffrey. “Market Timing and Capital Structure.” Journal of Finance, February 2002, Vol. 57, No. 1, pp. 1–32.

2 Jermann, Urban and Quadrini, Vincenzo. “Macroeconomic Effects of Financial Shocks.” American Economic Review, February 2012, Vol. 102, No. 1, pp. 238–71.

3 Manuelli, Rodolfo; and Sánchez, Juan. “Endogenous Debt Maturity: Liquidity Risk vs. Default Risk.” Federal Reserve Bank of St. Louis Working Paper 2018-034B, October 2018.

4 Guedes, Jose; and Opler, Tim. “The Determinants of the Maturity of Corporate Debt Issues.” Journal of Finance, December 1996, Vol. 51, No. 5, pp. 1809-33.

5 We limited our analysis to corporate issued bonds that are not “puttable” because maturity is not necessarily relevant for these bonds, as holders of puttable bonds have the right, but not the obligation, to demand early repayment of the principal.

Additional Resources

- On the Economy: Corporate Debt Since the Great Recession

- On the Economy: What Types of Financial Assets Do People Hold?

Citation

Juan M. Sánchez and Ryan Mather, ldquoThe Connection between Corporate Bond Maturities and Projected GDP Growth ,rdquo St. Louis Fed On the Economy, Jan. 16, 2020.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions