Corporate Debt Since the Great Recession

Corporate debt is a major source of financing for firms, which issue it to finance expansion and investment, mergers and acquisitions, or simply regular operations. Some authors and economists argue that the recent low interest rate environment has incentivized the rapid growth of corporate debt. As of the end of the first quarter of 2019, nonfinancial corporate debt was nearly $10 trillion, which is almost 47% of GDP, the highest it has been since data has been available.See the Financial Accounts of the United States from the Federal Reserve Board of Governors

Many people—including policymakers such as Federal Reserve Chair Jerome Powell—have argued that the rapid rise of corporate debt may pose threats to financial stability.See, for example, Powell, Jerome. “Business Debt and Our Dynamic Financial System.” Speech at the 24th Annual Financial Markets Conference, Federal Reserve Bank of Atlanta, May 20, 2019.> In this blog post, we look at the types and quality of debt issued since the Great Recession.

Debt Instruments

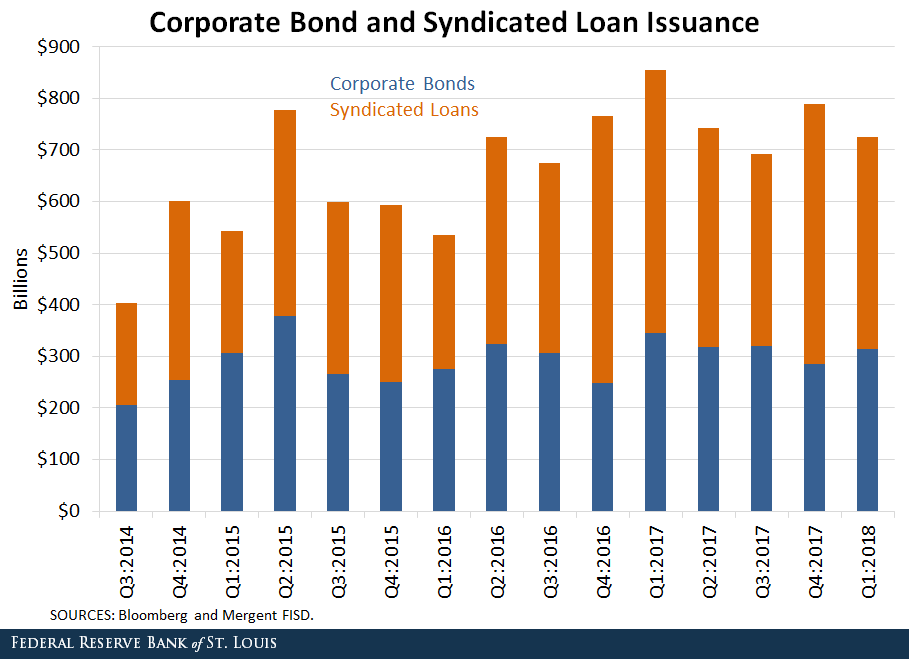

We first broke down corporate debt by the type of debt instrument. The two largest sources of debt financing for nonfinancial firms are corporate bonds and syndicated loans.

When a firm issues a bond, it borrows money from a lender and makes interest payments (commonly called coupons) at regular intervals. At a future date (called the maturity date), it repays the principal amount.

A syndicated loan is issued by a single borrower jointly to a group of lenders (known as a syndicate). The task of finding additional lenders falls to a lead bank, so it is often easier for a firm requiring a large loan to turn to syndicated lending. It is beneficial for lenders as well, since they get greater payoffs by lending more and are less exposed to the risk of borrower default by spreading the risk among multiple lenders.

The figure above shows total corporate bond and syndicated loan issuance since 2014. Total debt issuance via these two types of instruments has been rising, and syndicated loan issuance accounts for over a little more than half of total issuance (57% of issuance as of the first quarter of 2018).

Debt Quality

Syndicated Loans

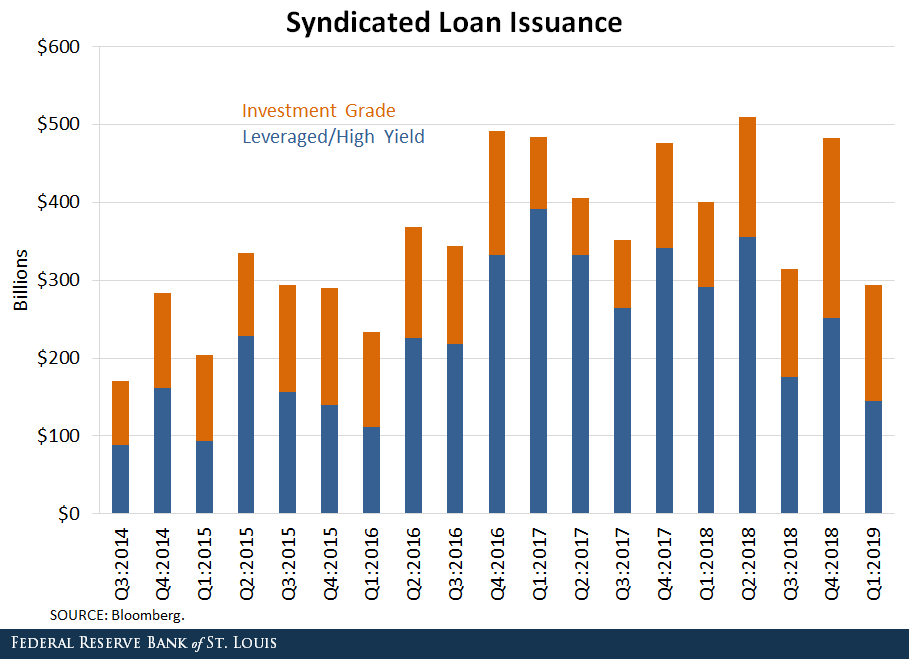

What about the quality of this debt? Is it riskier than usual? To analyze this, we broke down syndicated loan issuance between leveraged (or high-yield) loans and investment-grade loans:

- Leveraged loans are typically considered riskier by ratings agencies, since these are loans extended to firms with already high levels of debt or poor credit histories.

- Investment-grade loans are loans made to firms with good credit ratings, and these loans present a relatively low risk of default.

We observe from the graph below that the syndicated loans issued are mostly of the leveraged variety. In 2018, 63% of the syndicated loans issued were leveraged.

Corporate Bonds

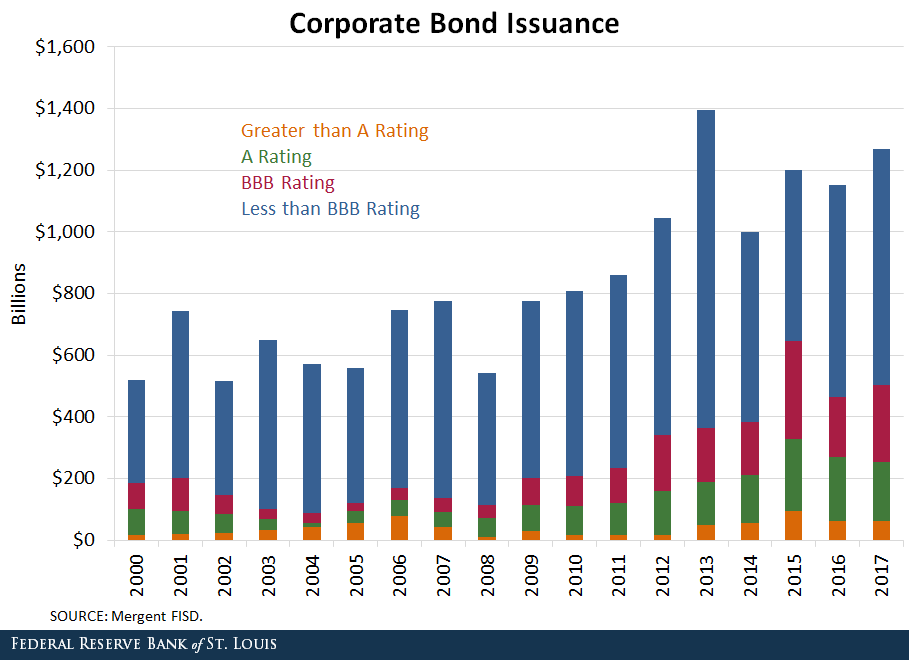

We observed a similar trend for corporate bonds as well, with high-yield bonds making up nearly 60% of total bonds issued in 2017. This can be seen in the figure below. Bonds with ratings of BBB or higher (that is, AAA, AA, A and BBB) are generally considered relatively safe. Bonds with ratings below BBB (BB, B, CCC, etc.) are considered low credit quality and riskier than investment-grade bonds.

While there is no consensus among economists on the degree to which corporate borrowing can affect the economy, it is worth noting that a large proportion of loans have recently been extended to firms with relatively high probabilities of default.

Notes and References

1 See the Financial Accounts of the United States from the Federal Reserve Board of Governors.

2 See, for example, Powell, Jerome. “Business Debt and Our Dynamic Financial System.” Speech at the 24th Annual Financial Markets Conference, Federal Reserve Bank of Atlanta, May 20, 2019.

Additional Resources

- On the Economy: What Types of Financial Assets Do People Hold?

- On the Economy: Does Age Matter for Your Portfolio Mix?

- On the Economy: Domestic Debt Before and After the Great Recession

Citation

Miguel Faria-e-Castro and Asha Bharadwaj, ldquoCorporate Debt Since the Great Recession,rdquo St. Louis Fed On the Economy, Aug. 13, 2019.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions