Staff Pick: How Do People Handle Financial Emergencies?

The On the Economy blog will periodically rerun posts that were of particular interest. The following is a March 2019 post by YiLi Chien and Qiuhan Sun on financial emergencies.

How do American households respond to a financial emergency? Obviously, this question is deeply related to households’ financial management and soundness, which vary greatly across the U.S. population. Hence, a further question is: How do their responses vary across household characteristics, such as income and age?

Options during a Financial Emergency

The 2016 Survey of Consumer Finances (SCF) provides insight into this issue. According to the survey, around 15 percent of households ran income deficits in 2016, which means that their spending exceeded their income. For the remaining 85 percent, the survey asked how they would respond to a financial emergency that left them unable to pay all of their bills. Households chose from the following four options:

- Borrow from others

- Spend from own savings

- Postpone payments

- Cut back spending

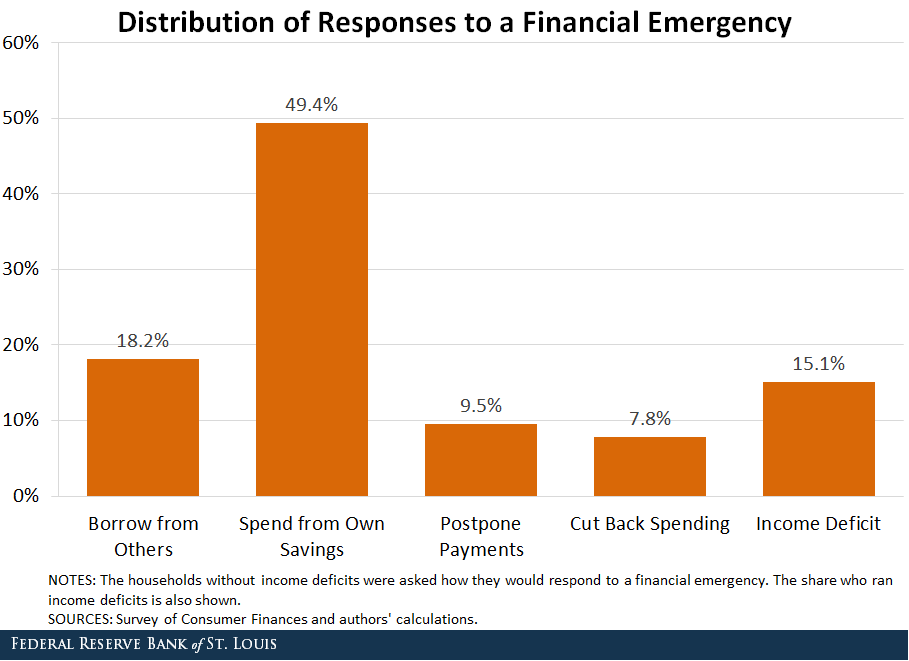

The figure below shows the distribution of responses to a financial emergency for the non-income-deficit households, as well as the share who ran income deficits.

Nearly half said they would use their savings. This indicates that a fairly good share of the population plans ahead and prepares for an unexpected financial emergency with precautionary savings.

The next most popular option was to borrow from others, accounting for about 18.2 percent. The options of postponing payments (9.5 percent) and cutting back spending (7.8 percent) were less popular.

Income and Financial Emergency Responses

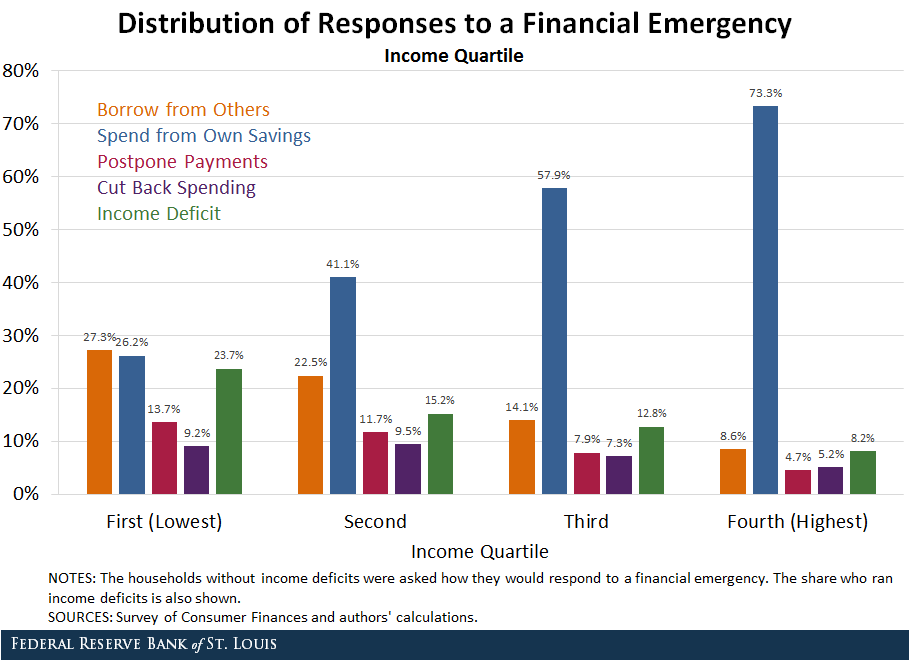

What factors then explain the variation of households’ responses? Intuitively, income is a key factor. The figure below confirms this intuition.

First, the fraction of income-deficit households decreased significantly as the level of household income rose, from 23.7 percent among the bottom quartile to 8.2 percent among the top quartile.

Second, high-income households were more likely than low-income households to buffer their spending against financial shocks through savings. From the top to bottom quartile, the fraction of households that would spend from their savings dropped significantly from 73.3 percent to 26.2 percent. The low-income households might have a harder time saving and hence would have to rely on other methods to finance emergency spending.

Third, the percentage of households that would borrow or postpone payments also considerably decreased with income.

Age and Financial Emergency Responses

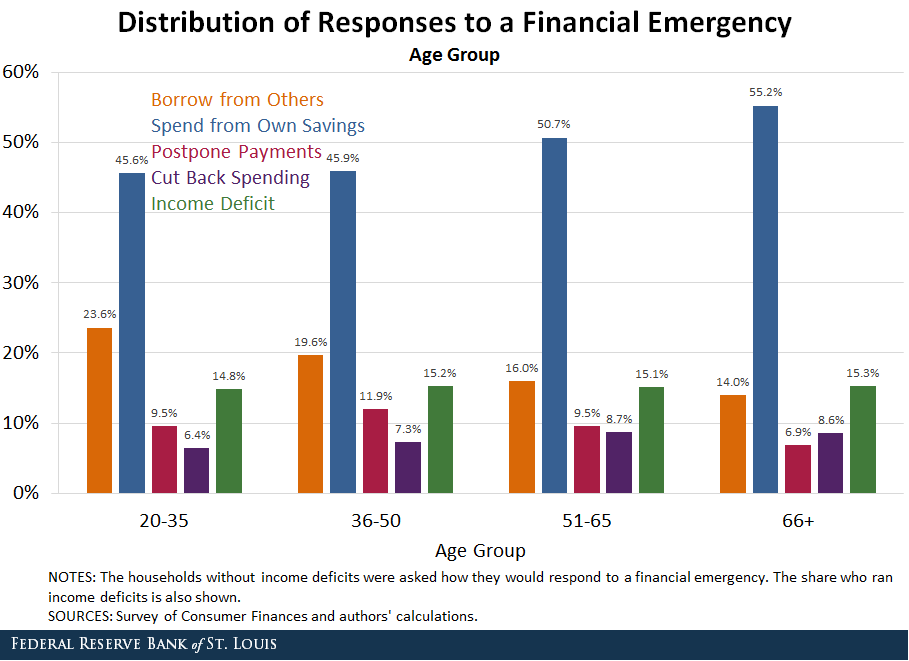

We found that age affected households’ responses only slightly. The figure below plots the distribution of financial choices as well as income-deficit households across four age cohorts.

The fraction of households running income deficits did not improve at all with age. For the other households, the fraction of households that buffered their financial risks through savings increased only slightly with age.

In addition, most of the increase in the use of savings came from reducing the option of borrowing from others. This suggests that the risk exposure of financial hardship does not improve in the course of the life cycle.

Summary

In short, it is encouraging to find that many American households plan for financial emergencies through precautionary savings. However, survey evidence also indicates that the fraction of those households in financial hardship or not well prepared for emergency spending does not improve much with age. This pattern could be worrisome, because low-income households not only earn less but also lack savings to buffer their spending from a financial emergency.

Additional Resources

- On the Economy: Is College Still Worth It? It’s Complicated

- On the Economy: Does Age Matter for Your Portfolio Mix?

- On the Economy: Do Millennials Pay Their Debts Back?

Citation

ldquoStaff Pick: How Do People Handle Financial Emergencies?,rdquo St. Louis Fed On the Economy, Feb. 11, 2020.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions