Do Millennials Pay Their Debts Back?

A popular subject in the press is to consider how millennials are managing their money: what they are buying, how much they are borrowing and what they are investing in. A common criticism seems to be that millennials borrow too much. Whether they do or do not, however, the next question is obvious: “Do millennials pay their debts back?”

We analyzed data from the Federal Reserve Bank of New York Consumer Credit Panel/Equifax on debt delinquency across a nationwide sample of people with credit reports. We considered records from 2003 until present day The reasoning for this restriction is to allow millennials enough time in our sample to generate some debt. In 2003, the oldest millennials would have been around 22 years old. and defined delinquency as having credit card debt payments that were at least 120 days late.

Then, we sorted the data by generation:

- Baby boomers

- Generation X

- Millennials

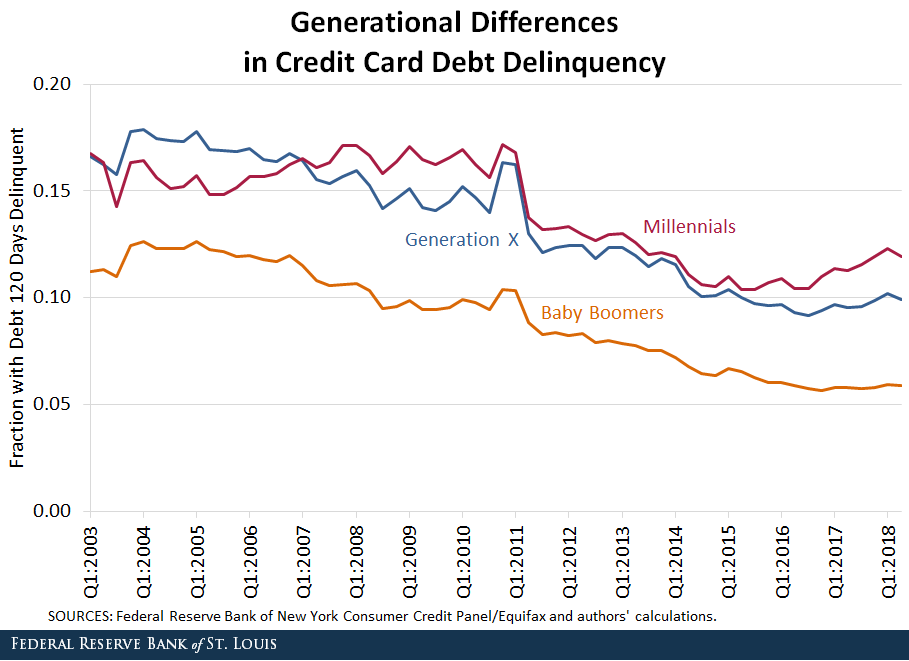

The figure below considers members of these generations that have at least some credit card debt and shows the fraction with credit card debt 120 days delinquent.

An immediate conclusion from this figure is that baby boomers seem to be the most trustworthy generation, with delinquency rates at times about 5 percentage points beneath that of the other generations over this period. In addition, Generation X individuals seem to have maintained a slim edge over millennials since the Great Recession.

Life Cycle Considerations

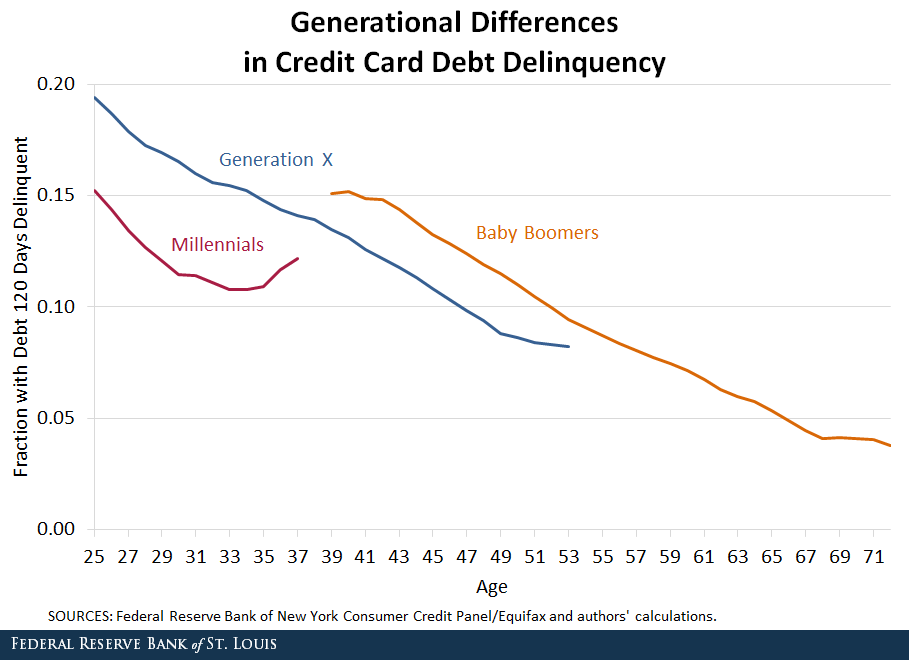

What this initial analysis ignores, however, is the significant life cycle component of the incidence of delinquency. In any generation, debt delinquency is most common among young people and becomes less common later in life. The figure below plots the same data, but uses the x-axis to show the age at which delinquency occurred.

In this case, the conclusion is precisely the opposite: Millennials’ delinquency rates were almost 5 percentage points beneath their nearest counterparts for much of the sample, and baby boomers’ rates were the highest by a slim margin.

Persistence of Financial Distress

These empirical trends take on special significance in light of a working paper I (Juan) wrote with my co-authors José Mustre-del-Río and Kartik Athreya: “The Persistence of Financial Distress.” This paper documents how debt delinquency is not a widespread and transitory phenomenon, but rather a concentrated and persistent one. A majority of people in the time period studied never had a credit card payment that was 120 days late. Among those who did, however, more than 30 percent spent at least a quarter of their time in serious delinquency.

What does that mean for millennials? Given the high persistence of debt delinquency, the lower incidence of delinquency among millennials would suggest that their relative financial trustworthiness will persist throughout the remainder of their lives.

Notes and References

1 The reasoning for this restriction is to allow millennials enough time in our sample to generate some debt. In 2003, the oldest millennials would have been around 22 years old.

Citation

Juan M. Sánchez and Ryan Mather, ldquoDo Millennials Pay Their Debts Back?,rdquo St. Louis Fed On the Economy, Nov. 22, 2018.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions