Financing the U.S. Response to COVID-19

The U.S. fiscal response to the COVID-19 pandemic was unprecedented in speed and size. The federal government enacted massive programs to assist households and businesses, mostly from April to June. The combined effects of this assistance and a depressed economy increased the federal deficit by about $2 trillion, resulting in a record deficit of $3.1 trillion for fiscal year 2020.The U.S. government’s fiscal year begins Oct. 1 and ends Sept. 30 of the subsequent year; it is designated by the year in which it ends. The $2 trillion figure was obtained by subtracting the deficit of fiscal year 2020 from the Congressional Budget Office’s March 2020 baseline, which was about $1.1 trillion. See the CBO website for the latest release and for the 10-year March projections. As a reference, the previous record was $1.4 trillion in fiscal year 2009, in response to the Great Recession, which followed the financial crisis of 2007-08.

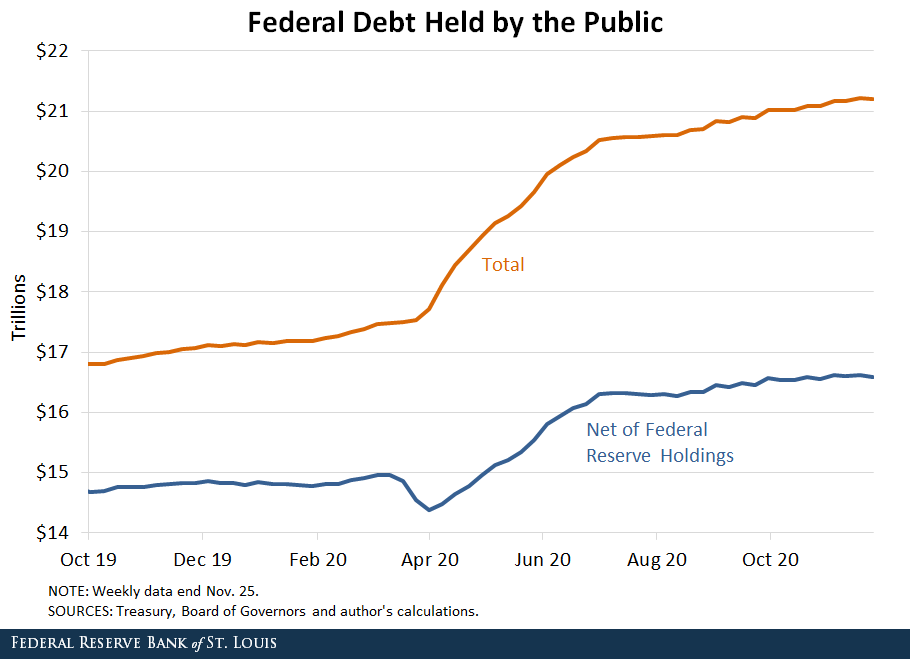

Fiscal deficits are naturally financed with debt. Consequently, federal debt held by the public increased by $4.2 trillion during fiscal year 2020, reaching $21 trillion.Federal debt held by the public excludes holdings by federal agencies (e.g., the Social Security trust funds) but includes holdings by the Federal Reserve. As with government assistance, a significant proportion of this new debt (about $2.9 trillion) was issued from April to June.

Financing the Response

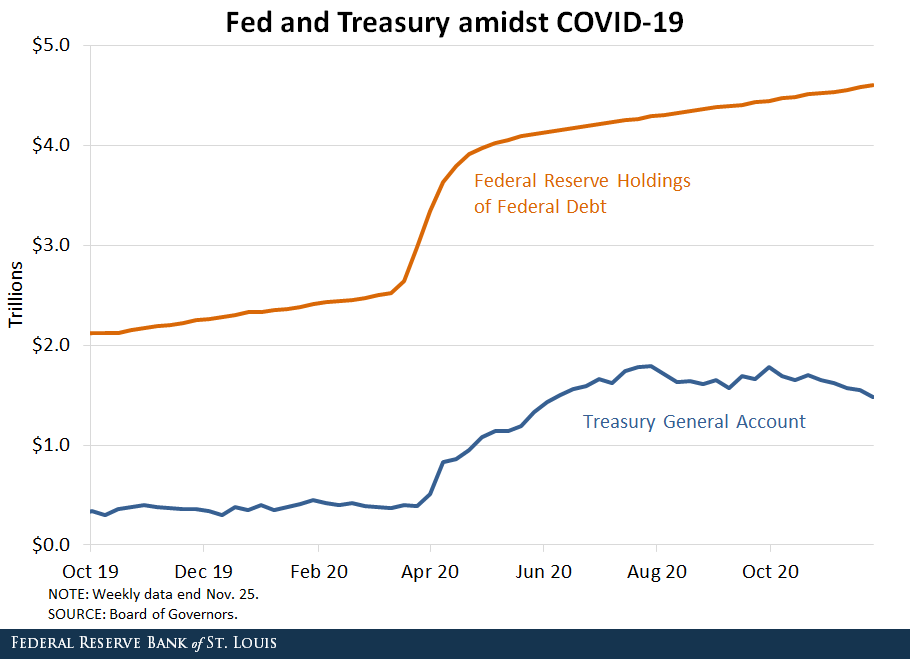

Interestingly, the amount of new debt issued exceeds the deficit by about $1.1 trillion. The reason for this is that the federal government issued excess debt as a precaution, in case further stimulus spending was needed under strained financial conditions. These additional resources are currently sitting in the Treasury’s account with the Federal Reserve, as seen in the figure below. Note that Congress needs to authorize any actual spending.

Biggest Buyers

Though the Fed quickly lowered short-term interest rates down to zero, financial conditions were not obviously auspicious from April to June for such a massive and sudden debt issuance. A pertinent question is who purchased the newly issued debt that let the federal government respond to the economic effects of the pandemic?

As it turned out, the biggest buyer of federal debt was the Fed, which acquired $2.3 trillion during fiscal year 2020. Hence, the net issuance to the non-Fed public was about $1.9 trillion, which is still quite sizable. The first chart shows debt held by the public net of Fed holdings, while the second chart shows Fed holdings of federal debt.

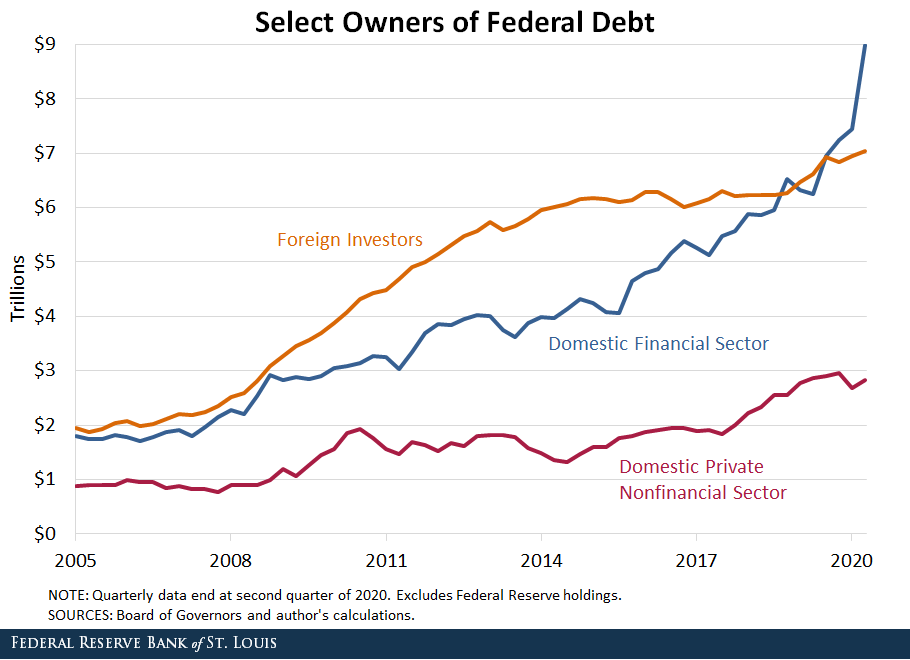

As the third chart below shows, the domestic financial sector (excluding the Fed) has become the main buyer of federal debt in recent years, a trend that was reinforced during the current episode.Data on federal debt by type of holder is currently only available through June 2020. Money market mutual funds were the key players within this group, increasing their holdings of Treasury securities by $1.4 trillion between September 2019 and June 2020. Again, the bulk of these purchases occurred from April to June. Depository institutions absorbed a less significant amount, about $250 billion.

In contrast to the financial crisis of 2007-08 and its aftermath, foreign investors have not played a role in financing the federal deficit during the pandemic. Holdings of federal debt by foreign investors increased substantially during fiscal years 2008 to 2014, by about $3.8 trillion, but the pace has slowed down considerably since then. During fiscal year 2020 (at least until June), foreign holdings of federal debt have remained essentially unchanged.

Notes and References

1 The U.S. government’s fiscal year begins Oct. 1 and ends Sept. 30 of the subsequent year; it is designated by the year in which it ends. The $2 trillion figure was obtained by subtracting the deficit of fiscal year 2020 from the Congressional Budget Office’s March 2020 baseline, which was about $1.1 trillion. See the CBO website for the latest release and for the 10-year March projections.

2 Federal debt held by the public excludes holdings by federal agencies (e.g., the Social Security trust funds) but includes holdings by the Federal Reserve.

3 Data on federal debt by type of holder is currently only available through June 2020.

Additional Resources

- St. Louis Fed’s COVID-19 resource page

- On the Economy: The Impact of the Fed’s Response to COVID-19 So Far

- Regional Economist: The U.S. Financial Landscape on the Eve of the Pandemic

Citation

Fernando M. Martin, ldquoFinancing the U.S. Response to COVID-19,rdquo St. Louis Fed On the Economy, Dec. 1, 2020.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions