Why Intellectual Property Rights Protection Matters for Economic Growth

Good protection and enforcement of intellectual property rights (IPR) are key to promoting international technology transfer, which is important for economic growth, especially in developing economies

Measuring International Technology Transfer

In a 2019 paper, Santacreu, Ana Maria. “A Gravity-Approach to International Technology Transfer: The Role of Intellectual Property Rights.” unpublished manuscript, 2019. I (Santacreu) used data on royalty and licensing fees for 54 countries over the period 1995-2012 to measure the extent of international technology transfer. Royalty payments have also been used as a measure of technology diffusion in other analyses. For example, see Santacreu, Ana Maria. “Does Trading with the U.S. Make the World Smarter?” Federal Reserve Bank of St. Louis, On the Economy Blog, May, 11, 2017; and Branstetter, Lee. “Is Foreign Direct Investment a Channel of Knowledge Spillovers? Evidence from Japan’s FDI in the United States.” Journal of International Economics, March 2006, Vol. 68, Issue 2, pp. 325-44. Royalty payments reflect charges for the use of foreign IPR, which can be used as a measure of knowledge diffusion.

The Organization for Economic Cooperation and Development (OECD) collects data on these cross-country transactions in its EBOPS 2002 – Balanced International Trade in Services database. In particular, it collects data on “payments and receipts between residents and nonresidents for the authorized use of proprietary rights (such as patents, trademarks, copyrights, industrial processes and designs including trade secrets, and franchises).”For additional analysis, see Santacreu, Ana Maria. “Trading Ideas between Countries.” Federal Reserve Bank of St. Louis, On the Economy Blog, April, 17, 2017.

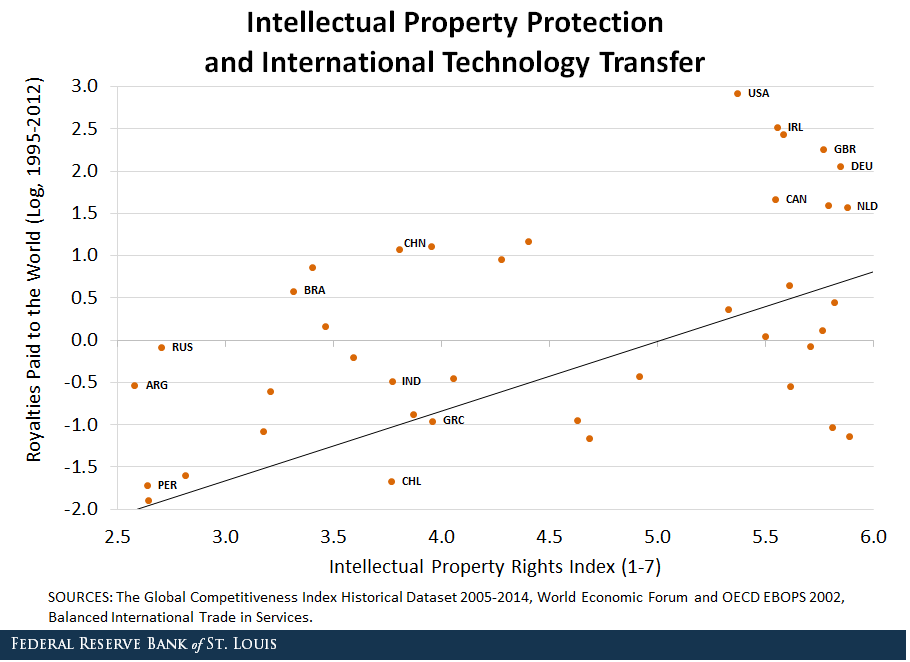

I found that royalty payments are positively related to the quality of IPR protection a country provides, measured by the Intellectual Property Protection Index from the Global Competitiveness Index historical database from the World Economic Forum.

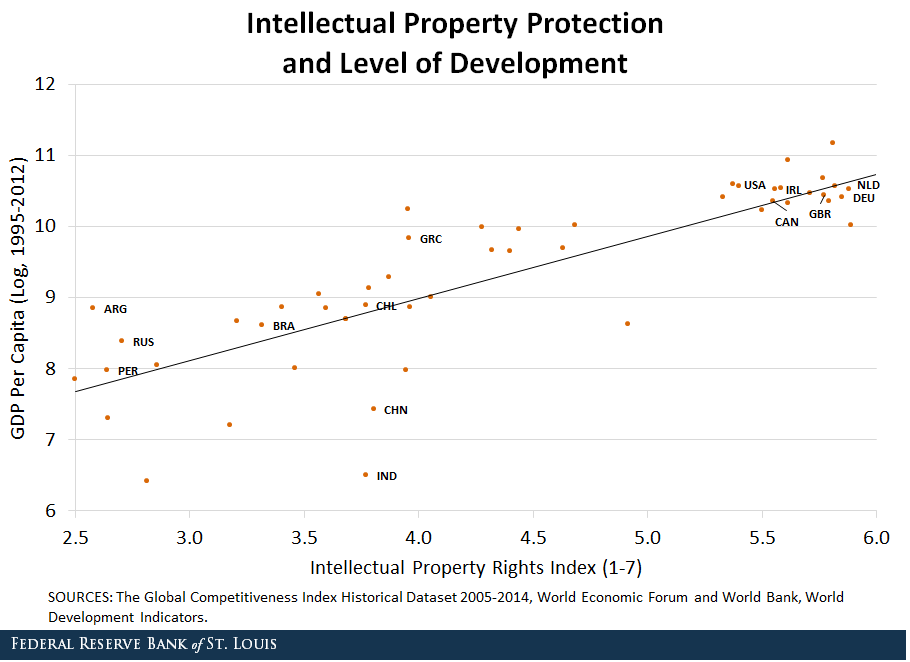

The figures below represent the findings from the paper.

IPR Protection and Development

First, developing countries have worse IPR protection than developed countries, as shown by the positive relationship between the level of GDP per capita (averaged over the sample period) of the country and the Intellectual Property Protection Index in the first figure.

For example, countries with lower GDP per capita (such as Argentina, India and Peru) tend to have lower IPR enforcement, whereas countries with higher GDP per capita (such as the U.S., Ireland and Canada) tend to have higher IPR enforcement.

IPR Protection and Technology Transfer

As a result of this relationship between GDP and IPR protection, developing countries with low GDP per capita tend to receive less technology from abroad, likely due to poor enforcement standards for technology usage. There is a positive relationship between the amount of royalties paid to the world (that is, the amount of IP received from other countries) and the Intellectual Property Rights Protection Index.

This is reiterated by the figure below, which shows that countries with higher GDP per capita not only tend to have greater IPR enforcement, but also tend to make more royalty payments to the world—meaning these countries are receiving large amounts of technology from the world.

However, despite the overall positive relationship between royalties paid to the world (averaged over the sample period) and IPR enforcement, the second figure highlights a few outlying countries with noteworthy features.

For example, China is shown to be far above the trend line, indicating that although China has lower GDP per capita and lower IPR enforcement, it is still a significant player in purchasing technology from the world.

We found similar results in a recent essay highlighting China’s surprising leap in technological innovation and knowledge sharing over time by analyzing China’s royalty payments to the world.See Santacreu, Ana Maria; and Peake, Makenzie. “A Closer Look at China’s Supposed Misappropriation of U.S. Intellectual Property.” Federal Reserve Bank of St. Louis, Economic Synopses, Feb., 2019. China’s high payments for foreign technology may signal improvements in IPR enforcement.

Importance for Economic Growth

Adoption of foreign technologies is an important channel in the process of development of countries that are far from the technology frontier. As these countries learn from foreign technologies, they gain the ability to eventually become innovators themselves and to start pushing the technology frontier.See Santacreu, Ana Maria. “Innovation, Diffusion, and Trade: Theory and Measurement.” Journal of Monetary Economics, October 2015, Vol. 75, pp. 1-20.

Therefore, economic policies aimed at improving the quality of IPR protection are key to promoting technology transfer and development.

Notes and References

1 Santacreu, Ana Maria. “A Gravity-Approach to International Technology Transfer: The Role of Intellectual Property Rights.” unpublished manuscript, 2019.

2 Royalty payments have also been used as a measure of technology diffusion in other analyses. For example, see Santacreu, Ana Maria. “Does Trading with the U.S. Make the World Smarter?” Federal Reserve Bank of St. Louis, On the Economy Blog, May, 11, 2017; and Branstetter, Lee. “Is Foreign Direct Investment a Channel of Knowledge Spillovers? Evidence from Japan’s FDI in the United States.” Journal of International Economics, March 2006, Vol. 68, Issue 2, pp. 325-44.

3 For additional analysis, see Santacreu, Ana Maria. “Trading Ideas between Countries.” Federal Reserve Bank of St. Louis, On the Economy Blog, April, 17, 2017.

4 See Santacreu, Ana Maria; and Peake, Makenzie. “A Closer Look at China’s Supposed Misappropriation of U.S. Intellectual Property.” Federal Reserve Bank of St. Louis, Economic Synopses, Feb., 2019.

5 See Santacreu, Ana Maria. “Innovation, Diffusion, and Trade: Theory and Measurement.” Journal of Monetary Economics, October 2015, Vol. 75, pp. 1-20.

Additional Resources

- On the Economy: Is China Improving Enforcing Intellectual Property Rights?

- On the Economy: Globalization of Innovation and the Increase of Knowledge Sharing

- Economic Synopses: What Does China’s Rise in Patents Mean? A Look at Quality vs. Quantity

Citation

Ana Maria Santacreu and Makenzie Peake, ldquoWhy Intellectual Property Rights Protection Matters for Economic Growth,rdquo St. Louis Fed On the Economy, Sept. 12, 2019.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions