Did Bond Purchase and Forward Guidance Effects Fall Over Time?

In our previous blog post, we argued that balance sheet policies and forward guidance clearly affected asset prices and that such effects likely improved economic performance with respect to the Federal Reserve’s dual mandate of price stability and maximum sustainable employment.

In this post, we take issue with the idea that later bond-purchase and forward guidance programs were less effective than earlier rounds.

Quantitative Easing Effectiveness

As we discussed in our previous post, when short-term interest rates approached zero in the fall of 2008, the Federal Open Market Committee (FOMC) turned to large long-term bond purchases, known as quantitative easing (QE), and forward guidance to reduce long-term yields and stimulate the economy.

Markets widely welcomed such programs, but many analysts later became skeptical of their effectiveness. Some prominent economists deny that even the early programs had any effect. Others argue that, while the initial programs were effective, later programs had little or no effect. For example:

- “We found little or no significant effect [of QE1] on mortgage interest rates once credit and prepayment risks are taken into account. It is even more difficult to find a favorable impact of QE3 on interest rates,” said John Taylor of Stanford University.Taylor, John B. “After Unconventional Monetary Policy.” Economics Working Paper 14108, Hoover Institution, Stanford University, March 2014.

- “The first tranche (QE1) was very successful in arresting a wrenching financial crisis in 2009. But the subsequent rounds (QE2 and QE3) were far less effective,” said Stephen Roach of Yale University.Roach, Stephen S. “Ten years on: What have we learned from quantitative easing?” World Economic Forum, Aug. 3, 2018.

Market Reactions to Announcements

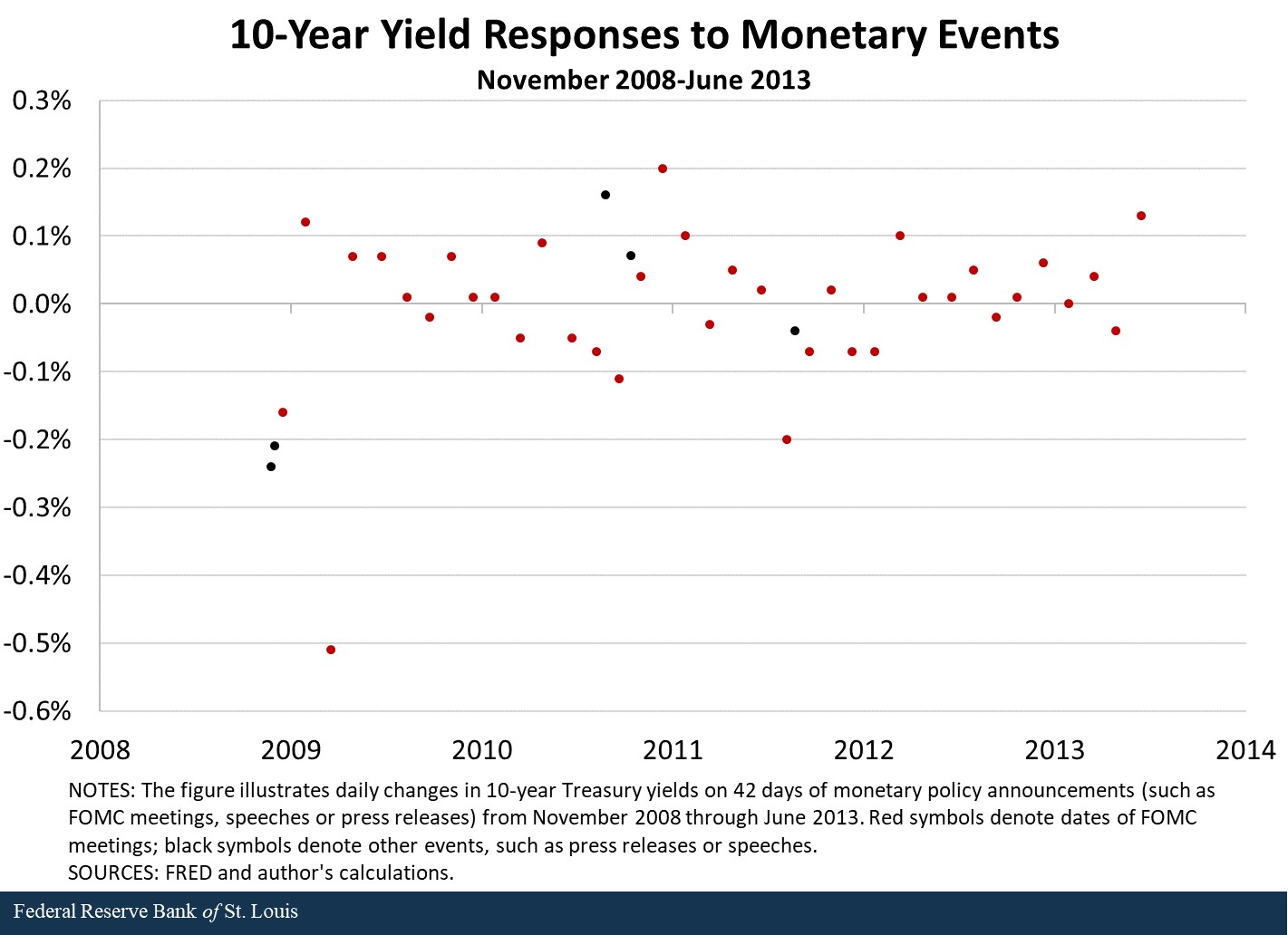

Most arguments that claim declining effectiveness are based on the observation that FOMC announcements of later bond-purchase programs produced much smaller yield declines in financial markets than did the initial set of announcements in 2008-09. The figure below illustrates daily changes in 10-year Treasury yields in response to 42 monetary announcements in 2008-13. The first several changes are clearly much larger than later changes.The one early positive change was Jan. 28, 2009, when the FOMC disappointed market expectations by failing to announce a program.

An alternative interpretation of the declining reactions is that while early bond-purchase news elicited large reactions from surprised markets, later programs produced much smaller surprises because markets had learned to anticipate them. That is, markets impounded the effects of later programs into prices prior to the actual announcements.

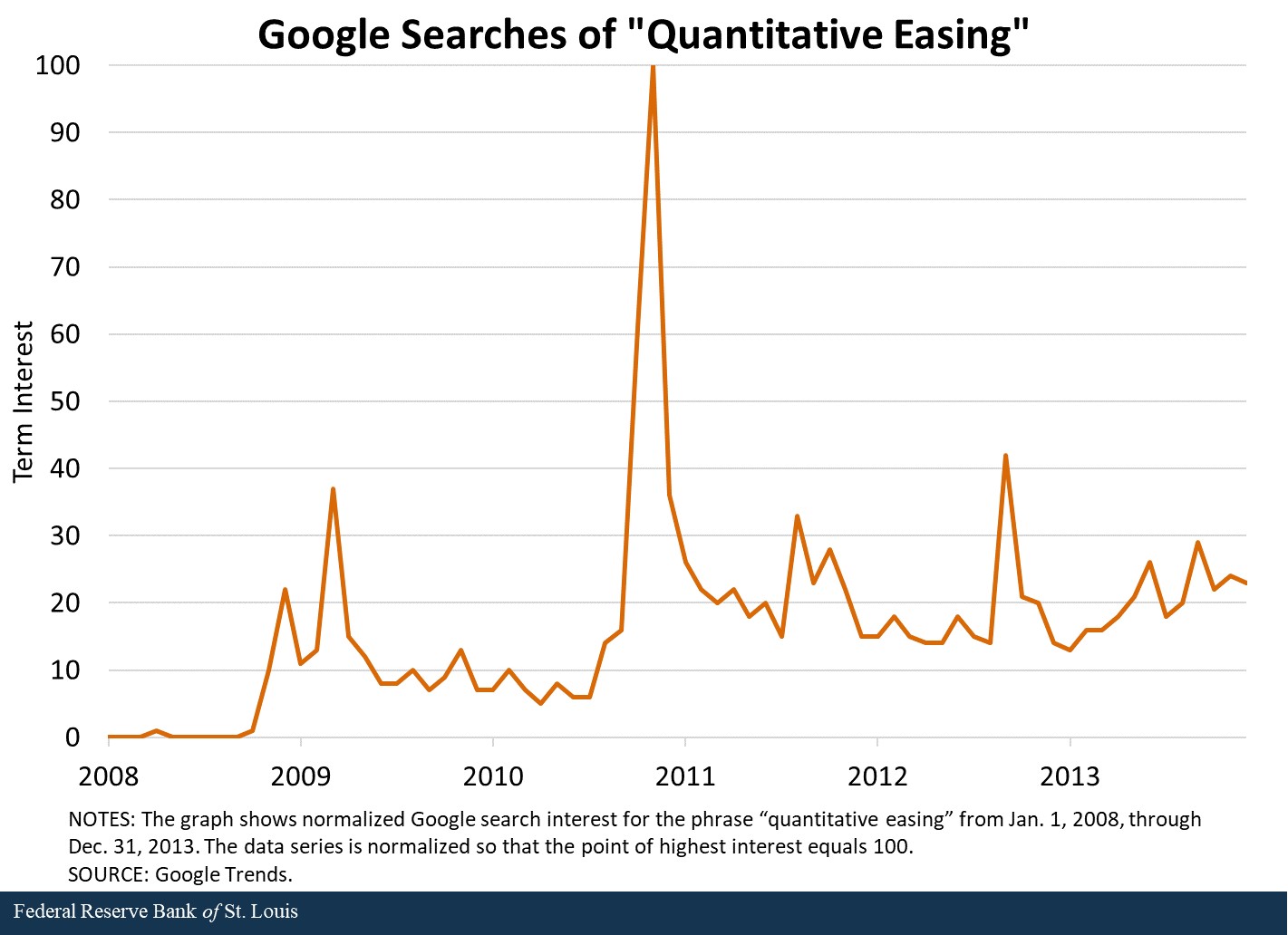

The figure below provides some suggestive evidence on this point. It shows that worldwide Google searches for “quantitative easing” were essentially zero prior to November 2008 but increased substantially during QE1 in 2009-10 before peaking at the start of QE2 in November 2010.

Effects of Announcements

How can we tell whether markets reacted less to later announcements because they considered the later programs to be less effective or because they anticipated those programs better?

Lacking good measures of market expectations of total bond purchases for all announcements, we can’t directly test whether market reactions were proportional to the sizes of the surprises. But we can look to see how yields on bonds of different maturities reacted to surprises in the distribution of central bank purchases across maturities. “Local supply” models predict that a bond-purchase program will most strongly affect bond yields near the most-purchased maturities. For example, a bond-purchase program that buys mostly eight-year bonds will most strongly affect the prices of bonds with seven to nine years of remaining maturity.

Effectiveness Evidence

A 2013 paper by Michael Cahill and his co-authorsCahill, Michael E.; D’Amico, Stefania; Li, Canlin; and Sears, John S. “Duration Risk versus Local Supply Channel in Treasury Yields: Evidence from the Federal Reserve’s Asset Purchase Announcements.” Board of Governors of the Federal Reserve System, Finance and Economics Discussion Series 2013-35, April 2013. and a 2014 paper by Nick McLaren, Ryan Banerjee and David Latto McLaren, Nick; Banerjee, Ryan N.; and Latto, David. “Using Change in Auction Maturity Sectors to Help Identify the Impact of QE on Gilt Yields.” The Economic Journal, May 2014, Vol. 124, Issue 576, pp. 453-79. each examined time variation in local supply effects of Fed and Bank of England asset purchases, respectively. Both studies identified consistently large and stable local supply effects of announcements from 2008-12 and 2009-12, respectively. That is, surprising changes to maturity patterns of later central bank purchases continued to affect relative yields across maturities only because such purchases were effective.

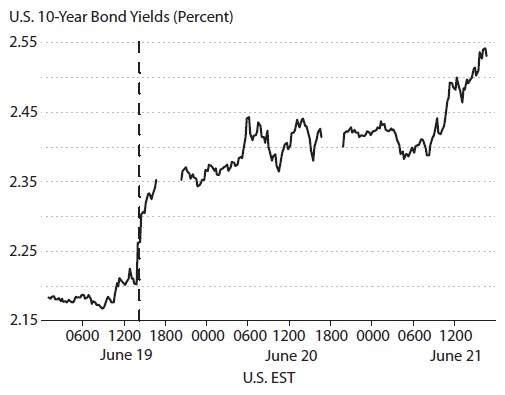

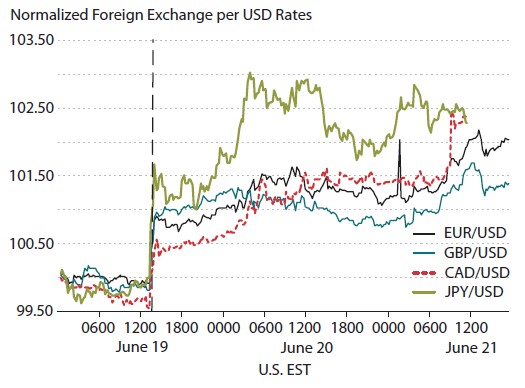

A second piece of evidence suggests that markets continued to respect the importance of asset purchases at least well into 2013. In a June 19, 2013, press conference, then-Federal Reserve Chairman Ben Bernanke suggested that the Fed might reduce its bond purchases later in the year. The figure below shows that this surprising suggestion substantially increased both long-term U.S. bond yields and the foreign exchange value of the dollar, one of several such episodes in the summer of 2013 that became collectively known as the "taper tantrum." The figure is excerpted from Neely, Christopher J. “Lessons from the Taper Tantrum.” Federal Reserve Bank of St. Louis Economic Synopses, No. 2, Jan. 28, 2014.

Asset Price Reactions to Chairman Bernanke's Press Conference of June 19, 2013

NOTES: The panels illustrated changes in asset prices on June 19-21, 2013. June 19 was Chairman Bernanke’s press conference, the time of which is denoted by the dashed vertical line. The first panel shows changes in U.S. 10-year bond yields, while the second panel shows the levels of USD exchange rates relative to their value of 100 at 2 p.m. on June 19. The x-axis shows hours of U.S. Eastern time for the three days. CAD, Canadian dollar; EUR, euro; GBP, British pound; JPY, Japanese yen; USD, U.S. dollar. Missing values refl¬ect no reported trading.

SOURCES: The figure is excerpted from Neely, Christopher J. “Lessons from the Taper Tantrum.” Federal Reserve Bank of St. Louis Economic Synopses, No. 2, Jan. 28, 2014.

In summary, after some experience with early Fed asset purchase programs, market participants learned to anticipate FOMC announcements and impounded their expectations into bond prices prior to the actual announcements of later programs.

Notes and References

1 Taylor, John B. “After Unconventional Monetary Policy.” Economics Working Paper 14108, Hoover Institution, Stanford University, March 2014.

2 Roach, Stephen S. “Ten years on: What have we learned from quantitative easing?” World Economic Forum, Aug. 3, 2018.

3 The one early positive change was Jan. 28, 2009, when the FOMC disappointed market expectations by failing to announce a program.

4 Cahill, Michael E.; D’Amico, Stefania; Li, Canlin; and Sears, John S. “Duration Risk versus Local Supply Channel in Treasury Yields: Evidence from the Federal Reserve’s Asset Purchase Announcements.” Board of Governors of the Federal Reserve System, Finance and Economics Discussion Series 2013-35, April 2013.

5 McLaren, Nick; Banerjee, Ryan N.; and Latto, David. “Using Change in Auction Maturity Sectors to Help Identify the Impact of QE on Gilt Yields.” The Economic Journal, May 2014, Vol. 124, Issue 576, pp. 453-79.

6 The figure is excerpted from Neely, Christopher J. “Lessons from the Taper Tantrum.” Federal Reserve Bank of St. Louis Economic Synopses, No. 2, Jan. 28, 2014.

Additional Resources

- On the Economy: Did Bond Purchases and Forward Guidance Affect Bond Yields?

- On the Economy: Is the Fed’s Taper Making the National Debt Situation Look Worse?

- On the Economy: The Ever Larger Fed Balance Sheet

Citation

Christopher J. Neely, ldquoDid Bond Purchase and Forward Guidance Effects Fall Over Time?,rdquo St. Louis Fed On the Economy, Sept. 2, 2019.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions