Did Bond Purchases and Forward Guidance Affect Bond Yields?

As short-term interest rates approached zero in the fall of 2008, the Federal Open Market Committee (FOMC) turned to large long-term bond purchases, commonly known as quantitative easing (QE), and forward guidance to reduce long-term yields and stimulate the economy.Quantitative easing, or QE, is a type of balance sheet policy. Strictly speaking, QE emphasizes the expansion of the Fed’s assets. Former Fed Chairman Ben Bernanke emphasized that Fed policies were more concerned with the risk and maturity composition of the Fed’s assets.

Markets widely welcomed such programs contemporaneously, but now some prominent economists deny that the programs had any effect. Others argue that, while the initial programs were effective, later programs had little or no effect. For example:

- “In my opinion, QE has essentially no effect,” said John H. Cochrane of Stanford University’s Hoover Institution. “Interview: John Cochrane.” Federal Reserve Bank of Richmond Econ Focus, Third Quarter 2013, pp. 34-8.

- "They're basically neutral events. I don't think they do very much," said Eugene Fama of the University of Chicago Booth School of Business. "Nobel prize winner on QE." The Santelli Exchange, CNBC, Oct. 29, 2013.

This blog post argues that balance sheet policies, such as bond purchases, and forward guidance clearly affected asset prices and that such effects likely improved economic performance with respect to the Federal Reserve’s dual mandate of price stability and maximum sustainable employment.

Market Reactions

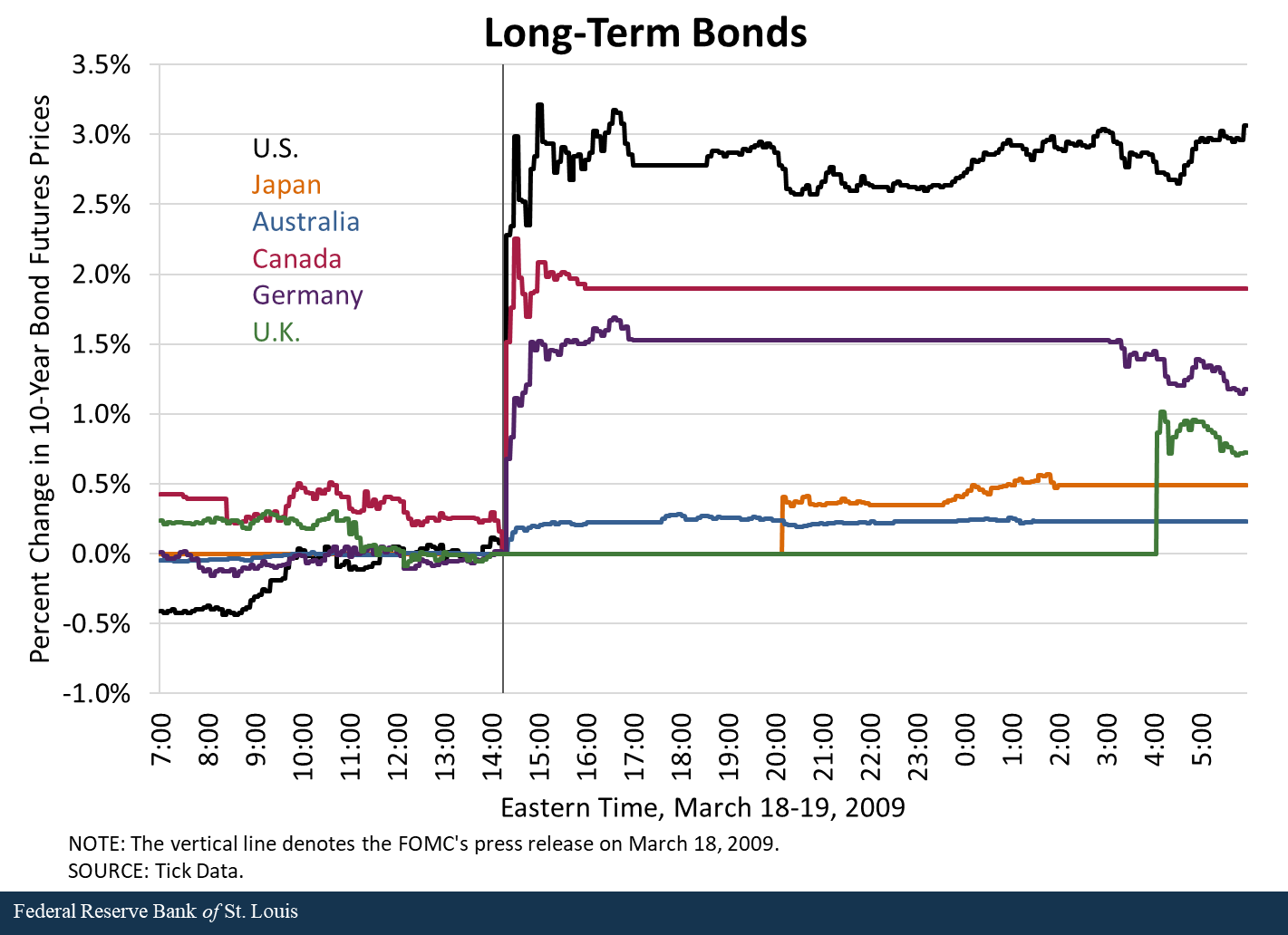

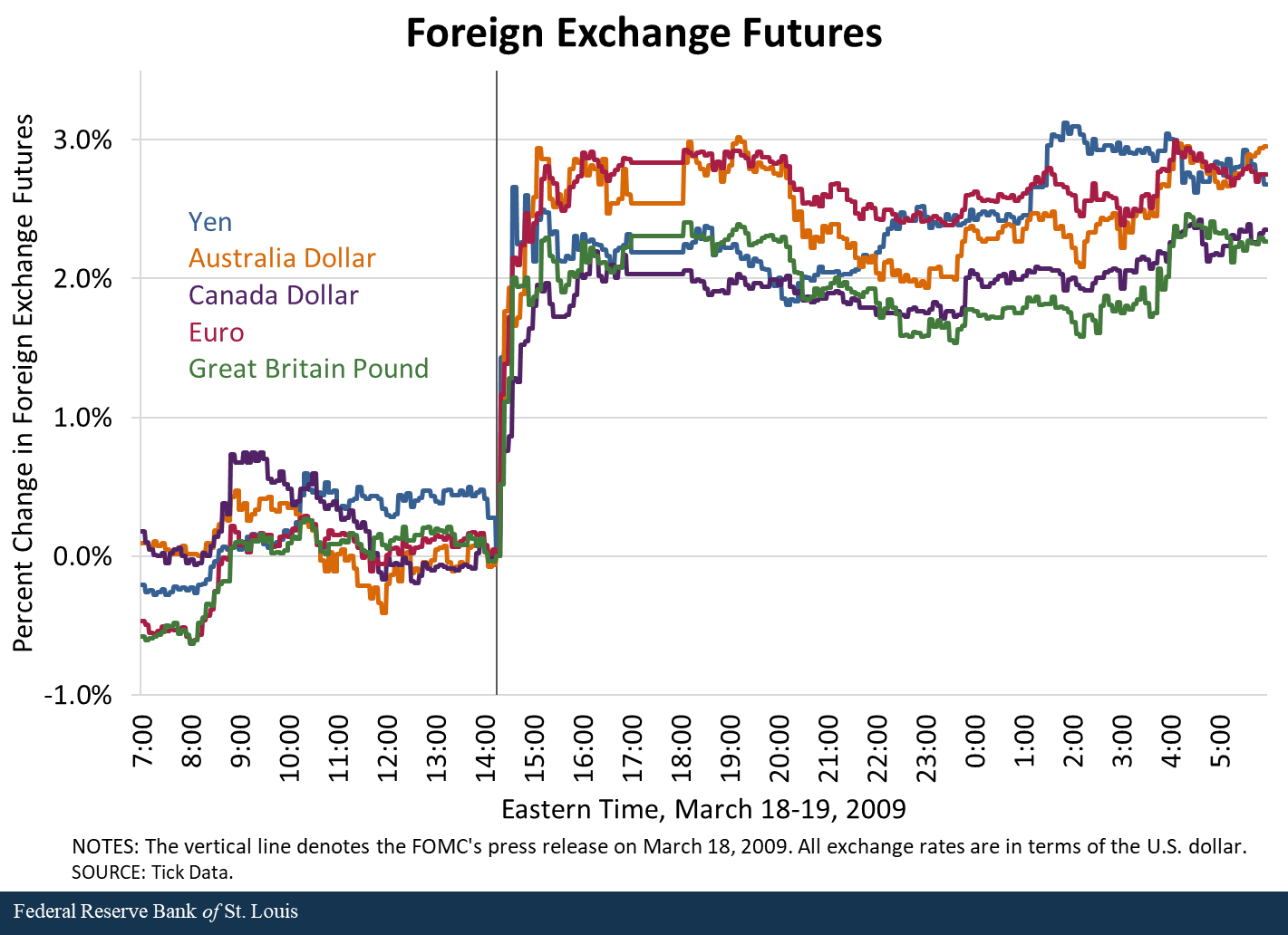

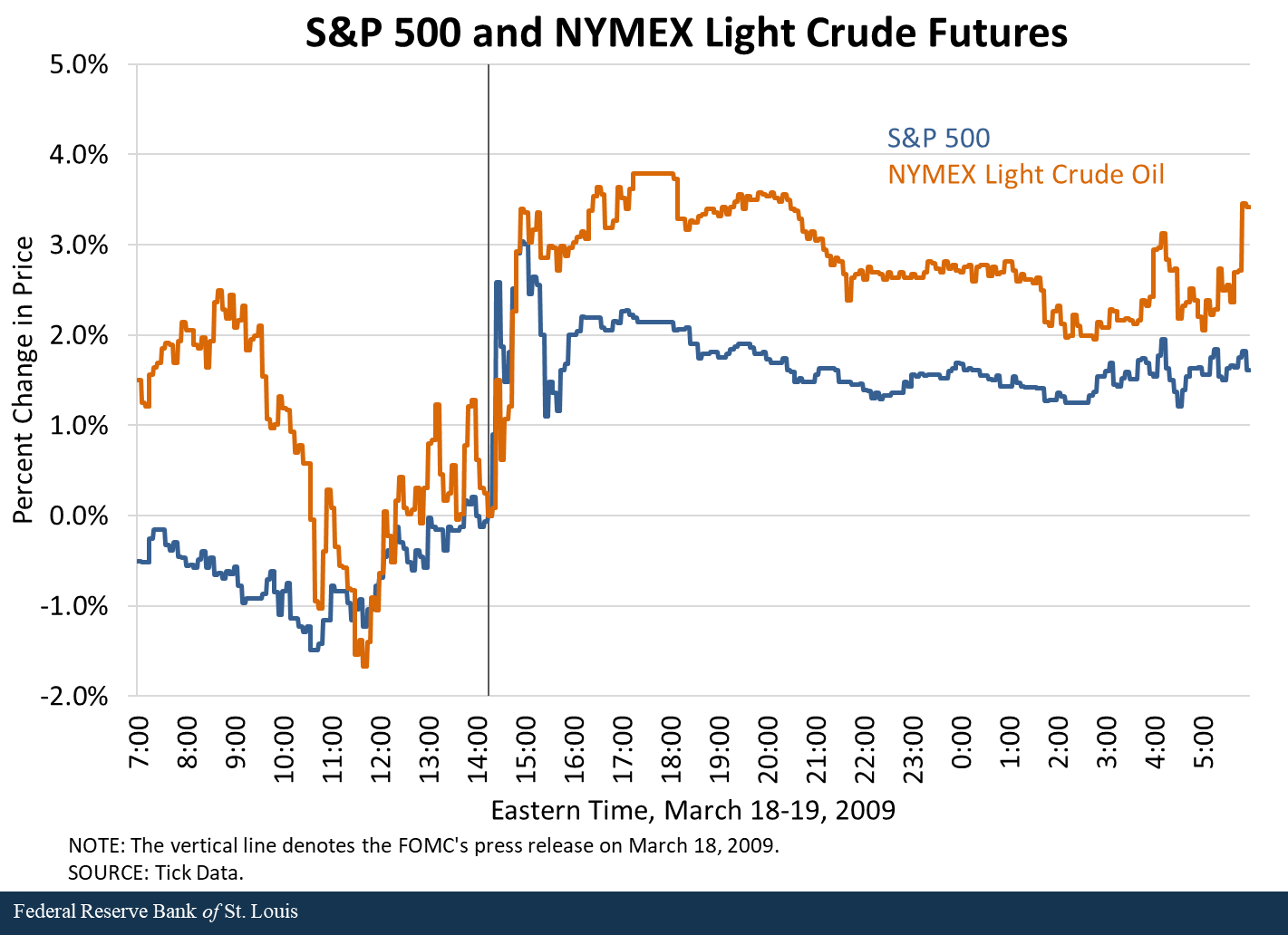

The most convincing evidence for the effect of bond-purchase and forward guidance programs is the large reactions of asset prices to surprising monetary policy announcements. The greatest such reaction was to the FOMC’s March 18, 2009, announcement of the second phase of QE1 at 2:15 p.m. ET. “FOMC Statement.” Board of Governors of the Federal Reserve System, March 18, 2009.

The figures above show that the March 18 announcement—of purchases up to $750 billion in agency mortgage-backed securities (MBS), $100 billion of agency debt and $300 billion of Treasury securities—raised international bond futures prices by 0.2%-3.5% and reduced the value of the dollar by 2%-3%. Consistent with the interpretation that the announcement raised expected growth, equity and oil prices rose by more than 2% in the hour following the announcement.Higher expected growth, by itself, will raise yields. A monetary expansion will reduce yields and raise stock and commodity prices, even while also increasing expected growth.

Did the Effects Wear Off?

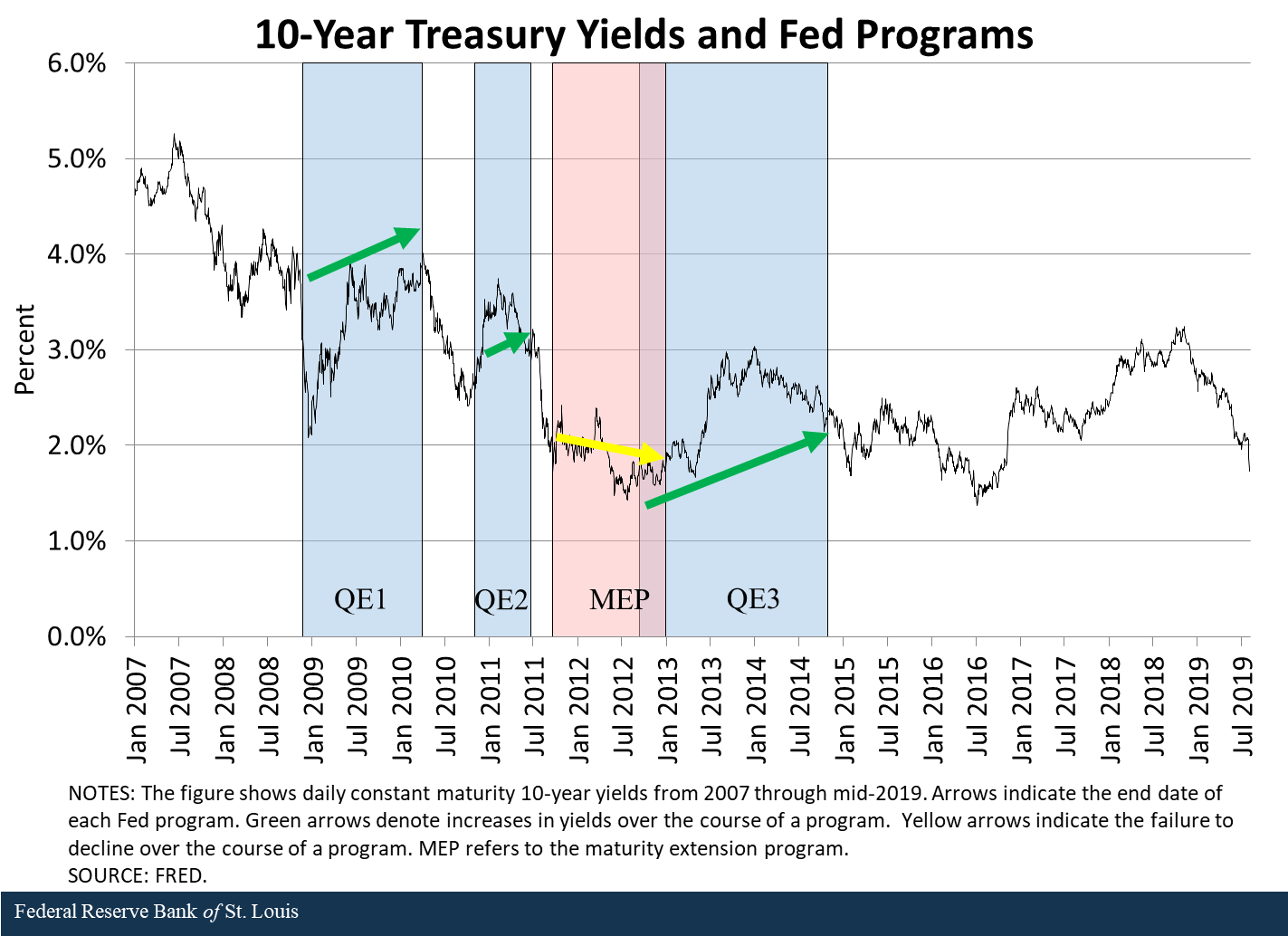

Critics usually admit such large announcement effects occurred but counter that yields generally rose somewhat in the months that followed such expansionary announcements. They interpret these rises in yields as indicating that the announcement effects were transient or “wore off.” The figure below shows that 10-year yields frequently rose or failed to fall much during bond-purchase programs.

This argument incorrectly assumes, however, that bond-purchase programs should continually reduce yields—outweighing other effects—so long as the programs exist. In fact, because financial markets are forward looking, almost the whole effect of bond-purchase programs should occur as markets come to expect them, perhaps before the purchases even start.

The assumption of very transient shocks to asset prices is also unusual. Economists typically think that all sorts of shocks to asset prices should be “persistent.” That is, shocks should not be expected to “wear off” easily.

Market participants could make money by buying an asset with a price temporarily depressed by a transient shock. This arbitrage would effectively eliminate the impact of the shock. Shocks can eventually “wear off” but ordinarily only slowly. It would be surprising if bond purchases had transient effects on yields. Instead, it is more likely that nonmonetary policy shocks raised yields during the courses of the bond-purchase programs.

Effects of Expected Growth

A prime candidate for shocks that raised yields is expected growth, which is one of the most important determinants of bond yields. When the growth outlook is poor, bond yields will be low, and the FOMC is likely to initiate a bond-purchase program to stimulate the economy if short-term rates are already near zero. The table below shows that yields declined substantially in the three-to-six month period prior to each bond purchase announcement.

| Six Months Prior | Three Months Prior | One Day Prior | Six-Month Change | Three-Month Change | |||

|---|---|---|---|---|---|---|---|

| QE1 (11/25/2008) | 3.85% | 3.79% | 3.35% | -0.50% | -0.44% | ||

| QE1 Expansion (3/18/2009) | 3.54% | 2.08% | 3.02% | -0.52% | 0.94% | ||

| QE2 (11/3/2010) | 3.72% | 2.94% | 2.63% | -1.09% | -0.31% | ||

| MEP (9/21/2011) | 3.34% | 2.99% | 1.95% | -1.39% | -1.04% | ||

| QE3 (9/13/2012) | 2.14% | 1.61% | 1.77% | -0.37% | 0.16% | ||

| NOTES: The first three columns of the table show 10-year Treasury yields six months prior, three months prior and one day prior to major bond purchase announcements. The last two columns show the six-month and three-month changes in those yields prior to the day before the announcement. MEP refers to the maturity extension program. | |||||||

| SOURCE: FRED. | |||||||

In other words, the programs were responses to slow expected growth. If markets see those bond-purchase programs as stimulating the economy, then yields will rise. So, one might expect that yields would tend to rise during successful bond-purchase programs, despite the initial reduction in yields as markets come to expect such a program.

Finally, even though bond-purchase program announcements clearly lowered yields, lowered the foreign exchange value of the dollar, and raised stock prices, critics might argue that such changes in asset prices had no or even a negative effect on employment and real activity. But a wealth of microeconomic evidence indicates that people and firms responded to these price changes by increasing economic activity. The following papers provide some examples of such studies:

- Chakraborty, Indraneel; Goldstein, Itay; and MacKinlay, Andrew. “Monetary Stimulus and Bank Lending.” Journal of Financial Economics, forthcoming.

- Di Maggio, Marco; Kermani, Amir; and Palmer, Christopher. “How Quantitative Easing Works: Evidence on the Refinancing Channel.” Review of Economic Studies, forthcoming.

- Fuster, Andreas; and Willen, Paul. “$1.25 Trillion Is Still Real Money: Some Facts about the Effects of the Federal Reserve’s Mortgage Market Investments.” Federal Reserve Bank of Boston Public Policy Discussion Paper 10-4, 2010.

- Kurtzman, Robert; Luck, Stephan; and Zimmermann, Tom. “Did QE Lead Banks to Relax Their Lending Standards? Evidence from the Federal Reserve’s LSAPs.” Journal of Banking and Finance, available Aug. 31, 2018.

- Lo Duca, Marco; Nicoletti, Giulio; and Vidal Martinez, Ariadna. “Global Corporate Bond Issuance: What Role for U.S. Quantitative Easing?” Journal of International Money and Finance, February 2016, Vol. 60, pp. 114-50.

- Rodnyansky, Alexander; and Darmouni, Olivier M. “The Effects of Quantitative Easing on Bank Lending Behavior.” Review of Financial Studies, November 2017, Vol. 30, Issue 11, pp. 3858-87.

Notes and References

1 Quantitative easing, or QE, is a type of balance sheet policy. Strictly speaking, QE emphasizes the expansion of the Fed’s assets. Former Fed Chairman Ben Bernanke emphasized that Fed policies were more concerned with the risk and maturity composition of the Fed’s assets.

2 “Interview: John Cochrane.” Federal Reserve Bank of Richmond Econ Focus, Third Quarter 2013, pp. 34-8.

3 "Nobel prize winner on QE." The Santelli Exchange, CNBC, Oct. 29, 2013.

4 “FOMC Statement.” Board of Governors of the Federal Reserve System, March 18, 2009.

5 Higher expected growth, by itself, will raise yields. A monetary expansion will reduce yields and raise stock and commodity prices, even while also increasing expected growth.

Additional Resources

- On the Economy: Is the Fed’s Taper Making the National Debt Situation Look Worse?

- On the Economy: The Ever Larger Fed Balance Sheet

- On the Economy: Why the Fed Should Create a Standing Repo Facility

Citation

Christopher J. Neely, ldquoDid Bond Purchases and Forward Guidance Affect Bond Yields? ,rdquo St. Louis Fed On the Economy, Aug. 29, 2019.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions