Marriage, Young Households and Student Loan Debt

The following is the second post in a two-part series on the relationship between balance sheets and marital status among young adult households.

Among young adults (ages 25-34), married households typically are wealthier than either single households or partnered households. Homeownership appears to play a large role in this gap. But these groups of young households also differ in terms of their student loan balances and shares.

In a recent issue of In the Balance, Visiting Scholar Fenaba Addo and Lead Analyst Lowell Ricketts noted that the average median age at first marriage has risen over the past few decades:

- In 1989, the average median age for first marriages was 26.2 for men and 23.8 for women.

- In 2016, the average median age was 29.5 for men and 27.4 for women.

They also noted that the share of unmarried partnered households rose over the same period. While the share of married households dropped from around 57 percent in 1989 to 37 percent in 2016, the share of partnered households rose from about 7 percent to 21 percent.

Marriage and Student Loan Debt

Addo and Ricketts explained that this shifting share of married versus unmarried young households is also associated with changing debt compositions of households. “This shift is most pronounced when examining the rise of student loan debt,” they wrote.

Among all young adults, the share of households with debt attributed to student loans has risen over time. The authors noted that:

- In 2013, the share of young households with student loan debt was 42.1 percent. For the first time ever, this was higher than the share holding credit card debt (40.1 percent).

- In 2016, the share holding student loan debt had risen to 46 percent, or about triple the share in 1989.

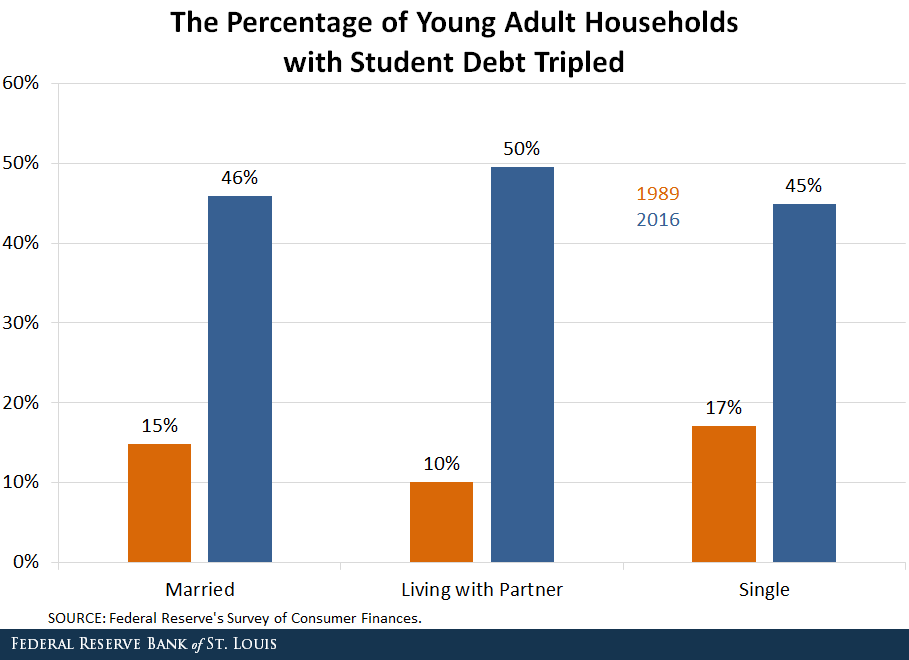

Addo and Ricketts also looked at the share with student debt by marital status, as shown in the figure below.

Single Households

For single households, the share that held student loan debt rose from 17 percent in 1989 to 45 percent in 2016. Student loan debt went from being the fourth most commonly held debt—behind credit card, auto and housing debt—in 1989 to the most commonly held by 2010, the authors noted.

Partnered Households

Similar to single households, partnered households saw their share holding student loan debt rise significantly, going from 10 percent of households in 1989 to 50 percent in 2016. Only the share holding credit card debt was higher, at 54 percent.

Married Households

While married households also saw their share holding student loan debt rise (from about 15 percent to 46 percent over this period), the authors noted that it remained the fourth most commonly held form of debt, continuing to be behind credit card, housing and auto debt.

The authors pointed out that the median student loan debt among married households ($10,400) in 2016 was most similar to that of partnered households ($7,900). However, the overall median net worth among married households was more than three times larger. Among single households, the median student loan debt in 2016 was $20,000.

The Balance Sheets of Young Unmarried Households

“[O]n aggregate young adult households were particularly impacted during the Great Recession,” Addo and Ricketts concluded. “It has been, however, a specific subset of young adult households, unmarried young adults (single and partnered), whose balance sheets continue to look particularly vulnerable 10 years after the economic downturn.”

Additional Resources

- In the Balance: As Fewer Young Adults Wed, Married Couples’ Wealth Surpasses Others’

- On the Economy: Are Student Loans Contributing to Racial Wealth Gaps?

- On the Economy: Wealth Gap Widens between Young and Old Families

Citation

ldquoMarriage, Young Households and Student Loan Debt,rdquo St. Louis Fed On the Economy, Jan. 22, 2019.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions