Married Households Are Wealthier than Other Young Adults

The following is the first post in a two-part series on the relationship between balance sheets and marital status among young adult households.

Greater net worth and other features of long-term financial stability have been linked to marriage among young households. So, what is the impact of the declining marriage rate among young adults? A recent issue of In the Balance explored the connection between marriage and wealth of young adult (25- 34-year-old) households.

Visiting Scholar Fenaba Addo and Lead Analyst Lowell Ricketts, both of the St. Louis Fed’s Center for Household Financial Stability, noted that the average median age at first marriage has steadily increased for both men and women:

- In 1989, the average median age for first marriages was 26.2 for men and 23.8 for women.

- In 2016, the average median age was 29.5 for men and 27.4 for women.

They also noted that the share of cohabitating households among young adults rose over the same period. While the share of married households dropped from around 57 percent in 1989 to 37 percent in 2016, the share of partnered households rose from about 7 percent to 21 percent.

Wealth of Young Households

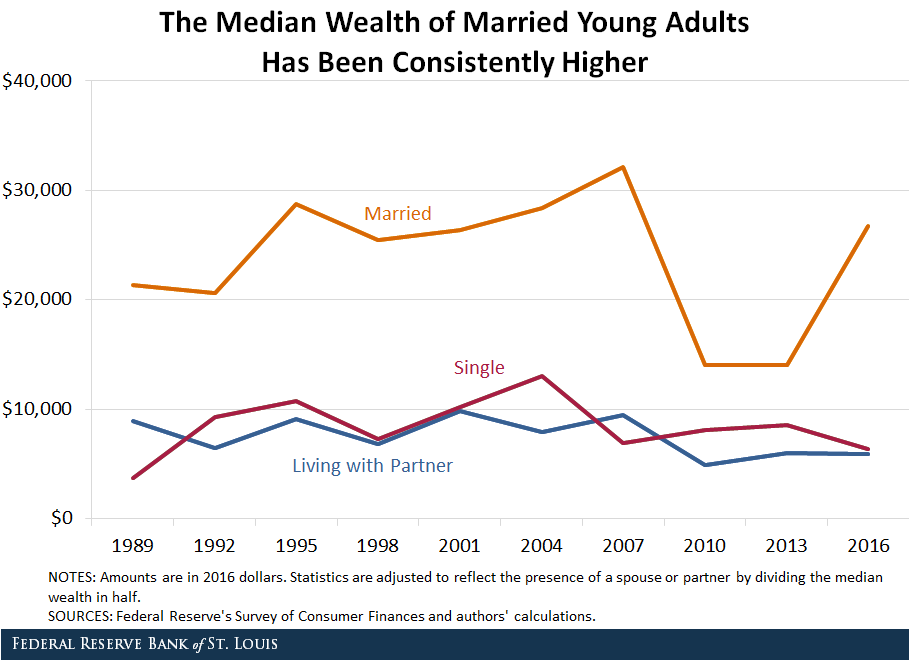

The figure below shows trends in median net worth (or wealth) among young married, single and partnered households over the same time period.

Among young households, the median net worth of married households was notably higher than that of single or partnered households. This also held true when omitting housing-related assets and debts from total net worth.

Addo and Ricketts noted that the gap closed somewhat following the most recent recession. Yet, from 2013 to 2016, the median net worth of married households almost doubled, while the wealth of unmarried young households (both single and partnered) stayed relatively flat.

Effect of Homeownership

The authors noted that married households have been more likely to own homes than single or unmarried households, and that the homeownership rate among married households has been increasing. “This is important because housing assets have appreciated in value considerably during the recovery,” Addo and Ricketts wrote. “As the share of married households declined over this period, gains in housing equity … were concentrated among a smaller group, who were more likely to be married.”

As much of this homeownership has been financed via mortgages, married young households had higher total debt levels than either single households or partnered households. However, their total assets were also higher relative to these two groups.

The next post in this series will examine the student loan debt among young adult households in the context of marital status.

Additional Resources

- In the Balance: As Fewer Young Adults Wed, Married Couples’ Wealth Surpasses Others’

- On the Economy: Are Student Loans Contributing to Racial Wealth Gaps?

- On the Economy: Wealth Gap Widens between Young and Old Families

Citation

ldquoMarried Households Are Wealthier than Other Young Adults,rdquo St. Louis Fed On the Economy, Jan. 21, 2019.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions