Last Recession Effect: New Car Buyers Hold Cars Longer

In response to the last recession, new vehicle sales in the U.S. experienced a quick and dramatic decline, falling by 40 percent over a period of 12 months. This amounted to a $107 billion decline in sales.

This had important effects on the U.S. economy. Hundreds of thousands of motor vehicle workers lost their jobs. By spring 2009, Chrysler and General Motors faced bankruptcy. This led the government to use Troubled Asset Relief Program (TARP) funds to bail out both. At one point, the federal government owned 61 percent of General Motors.

Effect on Auto Market

The reduction in new autos sold didn't stop people from driving. That is, the decline in new auto sales was not associated with a substantial decline in vehicle miles travelled.

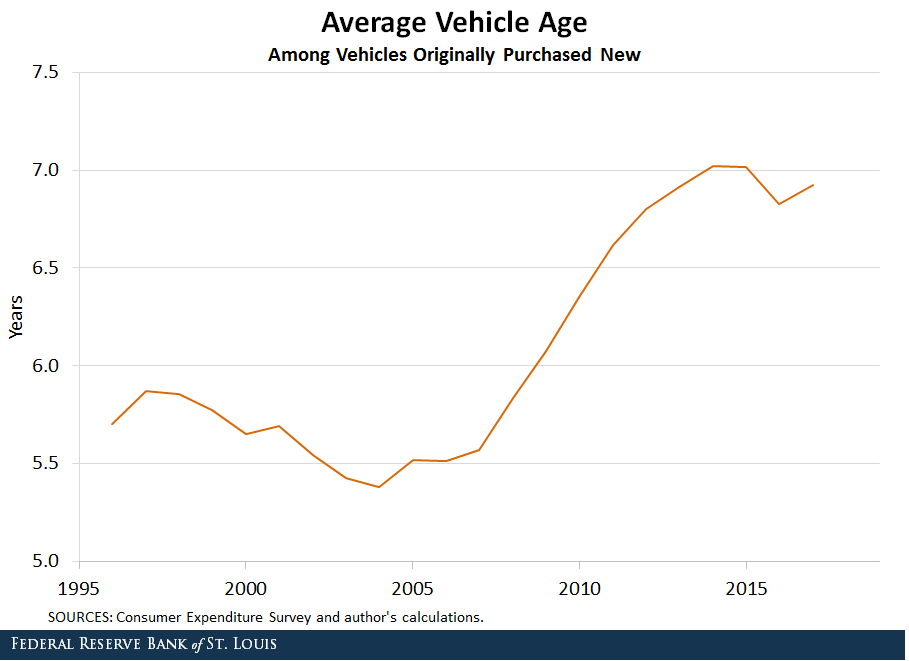

As such, the average age of cars on the road increased. The figure below plots the time series of the mean age of vehicles on the road that were originally purchased new.

In 2005, this average age equaled 5.5 years. Beginning with the overall decline in the U.S. economy starting in 2008, the age increased to over 6.8 years by 2012. On average, people who bought new cars were holding their cars longer.

Recent Trends

In recent years, many aspects of the U.S. economy have improved. National house prices—measured on aggregate by either Case-Shiller or by the Federal Housing Finance Agency—have climbed from their depths and are now above their peak values from 2006 and 2007. The unemployment rate is below 4 percent, about 6 percentage points less than its peak in 2009. Even new auto sales have rebounded.

Why Are Sales Rebounding while Car Age Increases?

It might seem counterintuitive that new auto sales have rebounded while the mean age of cars originally purchased new has not returned to its lower prerecession level.

First, it takes time for an increase in new auto sales to have a quantitatively meaningful impact on the average age of autos originally purchased new.

Another part of the explanation may be as follows: The recovery of new auto sales may have been largely supported by buyers who only keep their cars for a few years. A “quick churn” by new car buyers would contribute little to the change in the mean age of autos originally purchased new. Other new car buyers may have permanently increased the duration for which they hold a car, which would keep the mean age high.

These positive developments may lead more people who traditionally buy new cars to let go of their existing vehicles and return to new car dealerships with an eye to buy. Only time will tell.

Additional Resources

- On the Economy: Getting Ready for the Golden Years

- On the Economy: Born on 3rd Base? The Effects of Head Starts and College on Family Wealth

- On the Economy: How Big Was Recovery Act Spending?

Citation

Bill Dupor, ldquoLast Recession Effect: New Car Buyers Hold Cars Longer,rdquo St. Louis Fed On the Economy, May 28, 2018.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions