Wealth Gaps with White Families Narrow, but Remain Large

The wealth (or net worth) of non-white families grew faster than that of white families over the past three years. Still, wealth gaps between these groups remain significant.

According to the Federal Reserve Board’s 2016 Survey of Consumer Finances,1 the mean (or average) wealth of an American family was 25.5 percent higher in 2016 than it was three years earlier, reaching $692,100.2 The median (or typical) wealth of an American family was 16.2 percent higher in the later year, measuring $97,300.3

Increase in Wealth of Non-White Families

Unlike the period between 2010 and 2013 and in many previous three-year intervals, non-white families’ wealth generally increased faster than that of white families between 2013 and 2016:

- The average wealth of black families increased by about 35 percent.

- The average wealth of Hispanic families increased by about 72 percent.

- The average wealth of families identifying as other or multi-race rose 19 percent.

- The wealth of white families rose 28 percent.4

A similar story can be told with median wealth as well:

- The median wealth of black families increased by 29 percent.

- The median wealth of Hispanic families went up 46 percent.

- The median wealth of other or multi-race families increased 52 percent.

- The median wealth of white families rose 17 percent.

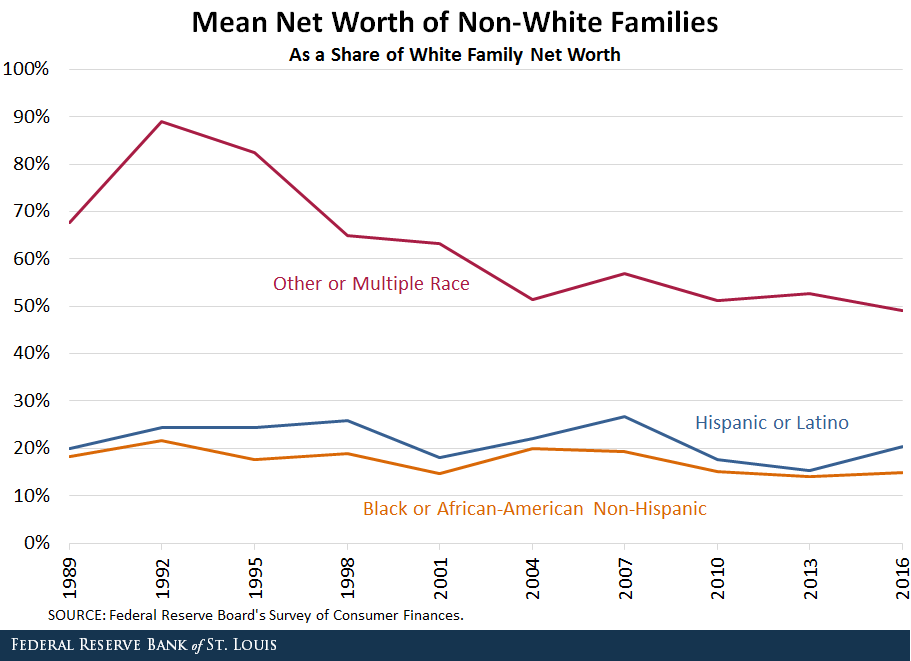

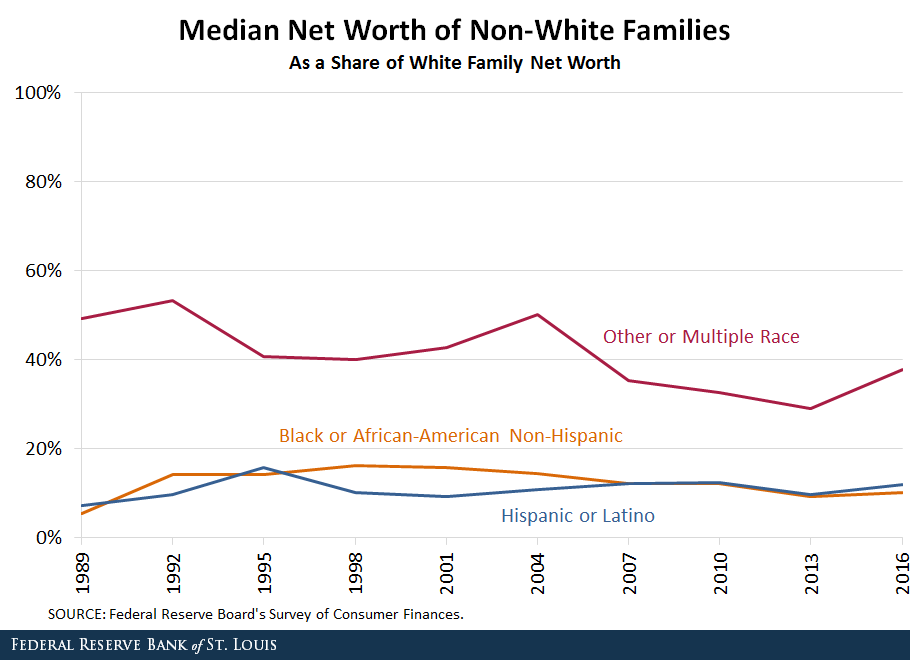

The result is that racial and ethnic wealth gaps measured either as means or as medians generally decreased between 2013 and 2016, as the figures below show.

It’s also clear, however, that racial and ethnic wealth gaps remain very large on both measures. Moreover, the gaps haven’t changed much since 1989, in the case of black and Hispanic families, and actually have increased for the group that includes all other families.

Notes and References

1 See “Survey of Consumer Finances,” Federal Reserve Board, Sept. 27, 2017.

2 All figures are adjusted for inflation and expressed in 2016 dollars.

3 Median wealth corresponds to the family precisely in the middle when ranking all families by wealth. Mean wealth is much larger than median wealth, indicating that wealth-holding is skewed toward (i.e., concentrated in) wealthier families. Mean wealth increasing faster than median wealth between 2013 and 2016 implies that the distribution of wealth became even more skewed during this period.

4 Families are classified according to their own self-identification in the survey. Groupings used here are white non-Hispanic; black or African-American non-Hispanic; Hispanic or Latino; and all other, which includes Asian, American Indian, Alaska Native, Native Hawaiian, Pacific Islander, other race or more than one race.

Additional Resources

- Center for Household Financial Stability: The Demographics of Wealth

- On the Economy: Why Did the Housing Bust Hit Black and Latino Families Harder?

- On the Economy: Wealth Gaps Grow with Educational Attainment

Citation

William R. Emmons, ldquoWealth Gaps with White Families Narrow, but Remain Large,rdquo St. Louis Fed On the Economy, Sept. 29, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions