Wealth Gaps Grow with Educational Attainment

While family wealth generally increases with education, not all races and ethnicities see gains the same way, according to an article in The Regional Economist.

Senior Economic Adviser William Emmons and Senior Analyst Lowell Ricketts, both with the St. Louis Fed’s Center for Household Financial Stability, built a model to answer a hypothetical question: How much wealth would we expect a particular family to have based solely on its education level and race/ethnicity, all else equal?

The Research

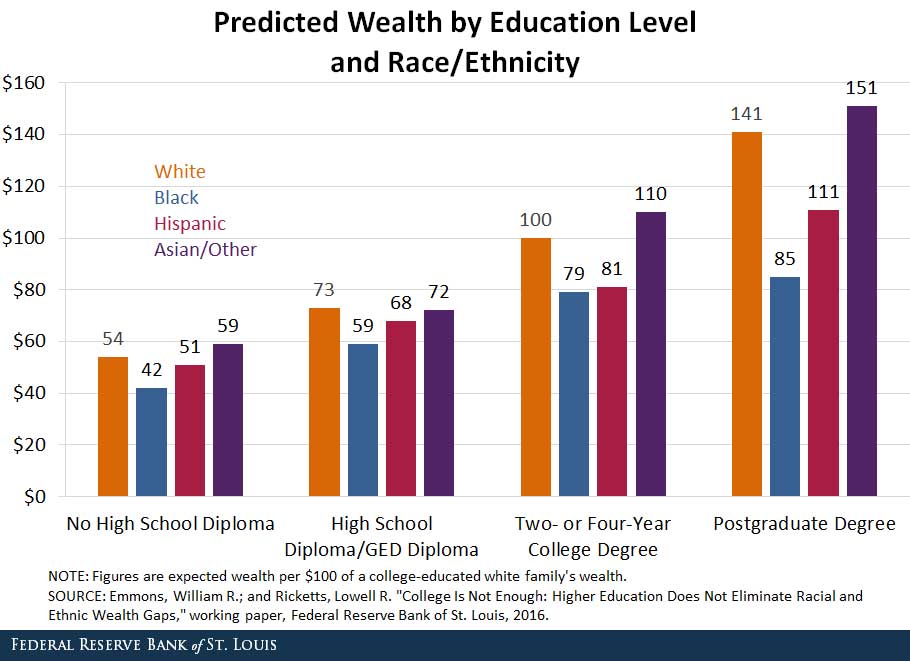

For comparison’s sake, Emmons and Ricketts used a white family with a family head holding no more than a two- or four-year degree as the reference family. In the figure below, the predicted wealth of all other education and race/ethnicity combinations is expressed relative to each $100 of the reference family’s wealth.

For example, a Hispanic family with no more than a high school diploma would be expected to have $68 of wealth for every $100 of wealth of a white family with no more than a two- or four-year degree.

Better Education Leading to More Wealth

The authors noted: “Our expectation that better-educated families will have more predicted wealth is confirmed by the upward-sloping pattern of predicted wealth from left to right.” For each race or ethnicity, the more education the family head has, the higher the family’s predicted wealth.

Emmons and Ricketts also noted that black and Hispanic families typically had less wealth than white families with the same education levels. Asian families had more expected wealth than white families at all education levels except at the high school diploma level, though the difference was slight.

Growing Gaps

One item the authors focused on was how the gaps between races and ethnicities grew larger as families achieved more education. They wrote: “For example, the predicted shortfalls among Hispanic and black high school graduates are only $5 and $14, respectively, compared with the totals for whites; the shortfalls increase to $19 and $21 for two- or four-year college graduates, and to $30 and $56 among postgraduate families, respectively.”

Why Do Rates Differ?

Emmons and Ricketts stressed that their model is better-suited for identifying what is not responsible for these gaps than what is responsible. In particular, they mentioned the following commonly suggested reasons as being related, but not particularly important determinants:

- Differences in average education level

- Differences in family structure

- Differences in income shocks or inheritances

They concluded that their research “points to deeper causes: structural, systemic or historical factors related to race or ethnicity that affect educational and/or wealth outcomes.”

They wrote: “The bottom line is that, while more education is associated with more wealth among all races and ethnicities, the links are different. For reasons we do not fully understand, the typical wealth effects of education appear to be lower and shallower for Hispanics and blacks.”

Additional Resources

- Regional Economist: Unequal Degrees of Affluence: Racial and Ethnic Wealth Differences across Education Levels

- On the Economy: Federal Income Taxes by Income Bracket

- On the Economy: Rising Inflation Doesn’t Impact Everyone the Same

Citation

ldquoWealth Gaps Grow with Educational Attainment,rdquo St. Louis Fed On the Economy, Feb. 2, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions