What Is the Outlook for the Federal Budget?

Numerous proposals to fix the U.S. federal budget exist. However, a challenge exists in meeting growing obligations from mandatory spending (that is, Social Security and health care) amid only modest increases in revenue over the next 10 years, according to a recent article in The Regional Economist.

“The prominence of mandatory spending programs implies less room for fiscal maneuvers in the future and will make reform more difficult to implement,” Senior Economist Fernando Martin wrote. “Financing of these expenditures relies heavily on taxing individual income (including payroll taxes). Closing the deficit without reforming entitlements will invariably lead to tax hikes.”

Overall Numbers

Martin analyzed the June 2017 projections by the Congressional Budget Office.1 These projections extend through 2027 and are based on current law.

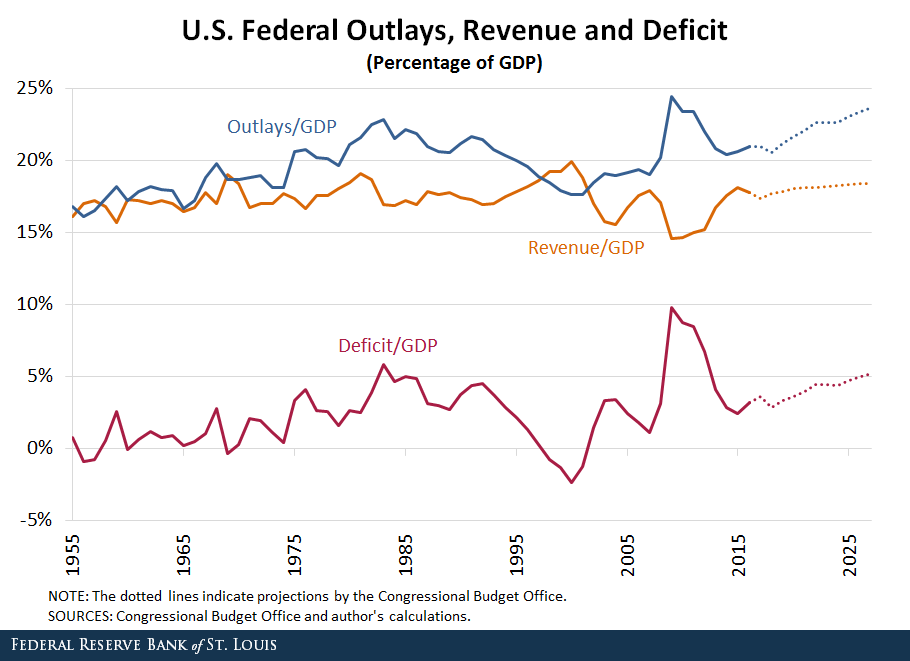

He noted the following, which are also illustrated in the figure below:

- Expenditures are projected to rise from 20.9 percent of gross domestic product (GDP) in 2016 to 23.6 percent in 2027.

- Revenues are projected to rise from 17.8 percent of GDP to 18.4 percent.

- The deficit is projected to rise from 3.2 percent of GDP to 5.2 percent.

Expenditures

In examining spending more closely, Martin noted that roughly two-thirds of total expenditures are mandatory outlays, and those are projected to increase significantly by 2027. Social Security and health care expenditures—the largest components of mandatory spending—are projected to rise from 10.4 percent of GDP in 2016 to 12.9 percent in 2027.

On the other hand, discretionary spending as a share of GDP has been declining and is expected to continue to do so.

Martin also noted that part of the projected increase in expenditures is due to larger interest payments on government debt. However, the interest rate on bonds could remain low, in which case projected deficits may be overstated.

Revenues

Turning to revenues, Martin noted that individual income and payroll taxes accounted for about 80 percent of total revenue in 2016 (amounting to 14.5 percent of GDP), while corporate income taxes accounted for only 9.2 percent of total revenue (amounting to 1.6 percent of GDP).

He cautioned that the modest projected increase in revenues over the next decade may be overstated because part of the increase in individual income taxes is from “real bracket creep.” This means a larger share of income is subject to higher tax rates as income grows faster than consumer prices.

However, he noted, it is conceivable that Congress would prevent some of that from happening due to equity considerations.

Government Debt

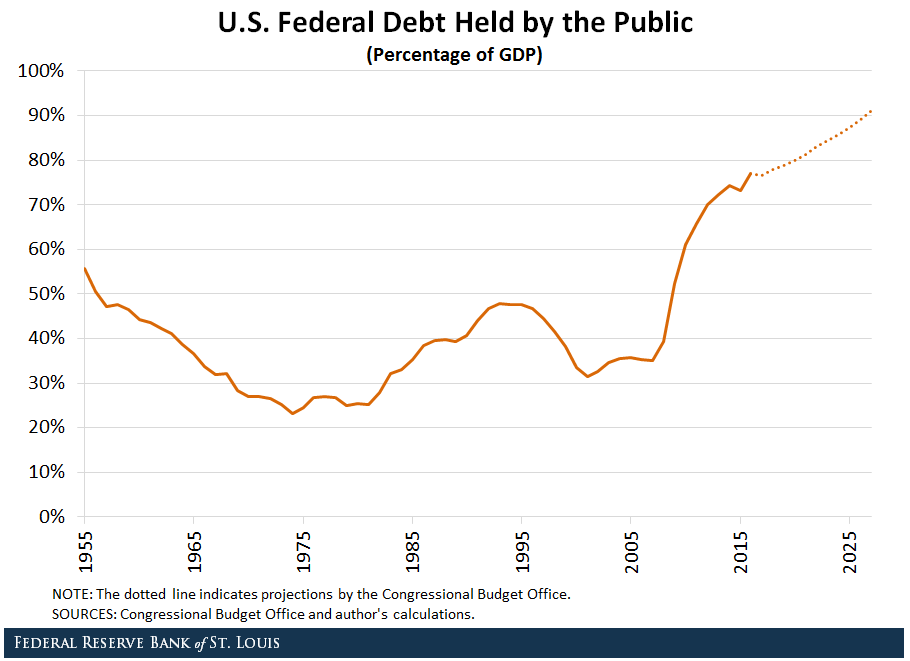

What does all of this mean for government debt? Martin pointed out that government debt held by the public is expected to rise from 77 percent of GDP at the end of 2016 to more than 90 percent of GDP in 2027, as shown in the figure below.

“Government debt levels are not yet a cause for concern in the U.S., although they might make fiscal responses to future recessions harder to implement. If current trends persist, debt held by the public will remain at manageable levels for the next decade,” Martin wrote.

However, he added that if another big adverse shock hits the U.S. economy, this outlook might change for the worse. “Even in this case, the U.S. has the advantage of issuing debt in its own currency, so outright default (as in Greece) is not a likely outcome, though inflation might be (as was the case during and immediately after World War II),” he concluded.

Notes and References

1 In this post, years refer to fiscal years for the federal government unless otherwise noted. For example, fiscal year 2016 began Oct. 1, 2015, and ended Sept. 30, 2016.

Additional Resources

- Regional Economist: Making Ends Meet on the Federal Budget: Outlook and Challenges

- On the Economy: Federal Income Taxes by Income Bracket

- On the Economy: How the U.S. Debt-to-GDP Ratio Has Changed

Citation

ldquoWhat Is the Outlook for the Federal Budget?,rdquo St. Louis Fed On the Economy, Oct. 10, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions