Who Would Be Affected by More Banking Deserts?

Although technology has made it easy to bank from almost anywhere, personal and public benefits are still derived from bank branches. In areas without branches—commonly referred to as “banking deserts”—the costs and inconveniences of cashing checks, establishing deposit accounts, obtaining loans and maintaining banking relationships are exacerbated.

Banking Deserts a Growing Concern?

The closing of thousands of bank branches in the aftermath of the last recession has intensified societal concerns about access to financial services among low-income and minority populations, groups that are often affected disproportionately in such situations. The number of people stranded in areas devoid of bank services would probably expand in the future if branches continue to close.

From this perspective, available resources may be better spent trying to prevent more deserts than trying to repopulate existing deserts with new branches.

What Areas Are at Risk?

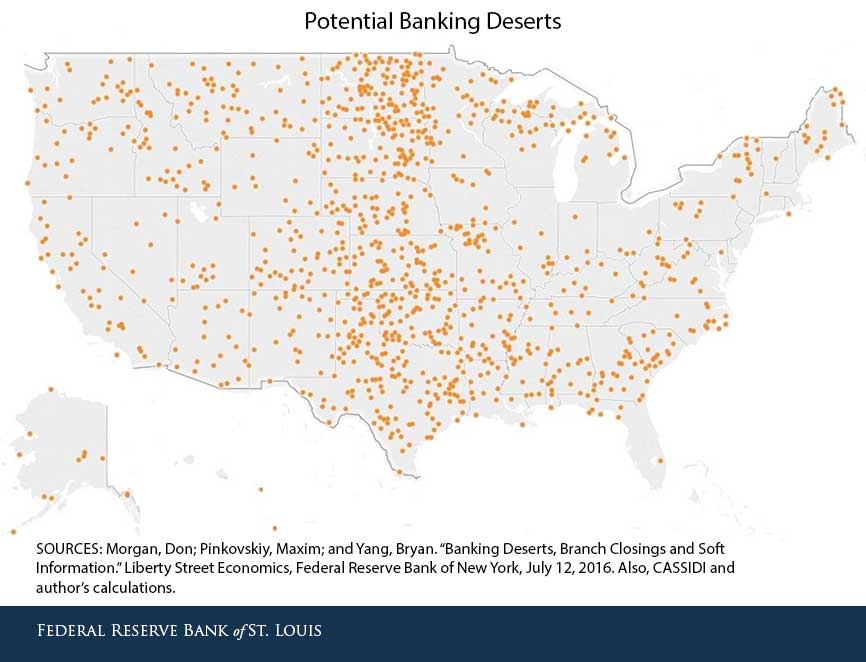

In the figure below, we isolated branches that were outside the 10-mile range of any others. That is, we found branches that would create new banking deserts if closed. Our analysis is based on demographic and economic data collected for the county subdivision in which each branch is located.

We identified 1,055 potential deserts in 2014, of which 204 were in urban areas and 851 in rural areas. The urban areas had a combined population of 2 million, while the rural areas had a combined population of 1.9 million.

These potential deserts have relatively low population densities of 26 people per square mile in urban areas and 12 people per square mile in rural areas. Comparative densities outside potential deserts are, respectively, 176 and 26 people per square mile. In other words, areas with dispersed populations are more at risk of becoming a banking desert.

Potential Effects of New Banking Deserts

Median incomes are $46,717 in potential urban deserts and $41,259 in potential rural deserts. This suggests that any desert expansion would affect lower-income people more than higher-income people.

Minorities constitute 9.8 percent of the population in potential urban deserts and 4.0 percent of the population in potential rural deserts. Both percentages are lower than those for existing deserts and nondeserts. This suggests that newly created deserts may not disadvantage minorities to a greater extent than existing deserts do.

Branches in potential deserts are small, with median deposits of $23 million in urban areas and $20 million in rural areas. They tend to be operated by small banks, with median total assets of $776 million in urban areas and $317 million in rural areas.

The small size of these branches and the banks that own them suggest that what stands between a community and its isolation within a new banking desert are not the decisions made by big banks with a national footprint but, rather, the decisions made by locally oriented community banks. Additionally, potential deserts are more likely to be located in Midwestern states.

Additional Resources

- Regional Economist: “Banking Deserts” Become a Concern as Branches Dry Up

- On the Economy: The Financial Challenges of Small Businesses

- On the Economy: Why Didn’t Bank Regulators Prevent the Financial Crisis?

Citation

Michelle Franke, ldquoWho Would Be Affected by More Banking Deserts?,rdquo St. Louis Fed On the Economy, July 17, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions