The Financial Challenges of Small Businesses

More than 60 percent of small businesses faced financial challenges in the past year, according to the 2016 Small Business Credit Survey.

The survey, which was a collaboration of all 12 Federal Reserve banks, provides an in-depth look at small business performance and debt. This report focuses on employer firms, or those with at least one full- or part-time employee.1 When looking at the financial challenges of small businesses, the report covered the second half of 2015 through the second half of 2016.

Financial Challenges and How They Were Addressed

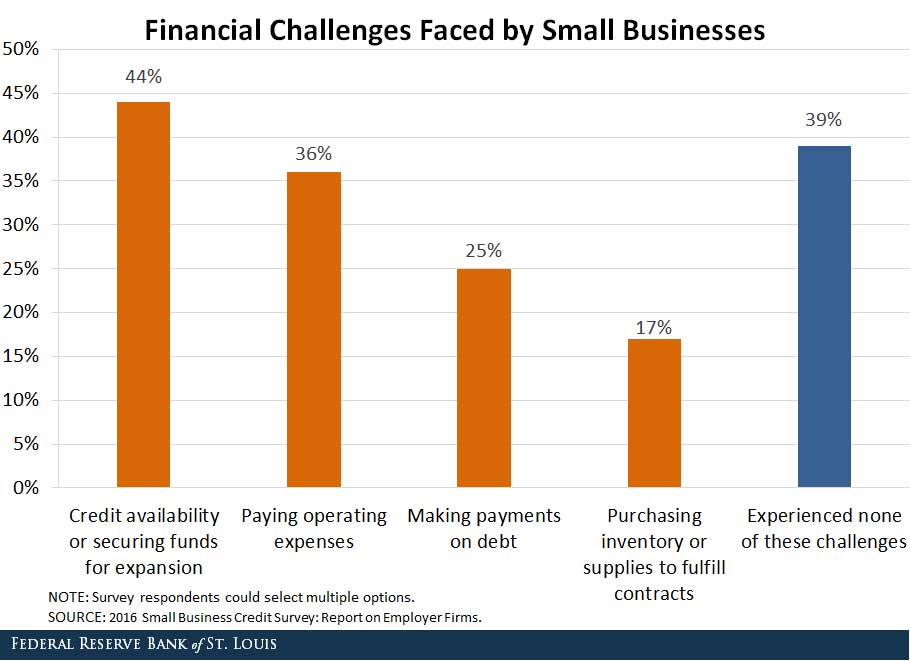

Among all firms, 61 percent reported facing financial challenges over this time period. Financial challenges included:

- Credit availability or securing funds for expansion

- Paying operating expenses

- Making payments on debt

- Purchasing inventory or supplies to fulfill contracts

Firms with smaller annual revenue were more likely to experience financial challenges. Of firms with $1 million or less, 67 percent reported facing financial challenges, compared to only 47 percent of firms with more than $1 million.

The figure below shows the breakdown of which financial challenges were most prevalent among small businesses.

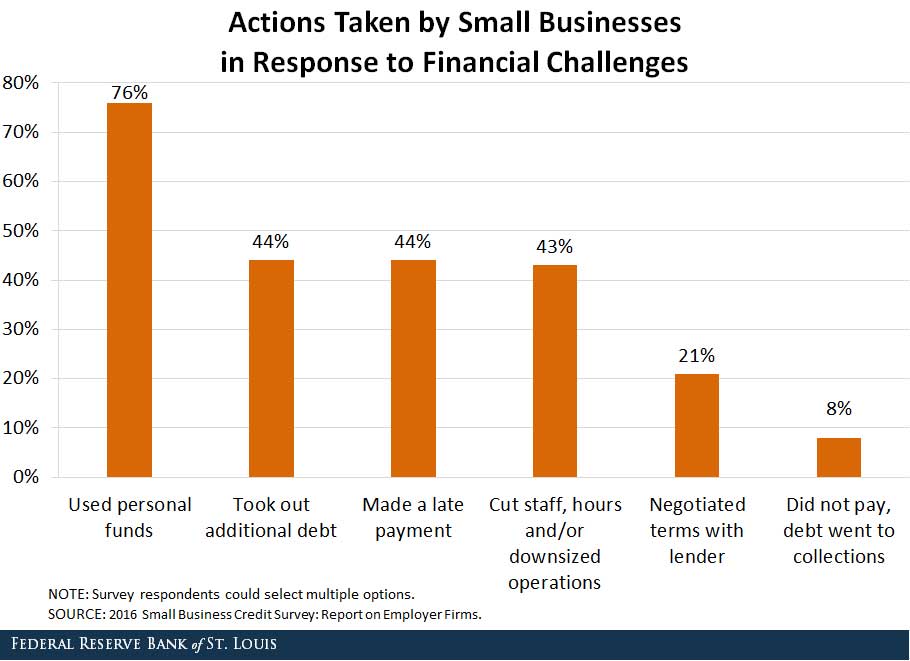

The survey also asked small businesses how they addressed these issues. Their responses are captured in the figure below. (It should be noted that respondents could also answer “unsure” and “other,” and those responses are not captured below.)

Notes and References

1 This does not include self-employed or firms where the owner is the only employee.

Additional Resources

- News Release: Small Business Credit Survey

- On the Economy: How Did Small Businesses Do in 2016?

- On the Economy: How Well Do Nonemployer Firms Fare?

Citation

ldquoThe Financial Challenges of Small Businesses,rdquo St. Louis Fed On the Economy, June 5, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions