How Income Inequality Is Affected by Labor Share

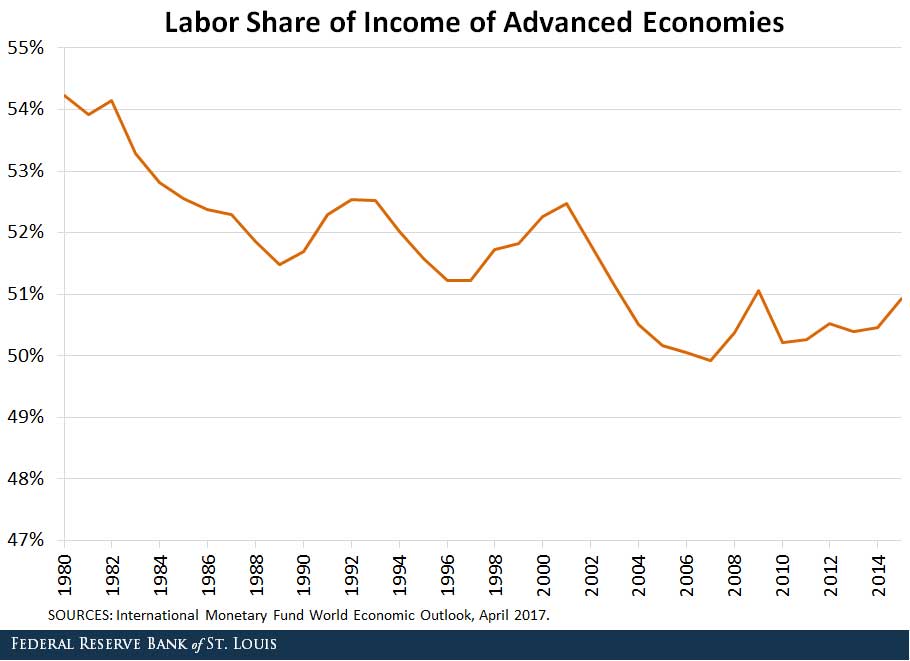

The labor share of most advanced economies has declined since the 1980s, and this decline has been associated with an increase in income inequality. This post finds that, indeed, inequality increased more in advanced economies that experienced a larger decline in the labor share.1

Measuring Labor Share

The labor share is the share of gross domestic product (GDP) that is paid as compensation in the form of wages, salaries and other benefits (such as pensions and insurance), and it is informative about the distribution of income between labor and capital.

As seen in the figure below, labor share declined 3.3 percentage points in advanced economies from 1980 to 2015.2

The Role of Technological Progress

The labor share (αL) is computed as the ratio of labor income (W * L) to nominal income (P * Y), or equivalently, as the ratio of relative wages (W / P) to labor productivity (Y / L):

αL = (W * L) / (P * Y) = (W / P) / (Y / L)

Hence, changes in the labor share can be explained by changes in the real wage and by changes in labor productivity.

Productivity Increases Outpacing Wage Increases

One of the explanations for the decline of the labor share has been an increase in productivity that has outpaced an increase in real wages, with several studies attributing half the decline to this trend.

This increase in productivity has been driven by technological progress, as manifested in a decline in the relative price of investment (that is, the price of investment relative to the price of consumption).3 As the relative price of investment decreases, the cost of capital goes down, and firms have an incentive to substitute capital for labor. As a result, the labor share declines.

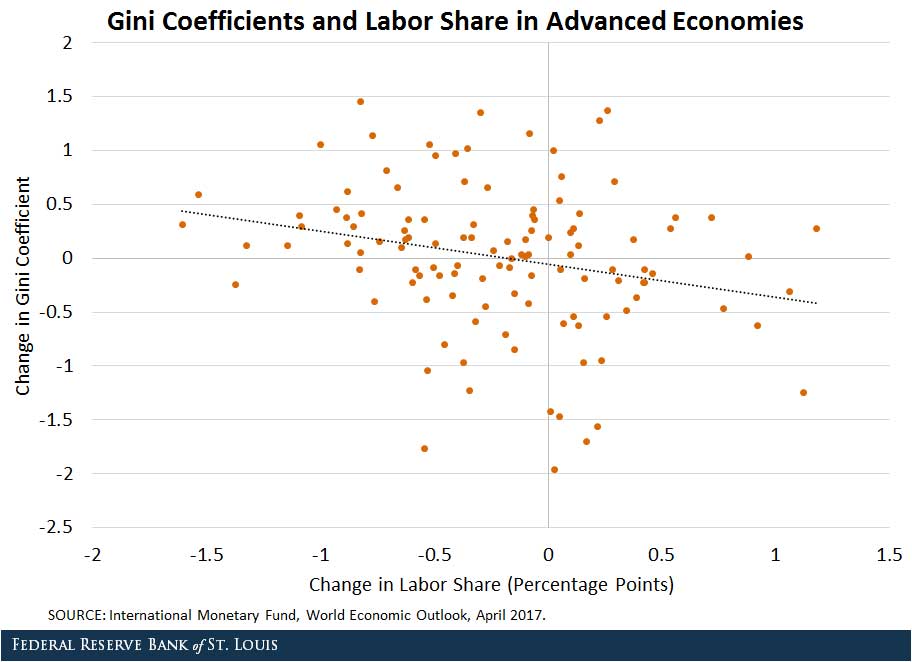

The decline in the labor share that results from a decline in the relative price of investment has contributed to an increase in inequality: A decrease in the cost of capital tends to induce automation in routine tasks, such as bookkeeping, clerical work, and repetitive production and monitoring activities. These are tasks performed mainly by middle-skill workers.4

Hence, these are the segments of the population that are more affected by a reduction in the relative price of investment. The figure below displays the correlation between changes in the advanced economies’ labor share and their Gini coefficients (which measure income inequality).

Policy Implications

Technological progress promotes economic growth, but as the findings above suggest, it can also reduce the welfare of a large part of the working population and eventually have a negative effect on economic growth.

An important role for policymakers would be to smooth the transition when more jobs are taken over by the de-routinization process. At the end of the day, technology should relieve people from performing repetitive tasks and increase the utility of our everyday lives.

Notes and References

1 “World Economic Outlook.” International Monetary Fund, April 2017.

2 The definition of an advanced economy comes from the IMF world outlook report grouping.

3 Karabarbounis, Loukas; and Neiman, Brent. “The Global Decline of the Labor Share.” Quarterly Journal of Economics, February 2014, Vol. 129. Issue 1, pp. 61-103.

4 Autor, David; and Dorn, David. “The Growth of Low-Skill Service Jobs and the Polarization of the U.S. Labor Market.” American Economic Review, August 2013, Vol. 103, Issue 5, pp. 1553-97.

Additional Resources

- On the Economy: How Is Employment Really Faring in the Eighth District?

- On the Economy: The Growing Skill Divide in the U.S. Labor Market

- On the Economy: How Has Income Inequality Changed over the Years?

Citation

Ana Maria Santacreu and Heting Zhu, ldquoHow Income Inequality Is Affected by Labor Share,rdquo St. Louis Fed On the Economy, July 31, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions