How Is Employment Really Faring in the Eighth District?

The Bureau of Labor Statistics (BLS) uses a voluntary survey of businesses called the Current Employment Statistics (CES) to produce monthly estimates of employment. The result is timely releases of local employment statistics.1 After the initial release, the BLS will update their estimates with any surveys returned late.

Current estimates indicate that employment in the state of Missouri, for example, grew at a brisk annualized rate of 2.9 percent in the fourth quarter of 2016 before slowing down during the first five months of 2017.

A More Accurate, but Later, Measure of Employment

While the CES survey is voluntary, businesses are required to report employment levels for state unemployment insurance programs. The BLS reports these state and local aggregated statistics with a six-month lag in its Quarterly Census of Employment and Wages (QCEW).

The QCEW is a more accurate measure of employment because it is an official count of the workforce, as opposed to the CES which is only a sample. Because the QCEW is more accurate, the BLS conducts a benchmark revision to the prior 15 months of CES estimates every March using the QCEW data.

Estimating Local Employment

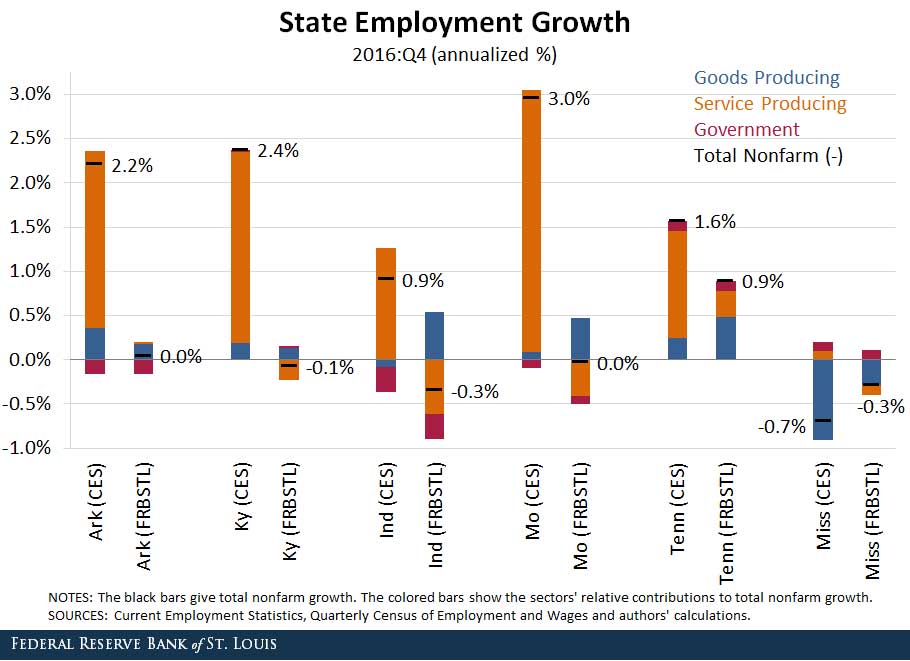

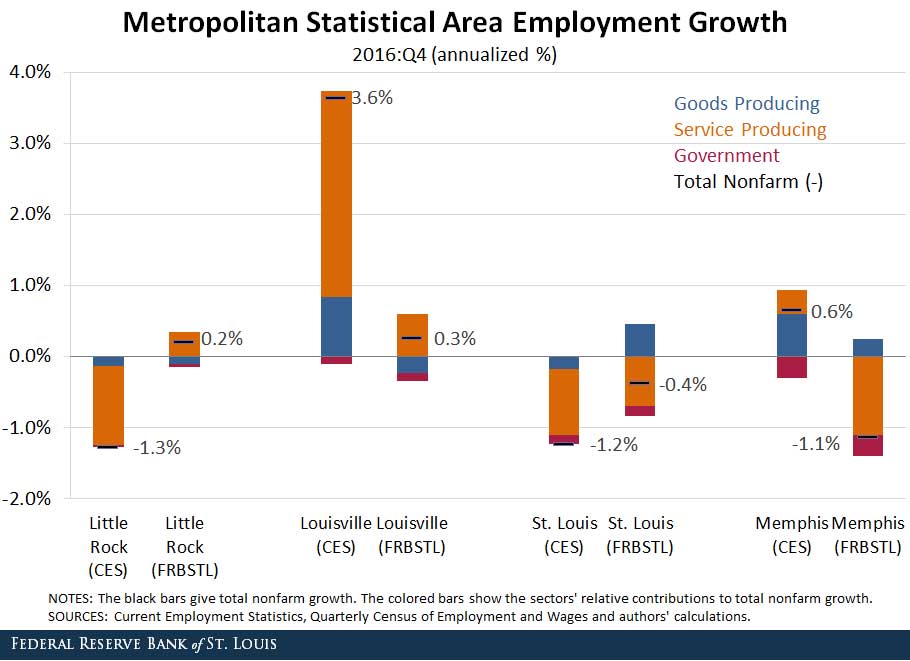

To gain a clearer picture of local employment trends, we have been producing our own estimates of local employment after each release of the QCEW.2 The figures below show our projections along with the currently published data.

Overall, our analysis indicates that employment growth was weaker across the Eighth District in the fourth quarter of 2016 than currently reported.

While the goods-producing sector (blue sections of bars) generally performed better under our projected estimates, the private service-providing sector grew at a much weaker (often negative) pace.

Employment in Arkansas

Our projected estimates report unchanged employment in Arkansas, down from currently reported growth of 2.2 percent. Both the goods-producing and private service-providing sectors grew at a slower rate than reported by the CES.

Our estimates report weaker growth in every industry but financial services, with the largest changes in other services and trade, transportation, and utilities.

In contrast to the statewide data, our estimates pushed growth upward in the Little Rock, Ark., metropolitan statistical area (MSA), as the goods-producing and private service-providing sectors both grew faster than currently reported.

These estimates suggest that the diverging growth picture between Arkansas and its largest metro area will likely be revised away next March.

Employment in Kentucky and Indiana

Our estimates show that growth in Kentucky was weaker than currently reported due to a contraction in the private service-providing sector. A shift from significant positive growth to below-zero growth in professional and business services drove the contraction.

Employment change in Indiana was also negative, with stronger growth in the goods-producing sector being offset by contractions in trade, transportation and utilities, and professional and business services. Growth in the Louisville, Ky., MSA was also pulled down.

Employment in Missouri

While current data report positive growth in Missouri, our estimates indicate that employment was largely unchanged in the fourth quarter. Despite stronger growth in the goods-producing sector, contractions in leisure and hospitality, and professional and business services contributed to negative growth in service-providing employment.

Our estimates for the St. Louis MSA brought employment growth closer toward our estimates for Missouri.

Employment in Tennessee and Mississippi

Our estimates show that growth in Tennessee is likely lower than currently reported because of weaker performance in the private service-providing sector, including professional and business services.

Mississippi is the only state in the District where our estimates indicate stronger performance. While employment still declined, higher growth in manufacturing helped push the change in employment up toward zero.

Growth in employment in the Memphis, Tenn., MSA was pulled down below that of Mississippi and Tennessee, as both the goods-producing and service-providing sectors performed worse in our estimates.

Employment in the Eighth District

The current data for 2017 shows relatively weak employment growth in the Eighth District, with moderate growth in the goods-producing sector and slow growth in the private service-providing sector. These figures are in line with our estimates for the end of 2016 as well as the most recent Beige Book reports.

While this leads us to believe that these trends will continue going forward, we will be better able to tell when QCEW data for the first two quarters of 2017 are released in September and December.

Notes and References

1 Typically new data for the previous month are released around the 20th of the following month.

2 We produced estimates for total nonfarm and each of the major industries (excluding government), following methods outlined by the Dallas Fed on its webpage discussing early benchmarking.

Additional Resources

- On the Economy: The Growing Skill Divide in the U.S. Labor Market

- On the Economy: What Is the Informal Labor Market?

- On the Economy: Is U.S. Manufacturing Really Declining?

Citation

Charles S. Gascon and Paul Morris, ldquoHow Is Employment Really Faring in the Eighth District?,rdquo St. Louis Fed On the Economy, July 10, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions