Serious Delinquency Rates for Student Loans Remain High

Serious delinquency rates1 for auto and student loans both rose during the recession. However, only the rate for auto loans hit a peak and fell, according to the most recent issue of In the Balance.

Don Schlagenhauf, chief economist for the St. Louis Fed’s Center for Household Financial Stability, and Lowell Ricketts, the Center’s senior analyst, examined the trend in delinquency rates since 2003 for both the nation and the Eighth District2 as part of their recently released Quarterly Debt Monitor. This offering will track and analyze new developments in and delinquency measures for select types of consumer debt.

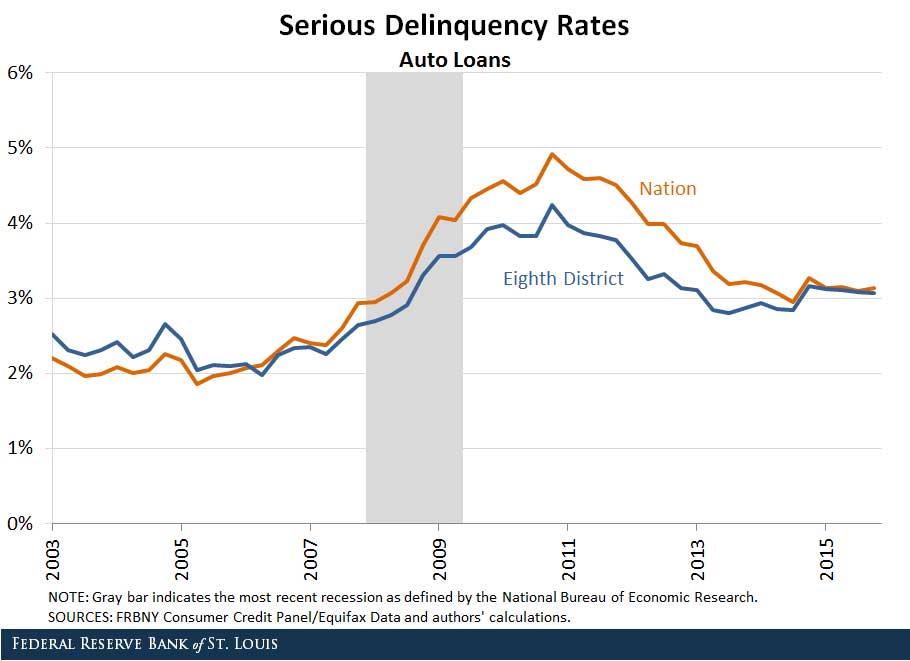

The authors found that the serious delinquency rate for auto loans peaked at close to double the prerecession rate, as seen in the figure below.

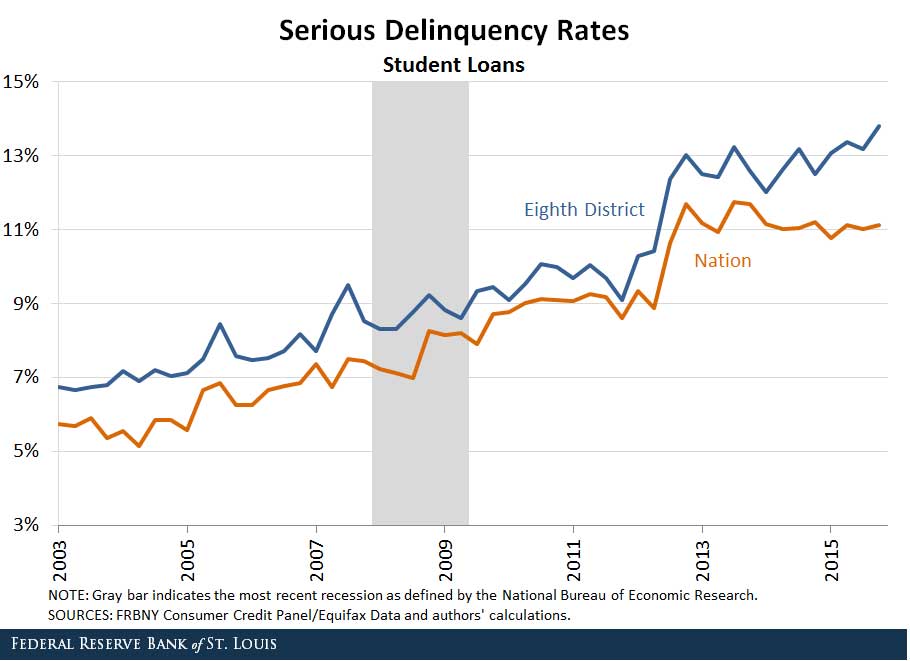

Serious delinquency rates for student loans, on the other hand, rose but never declined substantially, as seen in the figure below.

Schlagenhauf and Ricketts noted that the actual rate may be even higher for student loans, as many are in deferment, grace periods or forbearance, and are not actually in the repayment cycle.

The authors wrote that the implications of high serious delinquency rates for student loans aren’t clear. They noted: “However, a large share of young borrowers saddled with severely delinquent loans may inhibit aggregate economic growth as this group is unable to participate in other economic activities, such as buying a home or saving for retirement.”

Notes and References

1 Serious delinquencies are those with payments overdue by at least 90 days.

2 The Eighth District includes all of Arkansas and parts of Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee.

Additional Resources

- On the Economy: Auto and Student Debt Continue Rising

- On the Economy: Consumer Debt Grew, Fell Slower in Eighth District Versus the Nation

Citation

ldquoSerious Delinquency Rates for Student Loans Remain High,rdquo St. Louis Fed On the Economy, May 17, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions