Looking beyond the Unemployment Rate

The unemployment rate gets significant attention in labor market discussions, but unemployment duration should also be considered, according to a recent article in The Regional Economist.

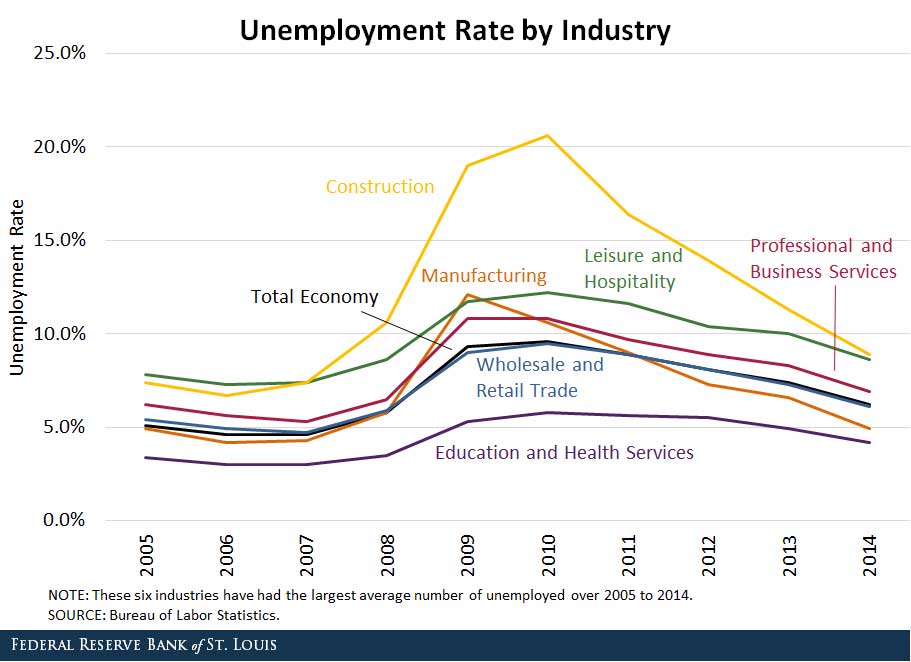

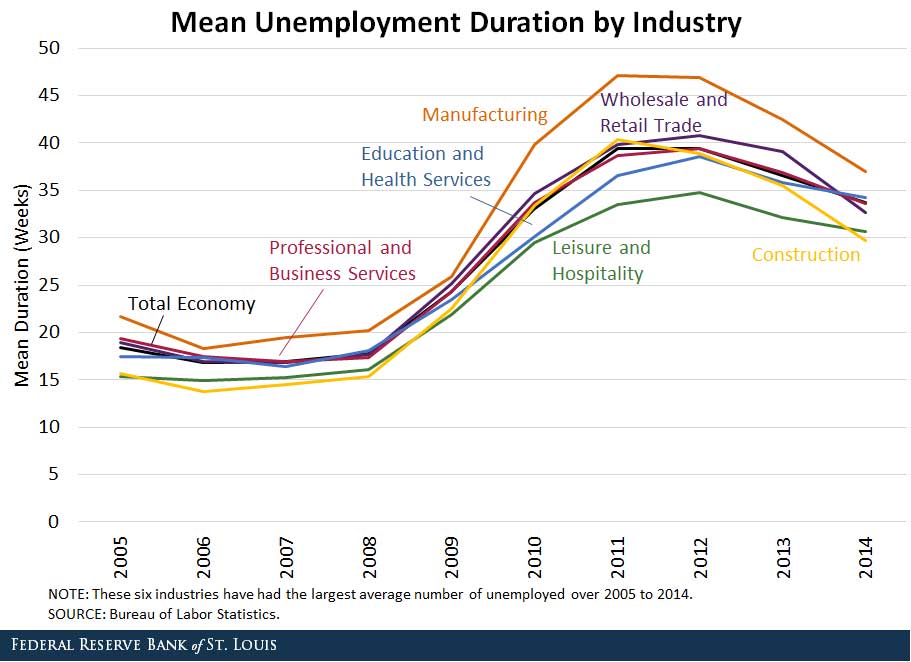

Senior Economist YiLi Chien and Research Associate Paul Morris first contrasted the unemployment rates and durations for the six industries with the largest average number of unemployed. This was over the period 2005-14, which includes the Great Recession. As can be seen in the charts below, the rates and durations largely moved together during this period.

The authors pointed out the distinguishing feature that unemployment duration peaked later than the unemployment rate. They noted that the lag continues today, as unemployment rates by industry have returned to precrisis levels, while durations remain elevated. They wrote: “It will be interesting to see whether the durations will revert eventually.”

Correlation

Chien and Morris also looked at the correlation between the unemployment rate and unemployment duration. They explained that it’s reasonable to expect a positive relationship between the two. “However, the data show that the average unemployment rate for each industry from 2005 to 2014 and the average mean duration for each industry across the same time period exhibit a negative relationship across industries (correlation coefficient of -0.67).”

Implications

Chien and Morris said these findings are important because focusing only on the unemployment rate might be misleading, especially in terms of welfare analysis for unemployed workers. For example, some industries have relatively short unemployment durations with higher-than-average unemployment rates. “Thus, the welfare impact for those unemployed workers might be overestimated if we look only at the unemployment rate.”

Further Analysis

One potential weakness of this analysis that the authors noted is that shorter unemployment durations in some industries could be caused by multiple reasons, such as a quick job-finding rate or by discouraged workers dropping out of the labor force. Chien and Morris did find that the negative relationship between unemployment duration and the unemployment rate was persistent throughout the business cycle. They wrote: “This indicates that the effect of discouraged workers might not be the major explanation.”

Conclusion

When examining possible causes for this relationship, Chien and Morris noted that the reason may lie in characteristics specific to the individual industries. For example, some industries that require specific skills may be more reluctant to fire workers if they are difficult to replace. They wrote: “By the same logic, some workers are easier to be fired and could find another job more quickly because of the low job-searching friction. Therefore, some industries could have a higher unemployment rate but a shorter unemployment duration on average.”

Additional Resources

- Regional Economist: Unemployment by Industry: Duration Must Be Considered, Too

- On the Economy: Is the U.S. Due for Another Recession?

- On the Economy: The GDP-Jobs Schism Looks to Have Asserted Itself Again in 2015

Citation

ldquoLooking beyond the Unemployment Rate,rdquo St. Louis Fed On the Economy, March 1, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions