Unemployment by Industry: Duration Must Be Considered, Too

To better understand unemployment in key industries, not only the unemployment rate but the duration of unemployment in those industries needs to be examined. Focusing only on the former could lead to misguided efforts to assist the unemployed. This article investigates the behavior of both the unemployment rate and the duration of unemployment across industries from 2005 through 2014, a period that includes the Great Recession (2007-09).

Strong Co-movement Trend

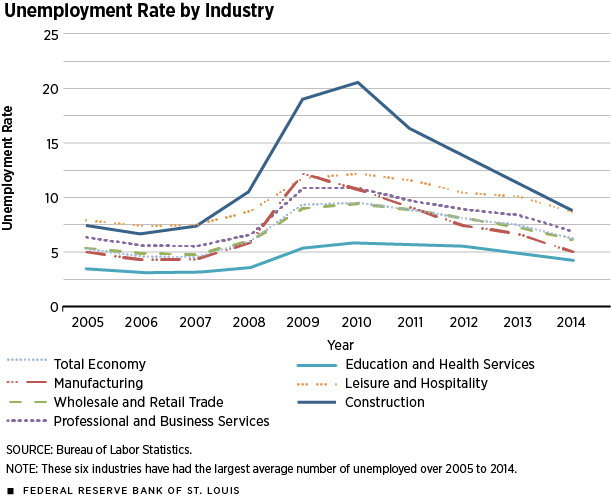

We obtained industry-level data on unemployment rates, unemployment duration and the total number of unemployed from the Bureau of Labor Statistics for 12 major industries.1 Figure 1 shows that the unemployment rates across the six industries with the largest average number of unemployed move together over time. The unemployment rates rose sharply for all six after the recession began in 2007 and gradually began to fall after 2010. Although the rates moved together, some industries were hit harder than others. For example, the unemployment rates of the manufacturing sector and of the leisure and hospitality sector rose more than the rate for the education and health services sector after the beginning of the recession; this shows that there is some heterogeneity in the rates despite the obvious co-movement.

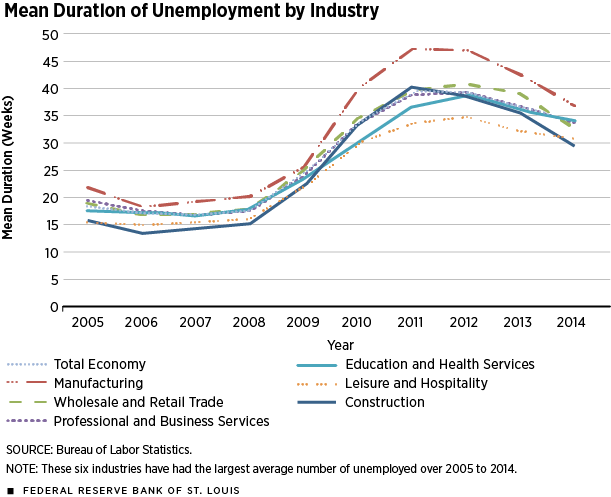

Similarly, the duration of unemployment across these industries shares this co-movement effect. Figure 2 plots the mean unemployment duration for the same six industries. The durations were relatively low before the recession and sharply increased during the recession. As the economy continued its recovery, they gradually came down, starting in 2012.

In terms of heterogeneity across industries, some industries tended to have shorter unemployment spells than others. These differences were generally persistent throughout the sample period. One distinguishing feature of unemployment duration is its lagged response to the business cycle. Comparing Figures 1 and 2, duration reached its peak across all industries later than the unemployment rate. This lag persists today, with the newest data showing that the various unemployment rates have returned to their precrisis levels while the various unemployment durations are still far above where they were in 2007. It will be interesting to see whether the durations will revert eventually.

Negative Correlation

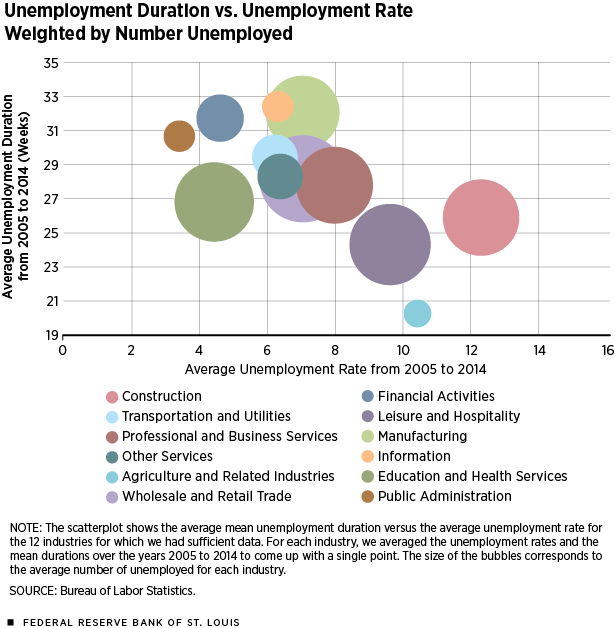

It is reasonable to suspect that there should be a positive relationship between the unemployment rate and unemployment duration. A higher-than-average unemployment rate in a specific industry may indicate that this industry is experiencing an economic hardship. Those workers laid off from that industry might face limited job opportunities, thereby lengthening their time spent unemployed. However, the data show that the average unemployment rate for each industry from 2005 to 2014 and the average mean duration for each industry across the same time period exhibit a negative relationship across industries (correlation coefficient of –0.67).

Figure 3 demonstrates this result. Each circle represents one industry, and the size of the circle represents the number unemployed in that industry. Clearly, the relationship between the unemployment rate and duration is negative: An industry with a higher unemployment rate tends to have a shorter unemployment duration. Take the construction sector and the leisure and hospitality sector as examples. Both industries have a higher than average unemployment rate from 2005 to 2014, yet their unemployment durations are two of the lowest among all industries.

However, the negative relationship is not perfect. An exception is the education and health services sector, which has both a relatively low unemployment rate and a relatively short duration. These workers are less likely to be unemployed and are more likely to quickly find a job after becoming unemployed.

Implications and Explanations

Our results suggest that focusing only on the unemployment rate might be misleading, especially in terms of welfare analysis for unemployed workers. In some industries, the unemployment duration is relatively short even with a higher-than-average unemployment rate. Thus, the welfare impact for those unemployed workers might be overestimated if we look only at the unemployment rate. On the other hand, workers in some other industries might experience longer unemployment duration even if they are less likely to be unemployed. For these workers, the welfare cost of being laid off could be relatively high.

Our analysis contains a potential weakness, as the shorter unemployment duration could be the result of a quick job-finding rate or the effect of discouraged workers leaving the labor force. It is possible that during the severe recession in 2007 some of the unemployed workers stopped looking for a job and left the labor force because of a very low chance of getting a job in the short run. To remedy this potential weakness in our analysis, we need to rely on the flow data that describe where these unemployed workers go as they transition from unemployment. But because of the limited accessibility of job-flow data across industries, this aspect of the research will have to wait. However, we did find that the negative relationship between unemployment duration and the unemployment rate across industries was persistent throughout the business cycle, as the relative industry rankings remained mostly stable for both measures. This indicates that the effect of discouraged workers might not be the major explanation.

Then what else could explain this relationship? The reason might come from some specific characteristics of the industry, as opposed to the level of the unemployment rate. One potential explanation is what is referred to as firm-specific human capital.2 For example, if a worker is equipped with a skill that is useful only within a specific industry, or even a specific company, then it could be hard to reallocate this worker to another job, which means that job-searching frictions—or the difficulties that arise in the hiring process because of mismatches in preferences between employers and employees—might be asymmetric from industry to industry. This asymmetric friction affects the behavior of employers, who are more reluctant to fire workers if it is difficult to replace them. By the same logic, some workers are easier to be fired and could find another job more quickly because of the low job-searching friction. Therefore, some industries could have a higher unemployment rate but a shorter unemployment duration on average.

Paul Morris is a research analyst at the Federal Reserve Bank of St. Louis.

Endnotes

- Data on the mining, quarrying, and oil and gas extraction industry were also available but incomplete. For information on each industry included in our analysis, refer to the Industries at a Glance page at www.bls.gov/iag/tgs/iag_index_naics.htm. [back to text]

- See Topel for the empirical evidence on firm-specific human capital. [back to text]

Reference

Topel, Robert H, "Specific Capital, Mobility, and Wages: Wages Rise with Job Seniority," Journal of Political Economy, University of Chicago Press, 1991, Vol. 99, No. 1, pp. 145-76.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us