The GDP-Jobs Schism Looks to Have Asserted Itself Again in 2015

By William Dupor, Assistant Vice President and Economist

It looks like 2015 will have been another year in which gross domestic product (GDP) disappoints and employment delights.

The two central measures of the economy's trajectory are the nation's GDP growth and its employment growth. In the recent past, the two measures have been telling different stories as to how well the U.S. economy is performing. This creates a vexing situation for policymakers, economists and financial market participants alike.

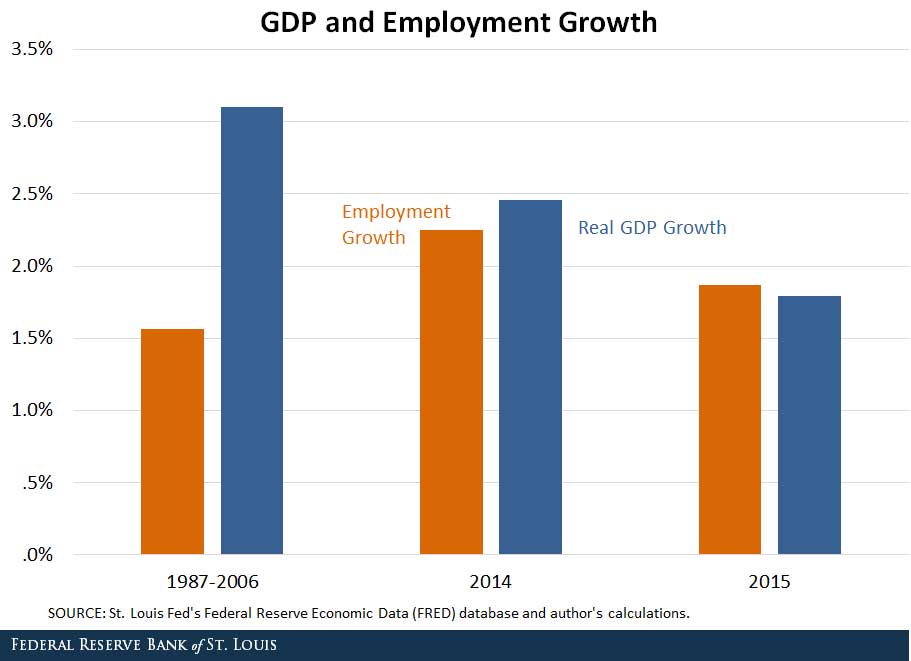

First, GDP is the combined market value of final goods and services produced within a nation's borders over a period of time. GDP includes, among other things, the consumer goods and services that people enjoy and new buildings and equipment used by companies to keep the engine of economic prosperity humming. At the same time, GDP is also the income that fills the pocketbooks of American workers and business owners. One technical detail is economists correct for inflation by computing and then focusing on real GDP. As seen in the figure below, real GDP grew at an average 3.1 percent annual rate in the 20 years prior to the 2007-09 recession.1

Employment is simply the number of workers in the economy. The figure also shows that employment grew at 1.6 percent over the same horizon. The overriding reason that real GDP grows faster than employment over longer horizons is technology. As technology improves over time, workers become more productive, generating more GDP per worker.

As the figure shows, relative to their historical records, real GDP has grown more slowly in the past two years, and employment has grown more quickly. In 2015, employment grew at 1.9 percent, and it looks that real GDP will grow at about 1.8 percent. A similar pattern occurred in 2014.

It is difficult to say whether the anomalous behavior of the two growth rates will disappear in the next few years. If it doesn't, the most disheartening explanation might be that the economy has downshifted into a period of slow technological growth that could last for many years.

Notes and References

1 Both variables are seasonally adjusted and measured as quarter-on-quarter annualized growth rates. Employment data are the nonfarm payroll and come from the Bureau of Labor Statistics. Real GDP data are from the Bureau of Economic Analysis (BEA). The fourth quarter 2015 real GDP number used is the BEA’s preliminary estimate.

Additional Resources

- On the Economy: What Is Potential Output, and How Is It Measured?

- On the Economy: Why Did Loan Growth Stay Negative So Long after the Recession?

- On the Economy: Overestimating the Loss of Human Capital

Citation

ldquoThe GDP-Jobs Schism Looks to Have Asserted Itself Again in 2015,rdquo St. Louis Fed On the Economy, Feb. 4, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions