Serving Low- and Moderate-Income Individuals and Households

Nearly 10 times as many nonprofits have seen decreases in funding sources as increases, according to the latest Community Development Outlook Survey, produced by the St. Louis Fed.

The survey asked a variety of stakeholders from Eighth Federal Reserve District states about issues facing low- and moderate-income (LMI) individuals, households and communities.1 The survey also asked specific questions of various types of organizations, including nonprofit organizations and financial institutions. (Overall survey responses and the differences between metro and rural respondents have already been covered.)

Nonprofits

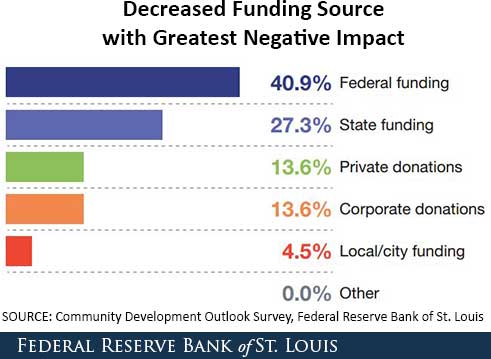

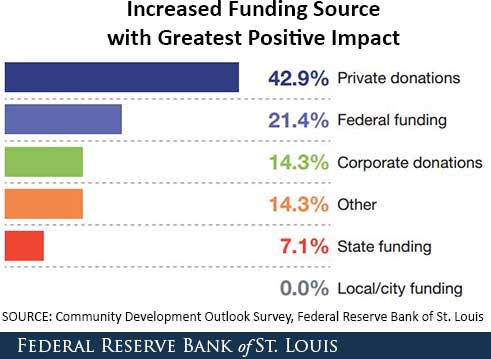

Only 4.3 percent of respondents from nonprofit organizations said their funding sources had increased over the past six months. In contrast, 39.1 percent said funding sources had decreased, with the remainder saying they had stayed the same. The figures below show the decreased funding sources with the greatest negative impacts on the organizations' ability to help the LMI community and the increased funding sources with the greatest positive impacts.

More than half (52.2 percent) of nonprofit respondents said demand by LMI individuals and households for services had increased over the past six months, while 34.8 percent said it had stayed the same and 13.0 percent said demand had decreased. However, the percentage indicating an increase in demand fell from 70.3 percent the previous year.

Financial Institutions

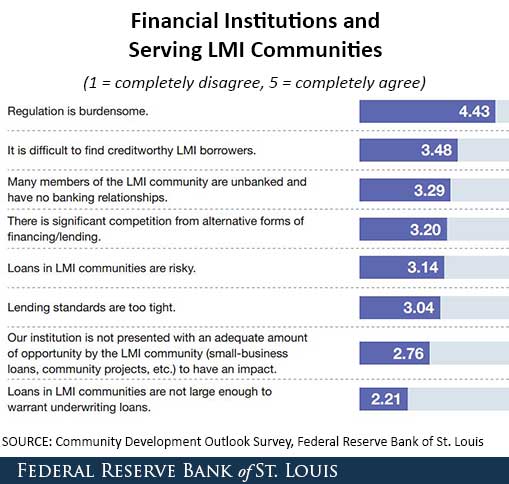

Respondents from financial institutions were asked how much they agreed with various statements regarding LMI individuals and households, such as statements involving lending. The results are in the figure below.

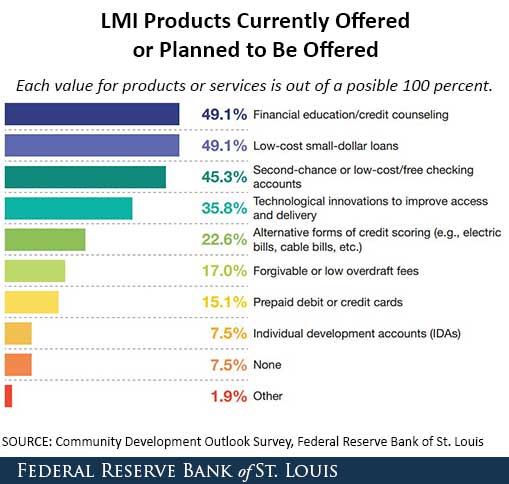

These respondents were also asked about the products and services they either currently provided or planned to provide. As seen in the figure below, financial education/credit counseling and low-cost small-dollar loans were the most commonly cited.

The percentage of respondents offering or planning to offer low-cost small-dollar loans rose from 40.4 percent in 2014. Also rising were alternative forms of credit scoring (18.2 percent in 2014) and forgivable or low overdraft fees (13.1 percent in 2014).

Notes and References

1 Eighth District states are Arkansas, Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee.

Additional Resources

Citation

ldquoServing Low- and Moderate-Income Individuals and Households,rdquo St. Louis Fed On the Economy, Jan. 28, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions