Why Did Loan Growth Stay Negative So Long after the Recession?

During and after the recent recession, loan growth at commercial banks decreased substantially and remained negative for almost four years. This contrasts to the more moderate patterns in the two previous recessions: 1990-91 and 2001.

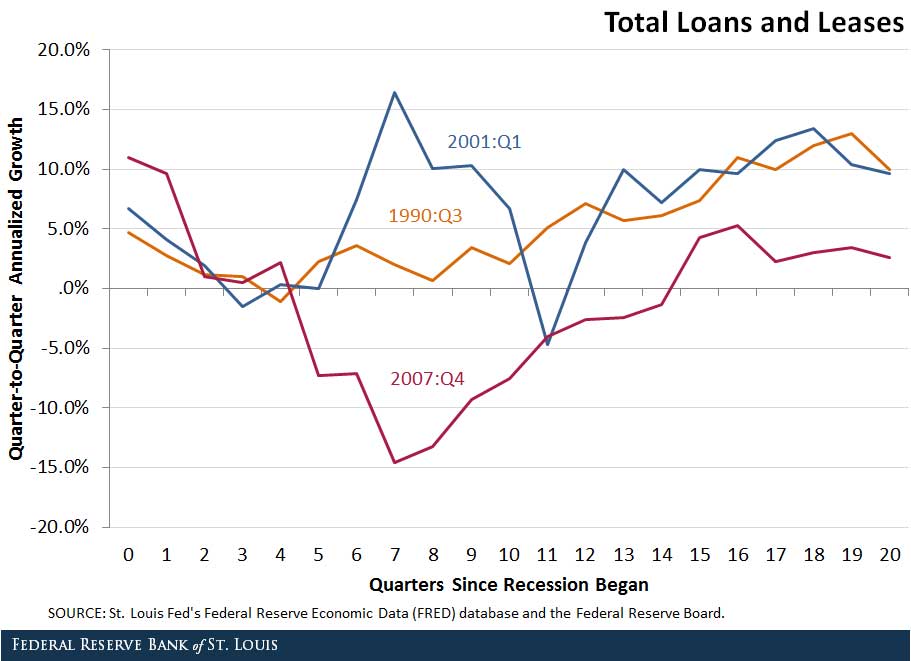

The figure below illustrates the evolution of the growth rate of loans and leases at commercial banks for the three most recent recessions. For each case, the data series start with the quarter the recession began.

While lending growth slowed to zero in the 1990-91 and 2001 recessions, it recovered after a few quarters. In contrast, during the most recent recession, loan growth became strongly negative and remained negative for almost three years.

The different evolution of loan growth could be due to differences in demand, supply, or a combination of both. Information from the Senior Loan Officer Opinion Survey might shed some light on credit supply and demand conditions.1 Survey reports of tightening lending standards would indicate that supply factors were responsible for the slowdown in loan growth, while reports of decreased loan demand would presumably reflect demand factors.

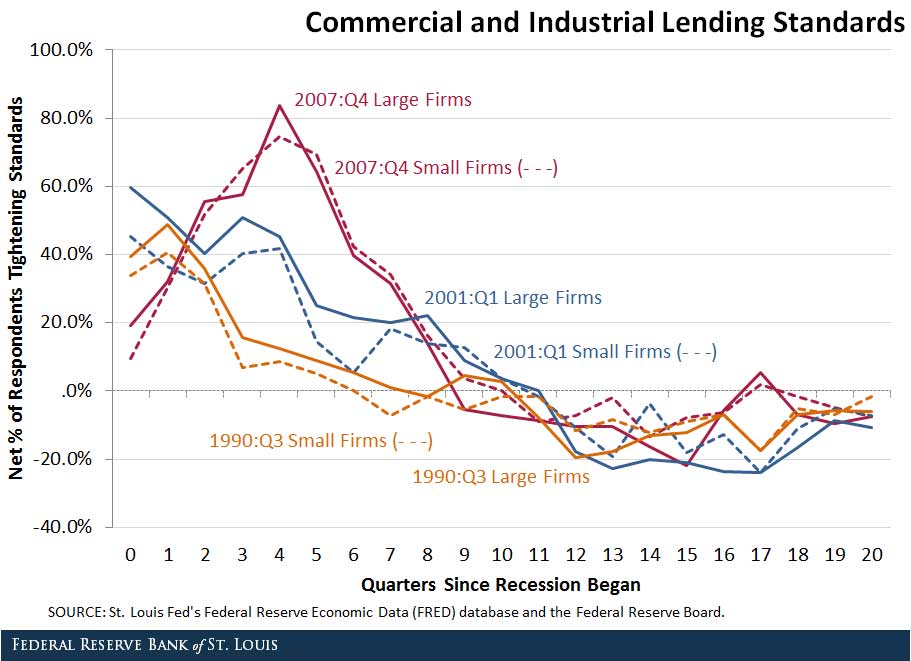

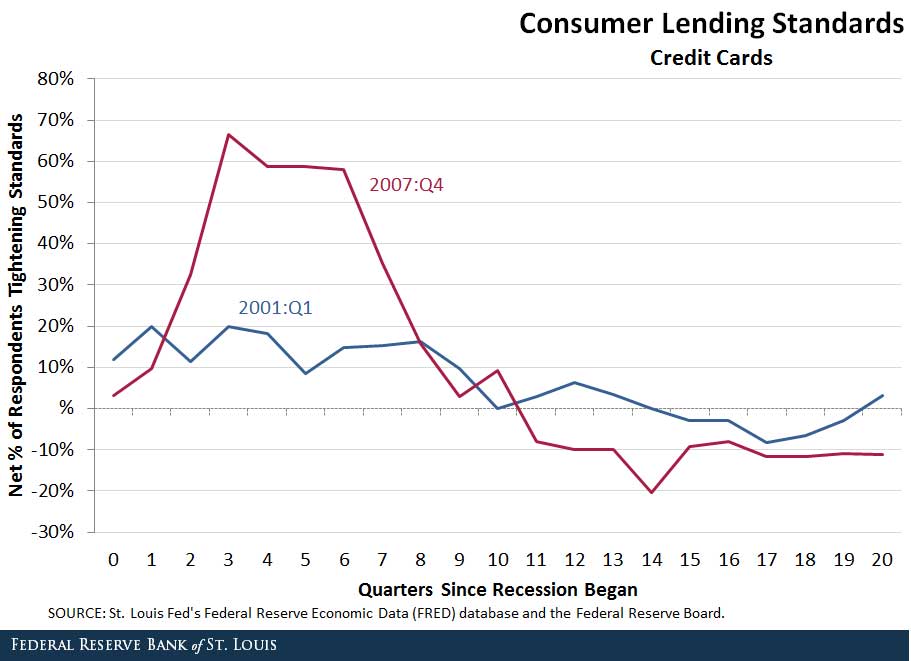

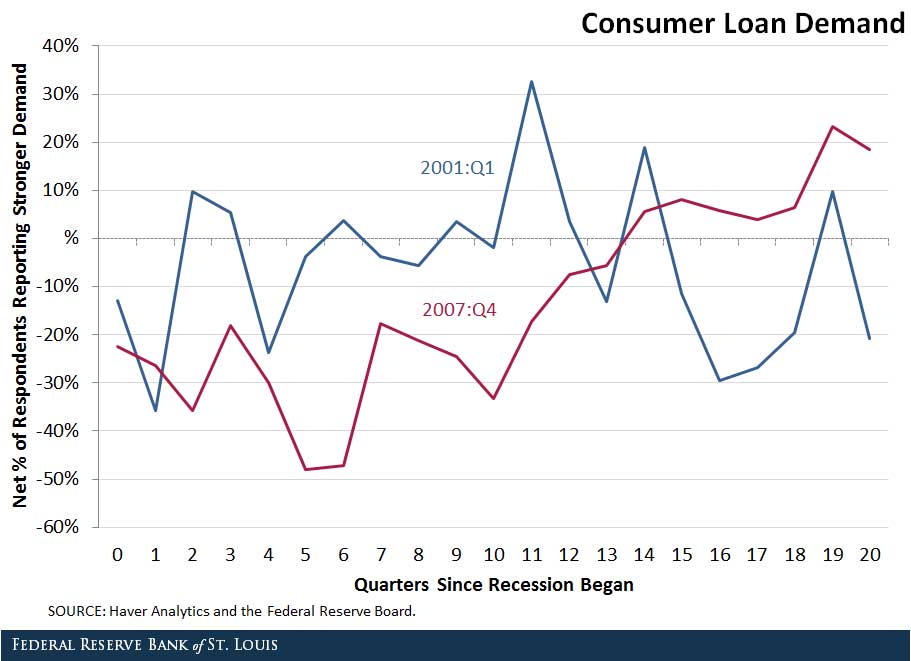

The first figure below shows the net percent of loan officers reporting tighter standards on commercial and industrial loans to small and large firms, while the second figure shows the same information for revolving consumer loans (credit cards).2 As before, each series in the graph starts with the quarter the recession began.3

The figures show that loan officers tended to tighten lending during all three recessions for both business loans and consumer loans. However, more loan officers reported a tightening of lending standards in the most recent downturn than in the previous ones. Tightening of standards will reduce loan supply. This tightening can account for part of the negative loan growth out of the 2007-09 recession.

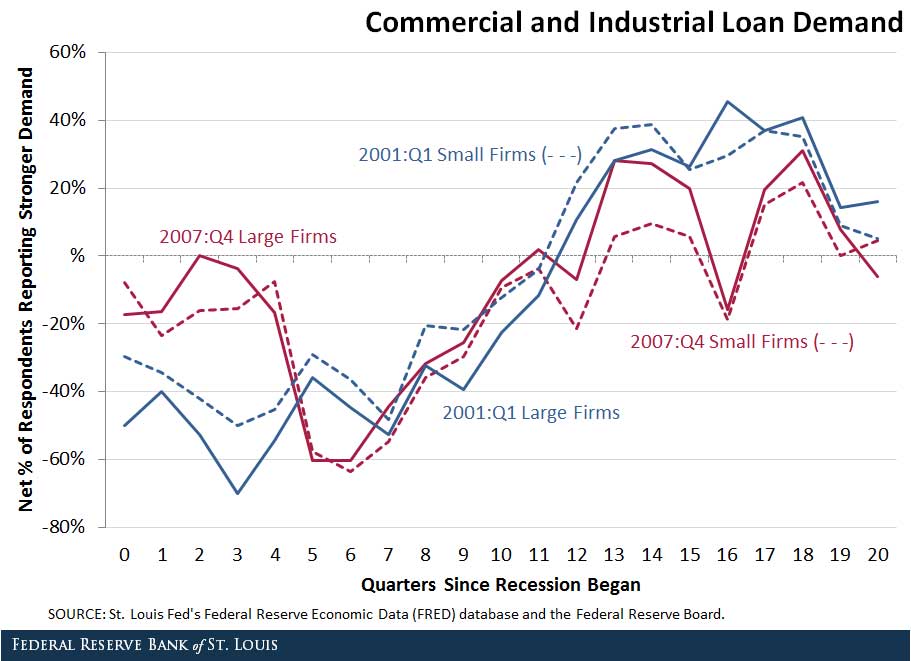

The next set of figures shows loan demand. The first figure shows that loan officers had perceived weaker demand for business loans in the two most recent recessions, but the falloff in demand in the two episodes seems to be roughly similar. On the other hand, the second figure shows that loan officers perceived consumer demand to have been much weaker for a protracted period in the most recent recession relative to that in 2001.

Both supply and demand factors have contributed to the sharp drop in bank lending during the Great Recession.

Notes and References

1 This quarterly survey is administered by the Federal Reserve Board of Governors. It surveys loan officers at about 80 U.S. commercial banks about recent changes in lending standards and loan demand. The responses are compiled into diffusion indexes and can be found in FRED. A diffusion index is calculated by taking the number of respondents reporting an increasing change (such as tightening standards or stronger demand), minus the number of respondents reporting a decreasing change (such as looser standards or lower demand), divided by the total respondents (including those reporting no change).

2 Data on lending standards for other consumer loan categories are not available prior to 2011.

3 Data on lending standards for consumer loans are not available for the 1990-91 recession.

Additional Resources

- On the Economy: Deposits Grow across Banks Following Financial Crisis

- On the Economy: How Credit Card Debt Default Has Evolved

- On the Economy: How Big Should the U.S.’s Disability Insurance Program Be?

Citation

Maximiliano A. Dvorkin and Hannah Shell, ldquoWhy Did Loan Growth Stay Negative So Long after the Recession?,rdquo St. Louis Fed On the Economy, Jan. 11, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions