Not All Interest Rates May Rise after Liftoff

On Dec. 16, the Federal Open Market Committee (FOMC) announced an increase in its policy interest rate (the federal funds rate) range from 0-0.25 percent to 0.25-0.5 percent. This decision to “lift off” was widely anticipated by financial markets. The FOMC has stated that the future path of the federal funds rate will be data dependent. If the labor market continues to improve and if inflation shows signs of returning to the FOMC’s 2 percent target, then further increases in the federal funds rate are likely in store for 2016.

The federal funds rate is very short-term in nature: It is the interest rate paid on reserves borrowed overnight by depository institutions. As such, one would expect this policy rate to have a direct influence on other short-term interest rates, like the yield on three-month U.S. Treasury securities. Theoretically, longer-term interest rates are influenced, at least in part, by the expected path of the policy rate. Thus, in the present context, if the Fed is expected to raise its policy rate over the course of future FOMC meetings, one should expect longer-term rates to rise as well.

In fact, the pattern just described is evident in the monetary tightening cycles that occurred in the early and late 1990s. This familiar pattern seemed to break down, however, during the tightening cycle that occurred in the mid-2000s. In that episode, short-term rates continued to rise along with the Fed’s policy rate, but longer-term rates hardly moved at all. The episode is commonly referred to as the “Greenspan conundrum,” since then-Fed Chairman Alan Greenspan openly mused about the puzzling behavior exhibited by short- and long-term interest rates at the time.

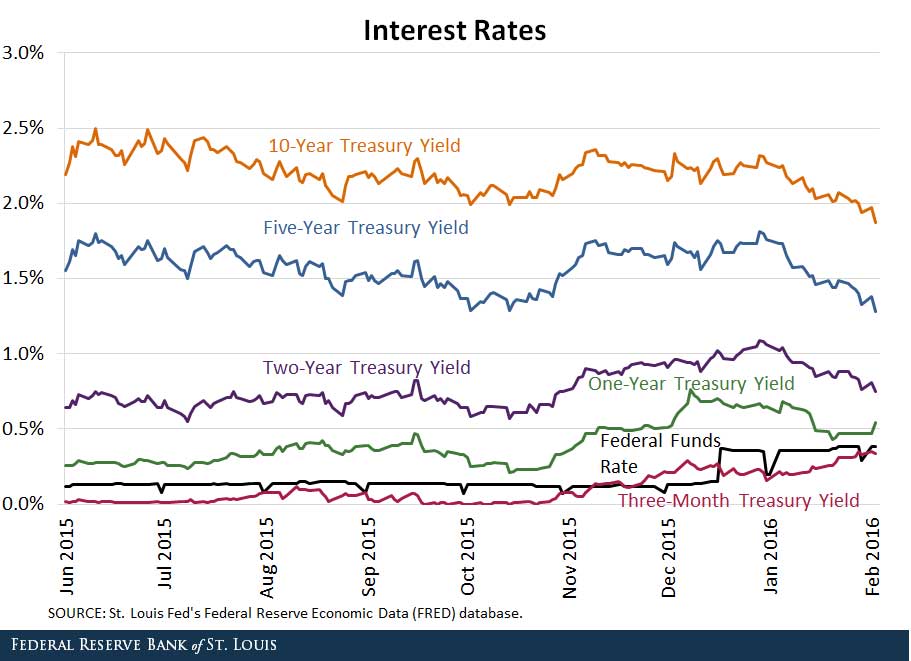

So what might we expect this time around? The figure below demonstrates very clearly how a short-term interest rate like the three-month Treasury yield moved very closely with the federal funds rate.

In fact, since the December liftoff date was widely anticipated, it is not surprising to see short-term rates rise even prior to the actual liftoff date.

Longer-term rates, ranging from one-year to 10-year yields, seemed to rise as well in anticipation of liftoff. But the effect seems to have rapidly ceased and even reversed itself, with rates at all maturities one-year and longer falling since liftoff.

One interpretation of this pattern is that it reflects an enhanced appetite for safe assets that has reasserted itself due to the uncertainties associated with world growth prospects, particularly in China but even domestically. If the depressed economic outlook persists into 2016, continued Fed rate hikes are likely to lead to yield-curve inversion, commonly thought to be a good forecaster of imminent recession. If weakness persists, however, it is more likely that future rate hikes would be postponed indefinitely, at least as long as inflation remains well below the FOMC’s 2 percent target.

Additional Resources

- On the Economy: What Does Data Dependence Mean?

- On the Economy: How Do Rate Hikes Affect the Dollar’s Exchange Rate?

- On the Economy: Private Investment Behavior around the Great Recession

Citation

David Andolfatto and Michael A Varley, ldquoNot All Interest Rates May Rise after Liftoff,rdquo St. Louis Fed On the Economy, Feb. 9, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions