Global Current Account Surplus: Is There Trade with Other Planets?

The current account of a country measures a couple of items:

- The difference between its exports to and its imports from the rest of the world

- The international asset position of a country with the rest of the world

If exports of a country are larger than its imports, we say that the country runs a current account surplus. In other words, the country is a net lender to the rest of the world. If a country’s exports are smaller than its imports, we say that the country runs a current account deficit, or is a net borrower from the rest of the world.

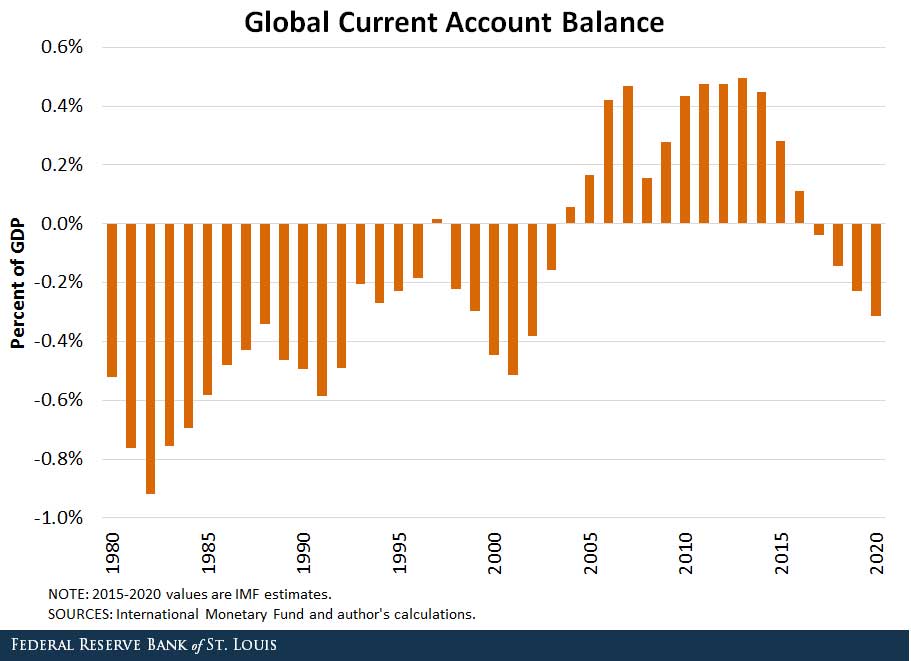

By definition, the current account of all countries should sum to zero, since one country’s exports is another country’s imports. In practice, however, this is not the case. The figure below shows that there is a discrepancy between global exports and imports.

The figure shows that in most years from 1980 to 2004, the world ran a current account deficit between -0.2 and -0.9 percent of global gross domestic product (GDP). This trend then reversed, with the world running a current account surplus of close to 0.5 percent of world GDP.

What can explain these discrepancies? Was the Earth a net importer of goods and services from other planets before 2005 and a net exporter afterwards?

According to the International Monetary Fund (IMF), these discrepancies are driven by several factors. For one, transportation lags could generate a positive current account if the exports of a country are recorded in one year and imports are recorded in the following year. Another factor, especially in emerging economies, is the underreporting of income generated through these transactions for tax evasion purposes. A 2009 IMF study found that the switch from a deficit to a surplus was due to a mismeasurement of services, which are easier to identify from exporters than importers (for example, big insurance companies providing services to small clients).1 The IMF’s projection for the next five years is that these discrepancies will decrease (as they have been since 2012) and that the world current account will be negative.

Accounting for the magnitude of these errors is difficult and still important to understand the existence of global imbalances around the world.

Notes and References

“Exports to Mars.” The Economist, Nov. 12, 2011.

1 For a detailed analysis, see Helbling, Thomas; and Terrones, Marco E. “From Deficit to Surplus: Recent Shifts in Global Current Accounts.” IMF World Economic Outlook: Sustaining the Recovery, October 2009, pp. 35-39.

Additional Resources

- On the Economy: Why Has the U.S. Net Foreign Asset Position Weakened?

- On the Economy: Is the Large and Persistent U.S. Trade Deficit a Concern?

- On the Economy: Why Are Economists Unconcerned about Foreign Investment in the United States?

Citation

Ana Maria Santacreu, ldquoGlobal Current Account Surplus: Is There Trade with Other Planets?,rdquo St. Louis Fed On the Economy, Feb. 22, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions