Overestimating the Loss of Human Capital

Measurements of the labor market such as the unemployment rate or the labor force participation rate (LFPR) say little about the productive capacity of workers. A recent Economic Synopses essay discussed how traditional measures of labor market slack may overestimate how much labor capital is either unemployed or not in the labor force.

Research Officer Alexander Monge-Naranjo and Technical Research Associate Faisal Sohail constructed measures of the unemployment rate and the LFPR that correct for the differences in workers’ productivity and compared them with traditional measures (which assume all workers are equally productive) followed by policymakers. As the authors point out: “From an economic perspective, the output loss from a highly productive unemployed worker can be the same, or even larger, than the output loss from several less-productive unemployed workers.” (For details on the methodology, see the Economic Synopses essay, “The Unemployment and Participation Rates for Aggregate Human Capital.”)

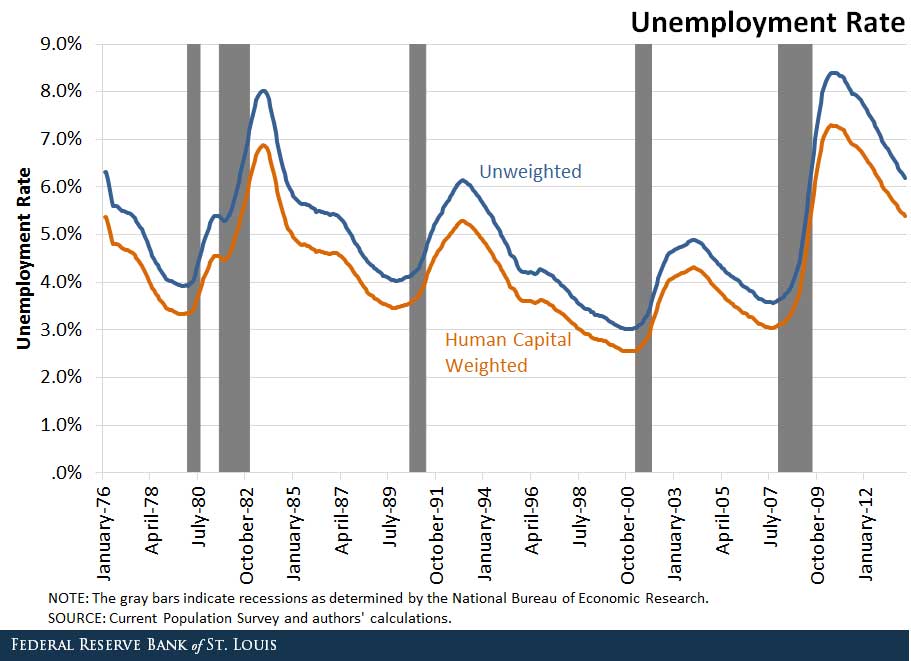

For the unemployment rate, Monge-Naranjo and Sohail found that the human-capital-weighted rate was always lower than the traditional rate. The difference between the two over the period 1975-2015 was about 0.7 percentage points. The difference also increased during and after recessions. The authors wrote: “These patterns are explained by the fact that those with higher human capital are less likely to be unemployed and even less so during downturns.”

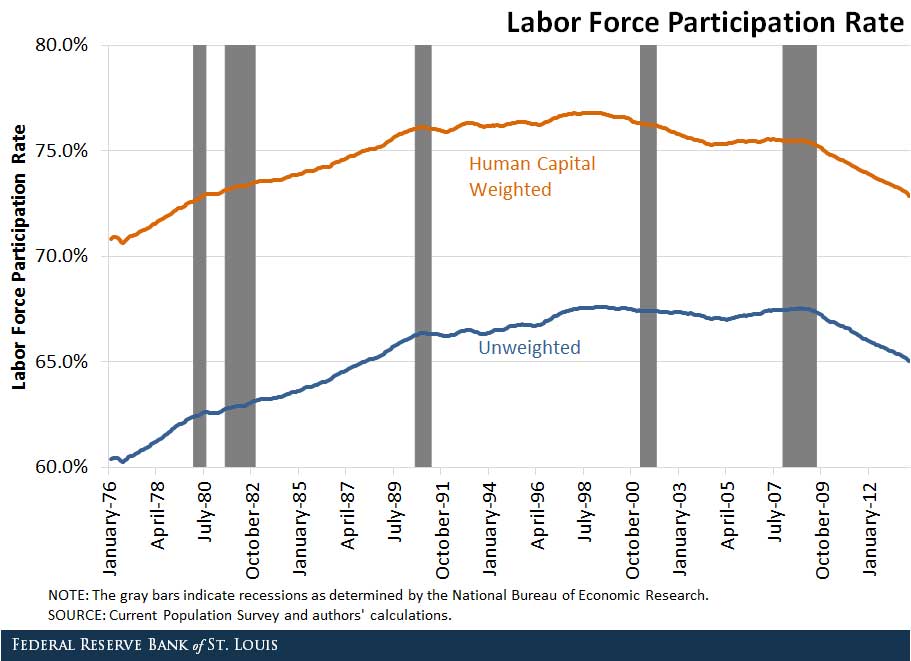

For the labor force participation rate, Monge-Naranjo and Sohail found that the difference between the human-capital-weighted rate and the traditional rate was an order of magnitude higher than between the unemployment rate series. They also noted that the difference between the weighted and traditional LFPRs has become smaller over time, declining from around 10.5 percentage points in early 1976 to 7.9 percentage points by the end of 2013.

The authors explained that the declining gap is consistent with recent trends in educational attainment and labor force participation in the U.S. They wrote: “In particular, the rise in educational attainment has increased the total stock of human capital in the population and the post-2000 decline in the LPFR has decreased the total stock of human capital in the labor force.”

Conclusion

Monge-Naranjo and Sohail concluded: “The traditional measures of labor market slack tend to overestimate the fraction of the country’s human capital either unemployed or not participating in the labor force. … Both overestimations are explained by the fact that a worker’s unemployment and nonparticipation rates decline with an increase in his or her human capital.”

Additional Resources

- Economic Synopses: The Unemployment and Participation Rates for Aggregate Human Capital

- On the Economy: What Causes a Country’s Standard of Living to Rise?

- On the Economy: It’s the Older Workers Who Have the Job Skills

Citation

ldquoOverestimating the Loss of Human Capital,rdquo St. Louis Fed On the Economy, Jan. 5, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions