Predicting the Impact of Oil Prices on Inflation

The low inflation rates currently observed in the U.S. play an important role in the discussion about policy normalization. The September statement of the Federal Open Market Committee (FOMC) says that “the Committee expects inflation to rise gradually toward 2 percent over the medium term,” and that it will raise the target range for the federal funds rate when it is “reasonably confident that inflation will move back to its 2 percent objective over the medium term.”1

Many market observers have noted that the recent drop in consumer price index (CPI) inflation seems to be related to the dramatic fall of crude oil prices between July 2014 and January 2015.2 In this post, we predict the future behavior of annual CPI inflation under three scenarios for the future behavior of oil prices.

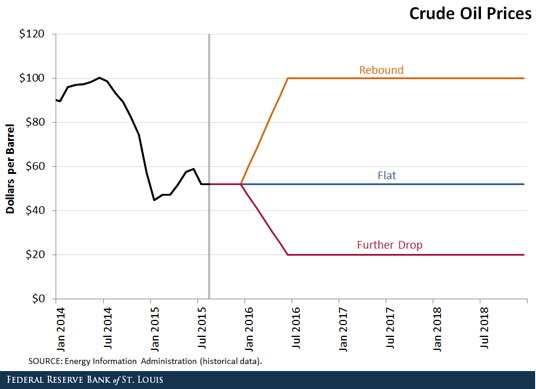

In all three scenarios, oil prices remain fixed until the end of 2015 at $52 per barrel.3 The three scenarios then differ in the behavior of oil prices during the first half of 2016:

- In the first scenario, oil prices remain flat at $52.

- In the second scenario, oil prices rebound to $100.

- In the third scenario, oil prices drop further to $20.

The scenarios then say that prices are fixed after June 2016. The three scenarios are depicted in the first figure below.

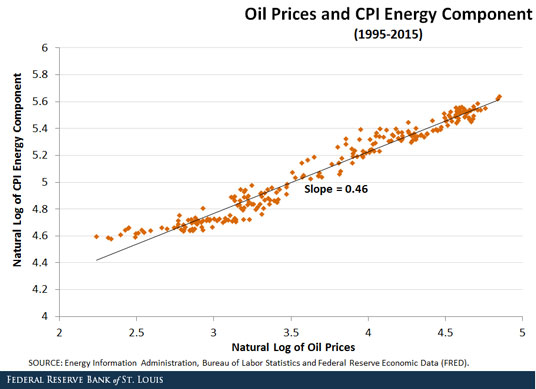

To gauge the effect of crude oil prices on annual inflation, we calculated the empirical relationship between the energy component of the CPI and crude oil prices. The figure below shows a remarkably stable relationship between log crude oil prices and the log energy component of the CPI over the period 1995-2015.

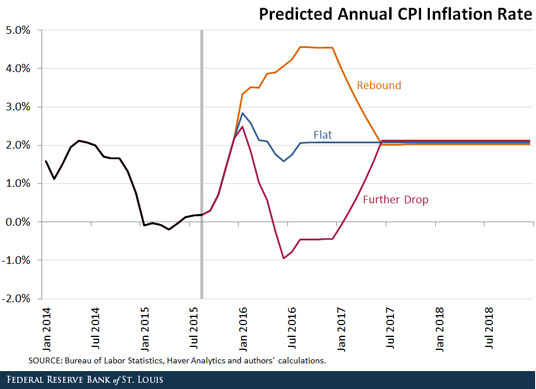

To simulate future inflation, we assumed that the other components of the CPI (such as food, shelter and medical care) keep inflating at the rate observed between January 2015 and August 2015. The underlying energy component of inflation is imputed using the oil price scenarios of the first figure and the elasticity computed from the second figure (which is 0.46). We used the elasticity and the variations in oil price from the first figure to impact the base energy price level observed in August 2015.4 The next figure shows the three predicted paths of inflation.

We now describe our predicted inflation paths:

- If oil prices remain around $52 for the remainder of 2015, inflation will gradually rise to 2.2 percent in December 2015. (Note that this movement is caused mechanically by the arithmetic fact that a one-time permanent drop in the CPI will only affect annual inflation rates for a period of one year.)

- If oil prices remain flat forever at $52, inflation will rise to nearly 3 percent by January 2016, and settle around 2 percent by mid-2016.

- If oil prices rebound to $100 in the first half of 2016, inflation will rise to 4.5 percent around mid-2016 and move back to about 2 percent by June 2017.

- If oil prices drop to $20 in the first half of 2016, annual inflation will fall to nearly -1 percent in June 2016, hover near -0.5 percent until December 2016, and settle at about 2 percent by June 2017.

Notes and References

1 See http://www.federalreserve.gov/newsevents/press/monetary/20150917a.htm for the full statement.

2 While the FOMC’s inflation objective is stated in terms of the producer consumption index (PCEPI), the rest of this post will use CPI inflation, the most widely reported measure of inflation.

3 As measured by U.S. crude oil imported acquisition cost by refiners. We imputed the August oil price to be $52, since it was not available at the time.

4 To produce the total CPI, we used the weights of energy and nonenergy expenditure categories published by Haver Analytics for August 2015. The weights are assumed constant thereafter. In results not shown, we updated the weights every month to account for relative price changes, and the results in the third figure are similar.

Additional Resources

- On the Economy: Oil Prices’ Effect on Employment Growth

- On the Economy: A Link between Oil Prices and Inflation Expectations?

- On the Economy: Has the Phillips Curve Relationship Broken Down?

Citation

Alejandro Badel and Joseph McGillicuddy, ldquoPredicting the Impact of Oil Prices on Inflation,rdquo St. Louis Fed On the Economy, Oct. 8, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions