A Link between Oil Prices and Inflation Expectations?

Between June 2014 and January 2015, Brent crude oil prices fell from around $110 per barrel to around $55 per barrel. Around the same time, breakeven inflation expectations1 fell from around 2 percent to around 1.3 percent. A recent article in The Regional Economist examined whether there is a link between the two.

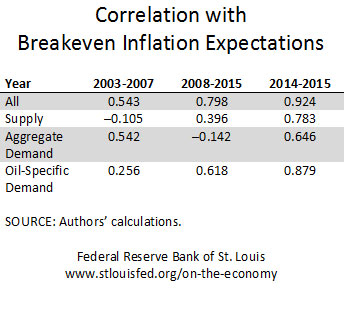

Economist Alejandro Badel and Research Associate Joseph McGillicuddy began by calculating the correlation between five-year breakeven inflation expectations and the log of the real price of crude oil. They found that the correlation had become much stronger since the financial crisis. Up through December 2007, the correlation was 0.54, while it was 0.75 afterward.

However, the correlation between the two variables was 0.13 for the full period January 2003 through April 2015. This is likely due to the mean of inflation expectations falling from about 2.28 percent before the financial crisis to roughly 1.79 percent afterward.

Changes in Oil Prices

To examine potential sources of the correlation, Badel and McGillicuddy broke oil price movements into three components:2

- Supply shocks, or unpredictable changes in crude oil production

- Aggregate demand shocks, or unpredictable changes in real economic activity that cannot be explained by supply shocks

- Oil-specific demand shocks, or changes in the price of oil that can’t be explained by supply shocks or aggregate demand shocks

The authors then calculated the correlations between breakeven inflation expectations and each of the components. Below are the results.

Badel and McGillicuddy drew two conclusions based on the data. The first had to do with the low correlation between inflation expectations and oil price for the full January 2003 through April 2015 period. The correlation being much higher in the three subperiods shown above suggests that the level shift in inflation expectations after the financial crisis was unrelated to oil price shocks.

Second, only the correlation between oil-specific demand shocks and inflation expectations was large and positive across all subperiods. Also, the correlation has increased recently. The authors noted, “The table, thus, suggests the need to further investigate the nature of oil-specific demand shocks.”

Notes and References

1 Breakeven inflation expectations are the difference between the yield on nominal government debt and the yield on inflation-indexed debt. In this case, the authors are discussing the five-year forward rate.

2 For more detail, see Badel, Alejandro; and McGillicuddy, Joseph. “Oil Prices: Is Supply or Demand behind the Slump?” On the Economy, Federal Reserve Bank of St. Louis, Jan. 13, 2015.

Additional Resources

- Regional Economist: Oil Prices and Inflation Expectations: Is There a Link?

- On the Economy: Oil Prices: Is Supply or Demand behind the Slump?

- On the Economy: How Accurate Are Measures of Inflation Expectations?

Citation

ldquoA Link between Oil Prices and Inflation Expectations?,rdquo St. Louis Fed On the Economy, Aug. 6, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions