Why Do Job Finding Rates Fall the Longer Someone Is Unemployed?

In some things, waiting brings better outcomes. We've all learned that it's better to spend more time searching at the buffet line before making a decision. Otherwise, you end up with a plate full of wontons and miss out on the crab legs at the end. Or perhaps it’s better to wait for the next shipment of sports cars instead of taking the last one on the lot—in a jarring lime-green.

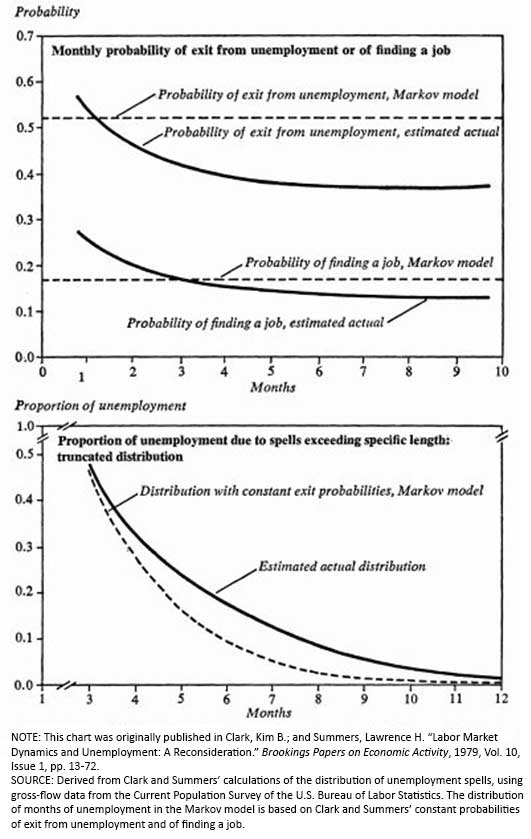

Searching for a job, in general, does not follow this rule. The longer a worker is unemployed, the lower his chance of finding another job. Kim Clark and Lawrence Summers were the first to document this, using the Current Population Survey (CPS)—the most common source of nationally representative unemployment data.1 The figure below is excerpted from their 1979 paper.

In this figure, we see the decline in the rate at which the unemployed find employment, shown in the top panel as the “probability of finding a job, estimated actual.” The authors compared this declining rate to the “Markov model,” essentially a hypothetical probability of finding a job if it were not affected by unemployment duration. As shown in the bottom panel, this implies a fat tail to the unemployment duration distribution. If workers all found jobs at the same rate, then there would be some unlucky ones still unemployed after many months, but far fewer than if the job finding rate also fell with unemployment duration.

But while the explanation is clear for why crab legs are hidden behind mounds and mounds of white rice, economists are fundamentally puzzled about why job finding rates fall with unemployment duration. The basic problem was laid out in a 1984 paper by James Heckman and Burton Singer, showing that there are two equally plausible reasons for the observed phenomenon:2

- The perhaps more intuitive explanation is called “true” duration dependence, which is that something happens to workers as they are unemployed for a long time. In this story, longer unemployment duration itself decreases the finding rates of workers.

- Alternatively, a “composition effect” may be at work. In this explanation, searchers differ in their ability to find a job when they first enter the unemployment pool. The fast finders will exit unemployment immediately, so most of the remaining workers will be people who naturally take longer to find a job, meaning that the average finding-rate at long durations will be lower.

Heckman and Singer essentially show that, without introducing new data or making strong assumptions, Clark and Summers could not possibly distinguish between the two explanations for their results. The shape of the curve could equally be replicated by proposing some distribution of ex ante differences in the finding rate or by proposing some rule by which unemployment duration affects job findings.

Since the Great Recession, the duration of unemployment has been evolving. Not only did the median unemployed worker's unemployment duration increase, the mean duration increased by even more. Another way to say this is that its “tail” elongated. We see this in the figure below.

From Clark and Summers, we have learned that this tail of unemployment duration is intimately tied to the low finding rate of the long-duration unemployed. When the tail elongates, what does this represent? In the aftermath of the Great Recession, is unemployment a worse fate? Or are there just more people who take longer finding a job in the pool of unemployed? For fundamental reasons, these are very difficult questions.

Notes and References

1 Clark, Kim B.; and Summers, Lawrence H. “Labor Market Dynamics and Unemployment: A Reconsideration.” Brookings Papers on Economic Activity, 1979, Vol. 10, Issue 1, pp. 13-72.

2 Heckman, James J.; and Singer, Burton. “Econometric Duration Analysis.” Journal of Econometrics, 1984, Vol. 24, Issue 1-2, pp. 63-132.

Additional Resources

- On the Economy: Has the Phillips Curve Relationship Broken Down?

- On the Economy: How Have Prime-Age Workers in School Affected the Labor Market?

- On the Economy: Oil Prices’ Effect on Employment Growth

Citation

David G Wiczer, ldquoWhy Do Job Finding Rates Fall the Longer Someone Is Unemployed?,rdquo St. Louis Fed On the Economy, Oct. 12, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions