How Long Until “Slack” Is Out of the Labor Market?

After peaking at around 10 percent in October 2009, the U.S. unemployment rate has now declined to 5.5 percent, close to its historical average rate. By this measure, the U.S. economy seems to have returned to “normal.”

On one hand, there is some reason to be skeptical of this conclusion, because some of the decline in unemployment is due to people exiting the labor force rather than finding employment. On the other hand, it appears that much of the decline in labor force participation is due to demographic, rather than cyclical, factors.1

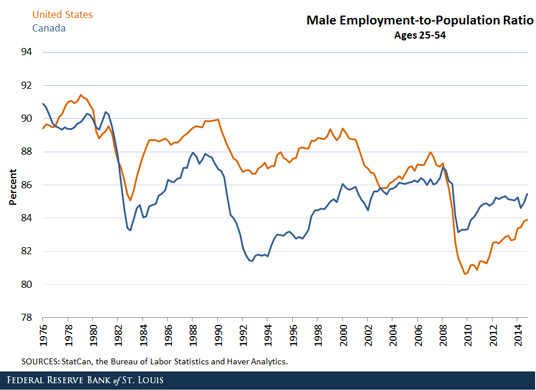

One way (albeit, a crude way) to control for demographic factors is to examine the employment behavior of prime-age males. The figure below plots the employment-to-population ratio for this demographic for the U.S. and Canada from January 1976 to February 2015.

A moderate secular decline in this ratio is evident in both countries. Note that Canada experienced a sharp and prolonged recession in the early 1990s, while the recession in the U.S. at that time was much less severe. For the most recent recession, the situation is reversed.

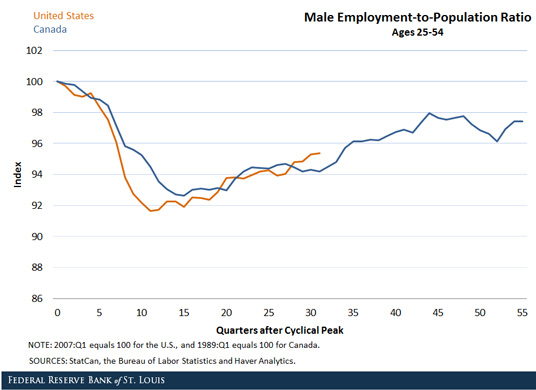

It is interesting to note that the recession and recovery dynamic in the U.S. from 2008 onward resembles the Canadian experience from 1990 onward, as shown in the figure below.

It is tempting to conclude, on the basis of this comparison, that the U.S. recovery in employment is not yet complete. If the Canadian experience is a guide, it may still take three to four years for employment to return to a “normal” level of between 87 percent and 88 percent. Since the current U.S. employment rate for prime-age males is presently 84.5 percent, one could make the case that there is still some “slack” in the U.S. labor market.

Notes and References

1 Canon, Maria; Kudlyak, Marianna; and Debbaut, Peter. “A Closer Look at the Decline in the Labor Force Participation Rate.” The Regional Economist, October 2013.

Additional Resources

- On the Economy: How Should Labor Productivity Be Measured?

- On the Economy: What Size Firm Has Created the Most Jobs in the Recovery?

- On the Economy: Why Did Labor Force Participation by Youth Drop?

Citation

David Andolfatto and Michael A Varley, ldquoHow Long Until “Slack” Is Out of the Labor Market?,rdquo St. Louis Fed On the Economy, March 30, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions