What Size Firm Has Created the Most Jobs in the Recovery?

In general, large firms proportionally destroy more jobs than small firms when unemployment is above trend and create more jobs when unemployment is below trend. A recent Economic Synopses essay examines whether this has been the case during the recovery from the Great Recession.

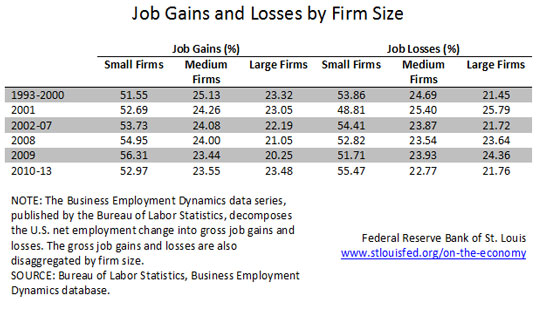

Economist Maria Canon and Senior Research Associate Yang Liu, both with the Federal Reserve Bank of St. Louis, examined job gains and losses by firm size for recession years and for the years before and after the past two recessions, with the results displayed in the table below. They broke job gains and losses into three groups:

- Small firms, 1-49 employees

- Medium firms, 50-499 employees

- Large firms, 500 or more employees

As shown in the table, Canon and Liu found that small firms did indeed create a higher fraction of new jobs and destroyed a smaller fraction of jobs late in the recessions. However, in the four years following the Great Recession, the share of jobs created by small firms decreased from 56.31 percent to 52.97 percent, while the share created by large firms increased from 20.25 percent to 23.48 percent, despite unemployment still being above trend.

Shares of job losses, on the other hand, followed traditional patterns during and after the Great Recession. Small firms’ share of job losses fell during the recession, then rose sharply during the subsequent recovery, while large firms’ share of job losses rose during the recession, then fell during the recovery.

Canon and Liu concluded by discussing potential implications of large firms creating a significantly higher fraction of jobs since the Great Recession than after the 2001 recession. In general, labor markets tighten after recessions, so large firms have to poach workers from small firms to fill their ranks. However, the labor market took longer to recover after the Great Recession, meaning there were more unemployed workers available for hire, so large firms did not have to poach workers from small firms.

Canon and Liu wrote, “Because poaching offers and wage gains are often linked, this feature of labor dynamics is also consistent with the slow wage inflation observed since the Great Recession.”

Additional Resources

- Economic Synopses: Firm Size and Employment Dynamics

- On the Economy: Trends in Youth Not in Education, Employment or Training

- On the Economy: Are Wages and the Unemployment Rate Correlated?

Citation

ldquoWhat Size Firm Has Created the Most Jobs in the Recovery?,rdquo St. Louis Fed On the Economy, Feb. 19, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions