Lowflation in Advanced Economies

Several commentators and policymakers, such as Christine Lagarde1 and Mario Draghi2, have expressed concerns that the eurozone may be experiencing disinflation (a decrease in the rate of price inflation) with the downward risk of deflation. The IMF has recently defined this environment “lowflation.”3 But the eurozone is not the only economy navigating the risky waters of lowflation, according to my research for an upcoming paper. Several other advanced economies are also experiencing either inflation below target or plain deflation.

Inflation in the eurozone is measured by the Harmonized Index of Consumer Prices (HICP). The Governing Council of the European Central Bank defines price stability as a year-on-year increase in the HICP for the Eurozone of below 2 percent, also clarifying that it aims to maintain inflation rates below, but close to, 2 percent over the medium term.4

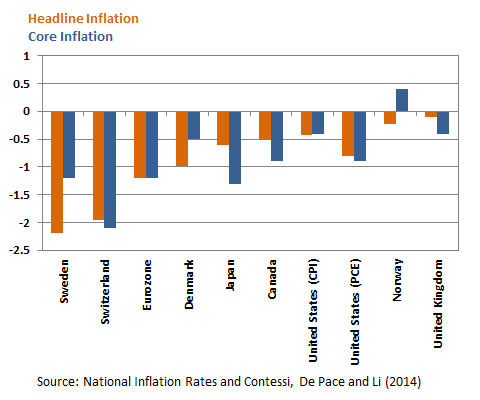

The figure shows nine advanced economies chosen as follows: three large economies (the eurozone, Japan and the United States) with different forms of large-scale asset purchases (LSAP), three small open economies (Sweden, Switzerland and the United Kingdom) with some form of LSAP and three small open economies (Canada, Denmark and Norway) without LSAP. The bars represent the deviation of headline (orange bars) and core (blue bars) inflation rates from the target rates for each economy in January 2014 (latest data available).

The targets are typically set at, or close to, 2 percent of the year-on-year increase in the Consumer Price Index (CPI). Exceptions include the United States (which targets the Personal Consumption Expenditure Price Index), Norway (which targets 2.5 percent growth in the CPI) and Denmark (which targets exchange rate stability with respect to the euro).

Why is this scenario worrisome? Even if advanced economies do not fall into plain deflation, prolonged lowflation below inflation targets may undermine the successful work of several central banks in anchoring inflation expectations to close to 2 percent in the past 20 years. In addition, lowflation has “real” consequences because it increases the real burden of repaying outstanding public and private debt that have grown quite large in advanced economies after the financial crisis.

For clarification, the chart was updated to include both U.S. CPI inflation (for comparison with other countries that use CPI inflation) and U.S. PCE inflation (the target of the Federal Reserve). The previous version included U.S. CPI inflation only.

1 Lagarde, Christine. "The Global Economy in 2014." Speech at the National Press Club, Washington, D.C., Jan. 15, 2014.

2 Draghi, Mario. "A Consistent Strategy for a Sustained Recovery." Speech at the Sciences Po, Paris, March 24, 2014.

3 Moghadam, Reza; Teja, Ranjit; and Berkmen, Pelin. "Euro Area — ‘Deflation’ Versus ‘Lowflation.’” iMFdirect, March 4, 2014.

4 "The Definition of Price Stability.” European Central Bank, Accessed March 10, 2014.

Additional Resources

- The Regional Economist: A Look at Japan's Slowdown and Its Turnaround Plan

- The Regional Economist: CPI vs. PCE Inflation: Choosing a Standard Measure

- Economic Synopses: Currency Returns During the Financial Crisis and Great Recession

- Review: An International Perspective on the Recent Behavior of Inflation

Citation

Silvio Contessi, ldquoLowflation in Advanced Economies,rdquo St. Louis Fed On the Economy, March 31, 2014.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions