Why Didn’t Higher Education Protect the Wealth of Hispanics and Blacks to the Same Degree As It Did that of Whites and Asians?

Overall, the wealth of families with college degrees experienced smaller drops due to the recent recession than the wealth of families without college degrees.1 However, this “wealth protection” didn’t extend to families of all races and ethnicities. Hispanic and black families with college degrees actually fared worse than their counterparts without college degrees.

In the latest issue of In the Balance, Senior Economic Adviser William Emmons and Lead Policy Analyst Bryan Noeth compared the experiences of families headed by someone with a college degree with the experiences of families with a head of household without a college degree. They also broke these groups out by race and ethnicity and did their comparison over the short term (2007-2013) and the long term (1992-2013).

Emmons and Noeth found that, for all families, those with a college degree saw their median wealth decline 24 percent between 2007 and 2013. Those without a college degree saw their median wealth drop 48 percent over the same period.

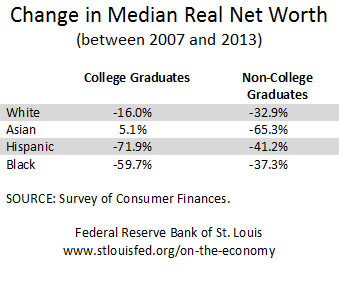

The table below shows the changes in median net worth according to race and ethnicity.

As the table shows, white and Asian families with college degrees fared better than their non-degree counterparts. However, Hispanic and black families with college degrees fared much worse than their counterparts without college degrees.

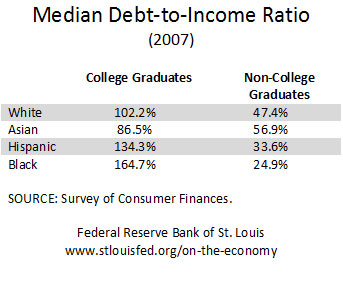

Emmons and Noeth noted that financial choices may have played a significant role in determining wealth outcomes. The table below shows the median debt-to-income (DTI) ratios for each racial and ethnic group in 2007.

The DTI ratios for Hispanic and black families with college degrees were noticeably higher than for white and Asian families with college degrees. They were also far higher than the DTI ratios for their non-degree counterparts. The authors submitted that heavy concentrations in residential real estate may have also played a role. Declines in the average value of owner-occupied homes among college-educated Hispanic and black families between 2007 and 2013 were 45 percent and 51 percent, respectively. The average value of owner-occupied homes declined 25 percent among college-educated white families and increased 6 percent among college-educated Asian families.2

The authors concluded, “Evidence presented here suggests that college degrees alone do not provide short-term wealth protection. … The underlying factors causing racial and ethnic wealth disparities undoubtedly are complex and deeply rooted. Further research is needed.”

Notes and References

1 Families with college degrees include those who also earned advanced degrees.

2 These figures refer to the percent change in the average value of owner-occupied housing owned by all members of a particular group in 2007 and 2013, whether they are homeowners or not. This statistic therefore captures both the decline in the value of homes retained by their 2007 owners through 2013 as well as the loss of a house through foreclosure or other distressed sale.

Additional Resources

- In the Balance: Why Didn’t Higher Education Protect Hispanic and Black Wealth?

- On the Economy: Wealth Gap Widens between Young and Old Families

- On the Economy: An Overview of the Connection between Education and Wealth

Citation

ldquoWhy Didn’t Higher Education Protect the Wealth of Hispanics and Blacks to the Same Degree As It Did that of Whites and Asians?,rdquo St. Louis Fed On the Economy, Aug. 18, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions