Lack of Hires Had Larger Effect on Labor Market in Recession Than Separations

The labor market’s slow recovery from the Great Recession has prompted considerable analysis beyond the most common labor market indicators, such as the unemployment rate and payroll employment. Data on job hires and job separations also provide interesting information on the health and progress of the labor market.1

We’ve previously discussed employment losses and employment gains by industry, observing significant amounts of heterogeneity, and suggested that job polarization might explain these trends. To understand more deeply what explains this heterogeneity, we looked at job hires and job separations by industry.

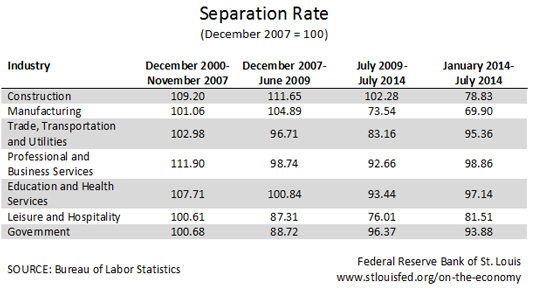

During the Great Recession, the construction and manufacturing sectors increased their separation rates relative to 2001-07, while all other sectors decreased their separation rates.

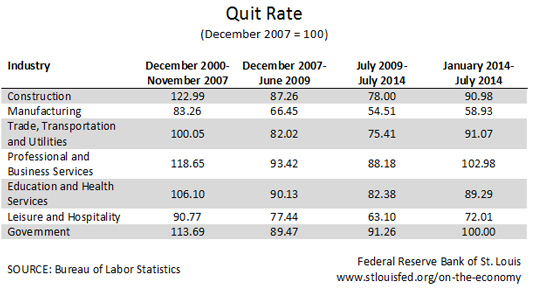

Voluntary separation rates (quits) decreased in all sectors over the same period, implying that involuntary separations increased even more in construction and manufacturing.

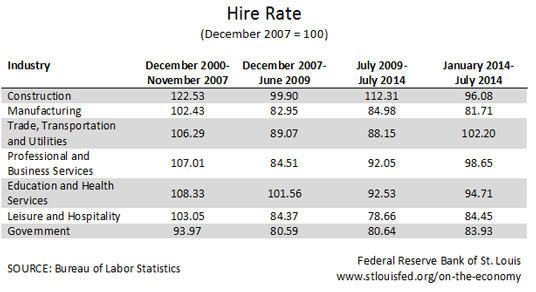

Hire rates also decreased during the Great Recession in all seven sectors, with only a mild decrease in the education and health services sector (which also was the only private sector that increased payroll employment during the recession). Except for those in the construction and manufacturing sectors, employers adjusted their employment levels by hiring at lower rates rather than separating more workers.

How did each sector perform after the Great Recession? Between July 2009 and July 2014, hiring rates:

- Increased in the professional and business services, construction, and manufacturing sectors relative to the Great Recession

- Stayed almost constant in the government sector and the trade, transportation and utilities sector

- Decreased in the education and health services sector and in the leisure and hospitality sector

Separations, however, decreased across all private sectors, and voluntary separations continued to decrease as well in all sectors except government.

In the first seven months of 2014, separation rates continued to decrease relative to December 2007-June 2009 across the private sector (with almost no change in the professional and business services sector), while voluntary separation rates (except for those in the manufacturing sector and the leisure and hospitality sector) significantly recovered relative to December 2007-June 2009. Except for the manufacturing, construction, and education and health services sectors, hire rates in the first seven months of 2014 were also improved from to their December 2007-June 2009 rates, and the trade, transportation and utilities sector experienced higher hiring rates than in December 2007.

In conclusion, job separation rates and hire rates by industry show that only the construction and manufacturing sectors significantly increased their separation rates during the Great Recession, while all industries adjusted their employment levels by decreasing their hire rates. The recovery after the Great Recession has been due to hire rates increasing mildly but without reaching prerecession levels (see average hires for the period December 2000-November 2007), and we observe that—with the exceptions of the construction, manufacturing, and leisure and hospitality sectors—all three indicators (separations, voluntary separations and hires) during the first seven months of 2014 show labor market conditions closer to those observed in December 2007. Hire rates in the manufacturing and leisure and hospitality sectors are still significantly lower than in December 2007 and the prerecession period, but these sectors have decreased their separation rates significantly.

Notes and References

1 For instance, St. Louis Fed Economist David Wiczer showed that, for the economy as a whole during the Great Recession, job separations did not spike relative to historical averages. Instead, the rate at which workers found jobs was very low.

Additional Resources

- On the Economy: U.S. Job Polarization Persists

- On the Economy: What Private Payroll Employment Numbers Say about the Labor Market

- On the Economy: Job Separation Rate Shows Economic Shifts

Citation

Maria E Canon, ldquoLack of Hires Had Larger Effect on Labor Market in Recession Than Separations,rdquo St. Louis Fed On the Economy, Oct. 6, 2014.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions