What Private Payroll Employment Numbers Say about the Labor Market

June marked the 52nd consecutive month of net private job growth. Even though we might think this is positive news, measuring the health of the labor market depends not only on how many jobs are created, but also which types of jobs are created. If part-time jobs are all that’s being created, labor might be underutilized, and the health of the labor market might not be as strong as we think.

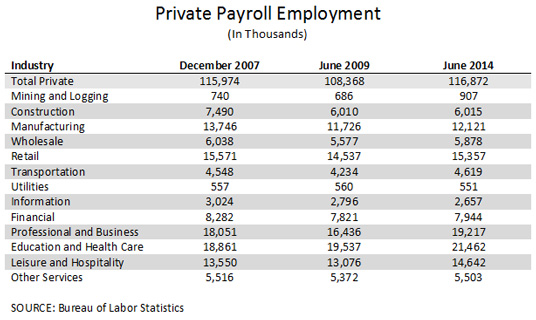

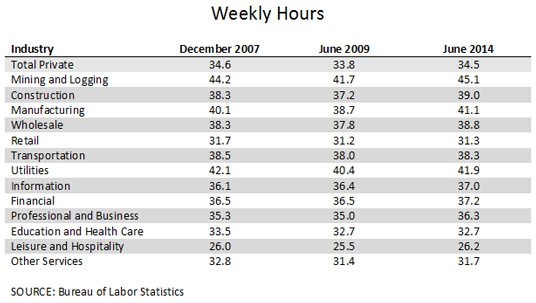

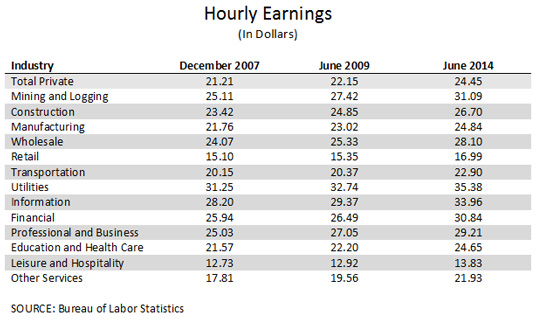

To more fully gauge the health of the current labor market, we studied private payroll employment numbers, hours worked per week and wages earned per hour for individual sectors relative to the same statistics when the Great Recession started. The tables below show these for three periods:

- December 2007, the beginning of the Great Recession

- June 2009, the end of the recession

- June 2014, the most recent data point

Private payroll employment in June 2014 was slightly higher than in December 2007 and almost 8 percent higher than at the end of the Great Recession. Looking at different sectors, only two sectors (information and utilities) had fewer employees in June 2014 than at the end of the recession.

Largest Sector Losses

Comparing the latest numbers with those in December 2007, the manufacturing and construction sectors have seen the largest declines in employment levels. These two sectors were the two biggest losers in terms of percentages of jobs lost during the recession: Manufacturing lost more than 2 million jobs (14.7 percent), and construction lost almost 1.5 million jobs (19.8 percent). Even though manufacturing’s employment has improved since the recession’s end, it remained 11.8 percent below its December 2007 level as of June 2014. Construction employment was essentially unchanged since the end of the recession.

Hours worked in construction and manufacturing were 13.0 percent and 19.1 percent above the average across all sectors as of June 2014, and hourly earnings in construction and manufacturing were 9.2 percent and 1.6 percent above average, respectively.

Largest Sector Gains

In contrast, the sectors that gained the most employees relative to the beginning of the recession are:

- Education and health care

- Leisure and hospitality

- Professional and business services

- Mining and logging

Employees in the mining and logging sector worked 30.7 percent more hours than the average of all sectors, and their hourly earnings used to be 18.4 percent higher than the average in December 2007 and were 27.2 percent more than the average in June 2014. However, this sector only gained 167,000 employees and employed only 0.8 percent of total private payroll employment.

The professional and business services sector gained almost 1.2 million employees relative to December 2007 and represented 16.4 percent of total private payroll employment as of June 2014. Workers in this sector worked 5.2 percent more hours per week and earned 19.5 percent more per hour than the average worker across all sectors.

The education and health care sector increased its payroll by more than 2.6 million workers and represented 18.4 percent of total private payroll employment. However, employees worked 5.2 percent fewer hours and earned 0.8 percent more per hour than the average across sectors.

Finally, the leisure and hospitality sector, which represented 12.5 percent of total private payroll employment as of June 2014, employed 1.1 million more workers than before the recession, but most of the those workers were part-time workers earning on average 43.4 percent less per hour than the average across sectors.

In conclusion, private payroll employment in June 2014 was slightly higher than in December 2007, and while most of the job losses occurred in the construction and manufacturing sectors (full-time jobs with average hourly earnings), most of the new jobs averaged 32 hours or more per week, with average or slightly higher than average hourly earnings. The only exception seems to be jobs in the leisure and hospitality sector. Therefore, there are no clear signs in private payroll employment statistics of higher levels of labor underutilization relative to December 2007.

Additional Resources

- Regional Economist: A Closer Look at the Decline in the Labor Force Participation Rate

- On the Economy: Youth Unemployment Notably High in Southern Europe

- On the Economy: Where Is the Slack in the Labor Market?

Citation

Maria E Canon, ldquoWhat Private Payroll Employment Numbers Say about the Labor Market,rdquo St. Louis Fed On the Economy, July 14, 2014.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions