Credit to Noncorporate Businesses Remains Tight

An article from the most recent issue of The Regional Economist, published by the Federal Reserve Bank of St. Louis, discusses how the uses of credit by corporate businesses and by noncorporate businesses have evolved in very different ways in the past few years.

Juan Sanchez, a senior economist with the St. Louis Fed, used the version of the Financial Accounts of the United States published June 5 to examine the use of credit by nonfinancial businesses since the recent financial crisis.1 Since their peaks during the financial crisis:

- Liabilities of corporate businesses have increased about 20 percent.

- Liabilities of noncorporate businesses have increased only 4 percent.

Among other distinctions, Sanchez notes that the ability to borrow or lend through the use of bonds is a key characteristic that helps explain the divergence in the use of credit between corporate businesses and noncorporate businesses. Namely, corporations can borrow and lend by issuing bonds, while noncorporations cannot.

Credit instruments—which include not only corporate bonds, but also commercial paper, depository institution loans and mortgages—are the main components of liabilities for both corporations and noncorporations, representing about 60 percent and 70 percent of liabilities, respectively. However, the composition of credit market instruments is very different for the two types of businesses:

- For noncorporate businesses, 69 percent of the debt is from mortgages, while 27 percent is from loans from depository institutions and 4 percent is from other loans and advances.

- For corporate businesses, 68 percent of the debt is from corporate bonds, with other loans and advances (11 percent), depository institution loans (7 percent), mortgages (6 percent), municipal securities (6 percent) and commercial paper (2 percent) making up the rest.

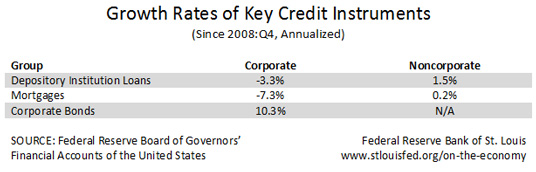

The breakdown above and the table below help explain the divergence. Growth of depository institution loans and of mortgages –the two most important credit instruments for noncorporations—has been sluggish at best. However, growth of corporate bonds—which is the most important credit instrument for corporations but not an option for noncorporations—has been significant.

Sanchez concluded, “Overall, credit to noncorporate businesses remains tight. This phenomenon is mostly accounted for by the sluggish recovery of loans from depository institutions and mortgages, which are very important for this type of business. Tight credit may be affecting the day-to-day operations of noncorporate businesses since credit is important for growth.”

Notes and References

1 This was the most recent version at the time the article was written.

Additional Resources

- Regional Economist: Credit to Noncorporate Businesses Remains Tight

- On the Economy: Credit Card Delinquency Rates Falling Faster for Younger Households

- On the Economy: Lack of Hires Had Larger Effect on Labor Market in Recession Than Separations

Citation

ldquoCredit to Noncorporate Businesses Remains Tight,rdquo St. Louis Fed On the Economy, Nov. 11, 2014.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions